Bloomberg to include yuan-denominated, Chinese government bonds in its benchmark indices

- Chinese government debt will be phased into the Bloomberg Barclays Global Aggregate Index beginning in April

- It is the latest inclusion of Chinese securities in a benchmark index

Financial information provider Bloomberg said on Thursday that it will include yuan-denominated, Chinese government bonds in a key global debt index from April, further expanding the importance of yuan as a global currency.

It is the latest effort to increase the exposure of benchmark indices to Chinese securities as Beijing moves to further open up its financial markets and global investors look for additional opportunities to access the mainland markets.

Bloomberg said that yuan-denominated government bonds and policy bank securities would be added to the US$54 trillion Bloomberg Barclays Global Aggregate Index from April and would be phased in over a 20-month period.

Chinese debt will also be eligible for inclusion in the Bloomberg Barclays Global Treasury and Emerging Markets Local Currency Government indices beginning in April.

China pushes for bonds to be included in global indices even as some foreign investors seek delay

“Today’s announcement represents an important milestone on China’s path towards more open and transparent capital markets, and underscores Bloomberg’s long-term commitment to connecting investors to China,” Bloomberg chairman Peter Grauer said. “With the upcoming inclusion of China to the Global Aggregate Index, China’s bond market presents a growing opportunity for global investors.”

When fully implemented, local currency Chinese bonds would be the fourth largest currency component in the index behind the US dollar, the euro and the Japanese yen, Bloomberg said.

Using data as of January 24, the index would include 363 Chinese securities, representing about 6 per cent of the index upon completion of the phase-in period, Bloomberg said.

S&P Global gets the nod to enter China’s bond rating market

Bloomberg said that the inclusion came after the People’s Bank of China, the Ministry of Finance and the State Taxation Administration completed several market reforms to increase investor confidence and improve market accessibility.

“It’s a pivotal time in the development of China’s markets and inclusion in our Global Aggregate Index is significant for facilitating Chinese market access for global investors,” said Steve Berkley, global head of Bloomberg Indices.

Bloomberg first announced plans to include Chinese government bonds in its indices last March.

For passively managed mutual funds and other index trackers, the change will increase their exposure to Chinese securities.

China bond defaults tripled in 2018 – the case of one property developer shows why

Andre de Silva, head of global emerging markets rates research at HSBC, said in a research note on Thursday that the inclusion of Chinese onshore government and policy bank bonds could translate into about US$150 billion in inflows as funds and other investors reallocate their holdings.

“This announcement is not a surprise to us as China had earlier fulfilled all three major prerequisites for the inclusion,” de Silva said.

The Bloomberg announcement comes just days after S&P Global Ratings was given formal permission by Chinese officials to open a wholly owned credit rating agency to rate Chinese domestic bonds, the first time that a foreign rating agency has been licensed to do so.

Meanwhile, FTSE Russell is expected to include China A shares in its global equity benchmarks in June and had said that Chinese government bonds would be added to its watch list for potential inclusion in the FTSE World Government Bond Index. Separately, MSCI is weighing whether to increase the weighting of China A shares in its indices later this year.

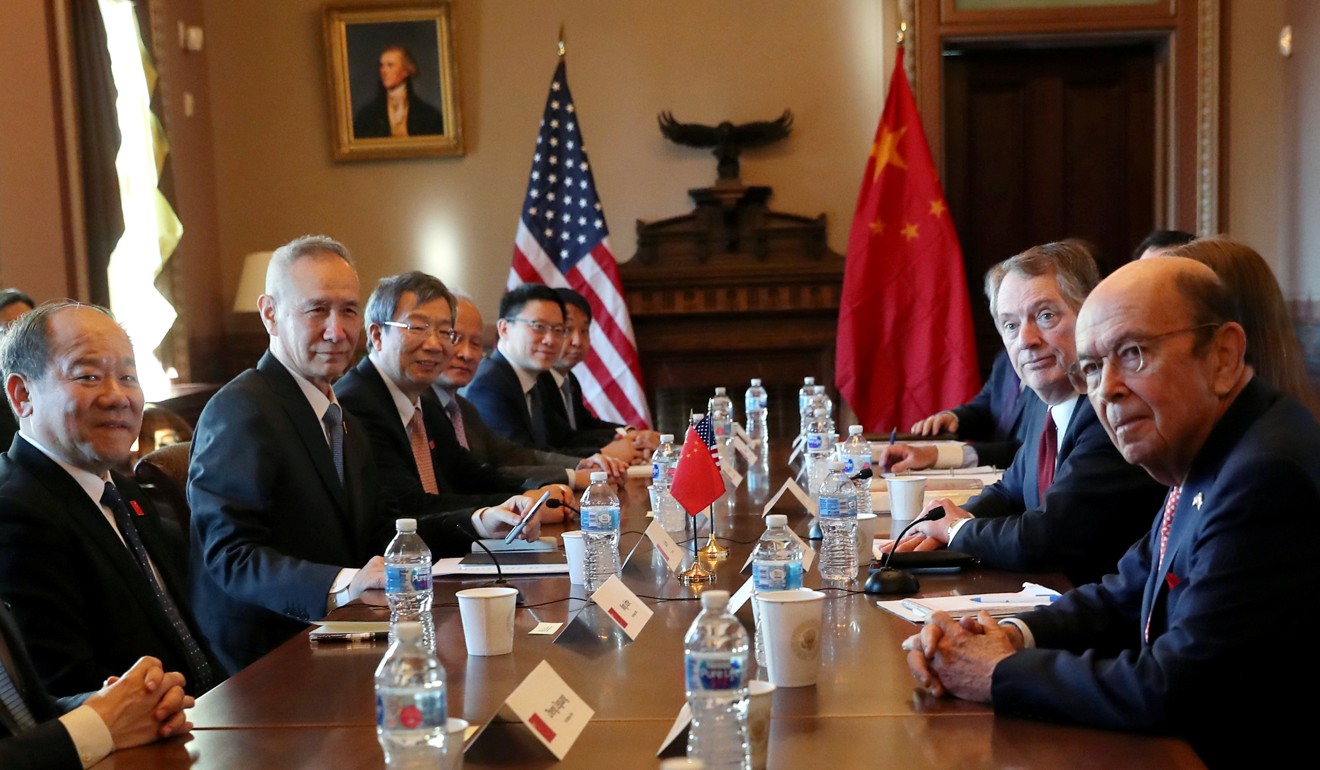

China’s efforts to increase access to its financial markets comes against the backdrop of escalating tension with the US that has seen President Donald Trump slap tariffs on nearly half of all Chinese imports.

A Chinese trade delegation is in Washington this week as the world’s two largest economies try to reach an agreement ahead of a March deadline. If the two sides cannot reach an accord, the US has pledged to increase tariffs on some US$200 billion of Chinese goods from 10 per cent to 25 per cent.