Chinese overseas property buying plummets 63 per cent in 2018, hitting four-year low

- Hong Kong is top buying destination, with its offices major targets, Cushman & Wakefield finds

- Dalian Wanda, among top sellers, offloads prime projects in Sydney next to the Opera House and Gold Coast

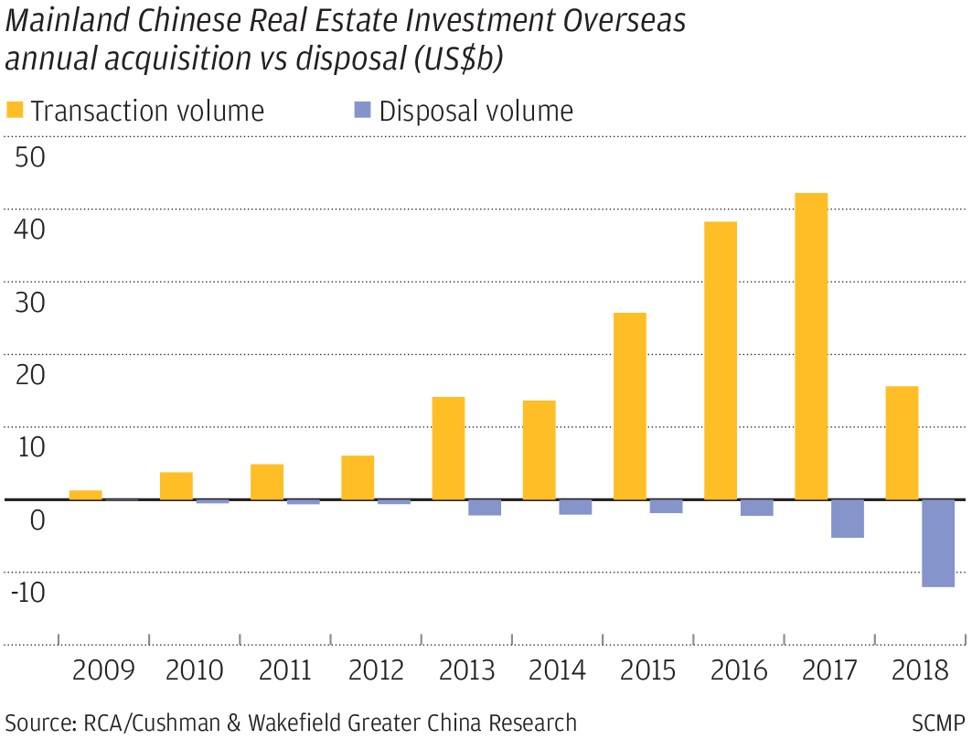

Property buying by mainland Chinese investors hit a four-year low of US$15.7 billion in 2018, plummeting 63 per cent year on year amid weakening sentiment, tightener policies and growing economic headwinds, according to a survey.

Hong Kong was one of the bright spots.

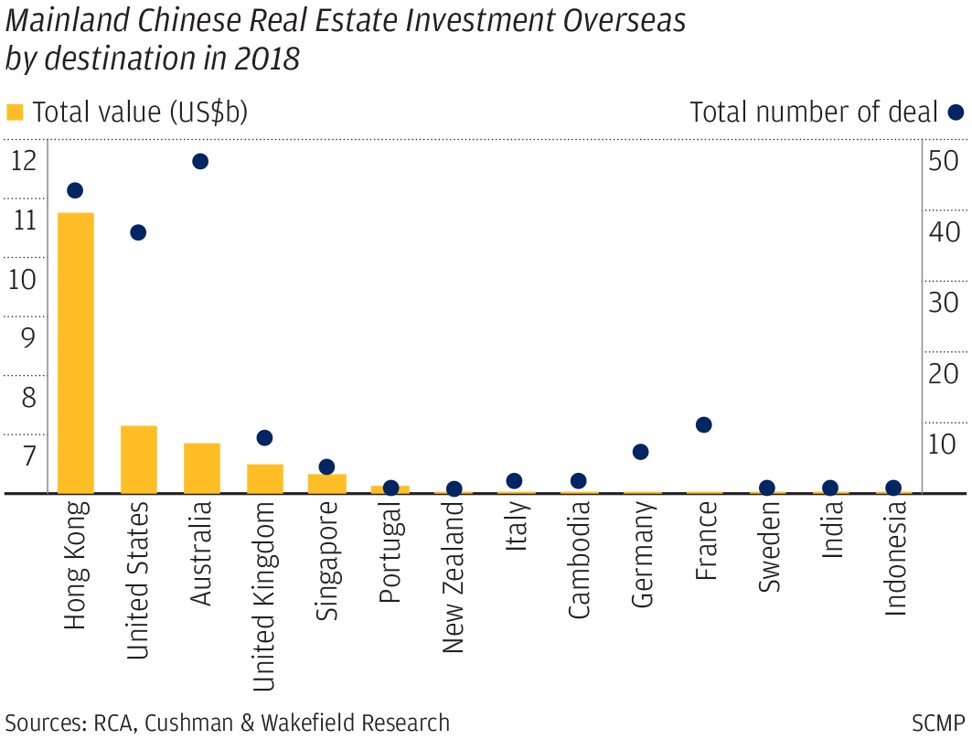

The city ranked as the top destination for mainland overseas property buying a second straight year, at US$9.5 billion. But still that was a 20 per cent decline year on year, according to data in the fourth annual survey conducted by global real estate service firm Cushman & Wakefield.

The survey was conducted of 150 top mainland real estate investors in the fourth quarter last year. The 51 that responded have a combined 280 billion yuan (US$41.70 billion) in offshore capital, according to the real estate services firm.

Of the top three deals in Hong Kong, all were offices, it found.

The most expensive deal was Hengli Group’s US$1.91 billion purchase in June of Cityplaza Three & Four. Next was the US$1.27 billion spent by China Taiping Insurance and China Create Capital for 18, King Wah Road in January of last year.

That was followed by a consortium led by C.C. Land that spent US$1.02 billion on Octa Tower in June.

The survey found 84 per cent of Chinese investors indicated that they had either frozen or reduced their overseas real estate allocations over the past year in comparison to 2017 after Beijing introduced a number of policies to restrict overseas investment to stop capital outflow.

Chinese investors sold over US$12 billion of overseas assets in 2018, data from Real Capital Analytics (RCA) showed, indicating a massive shift from buying to disposal.

Chinese conglomerate Dalian Wanda Group chaired by tycoon Wang Jianlin was among those who turned from top buyers some years earlier into a top seller last year.

Dalian Wanda’s sales list included US$511 million of One Circular Quay project located between the iconic Sydney Harbour Bridge and the Opera House and US$244 million of the Jewel Resort Site in the tourist hot spot Gold Coast of Brisbane in March.

The group also had a US$420 million sale of One Beverly Hills properties in the US in August and a US$226 million sale of City & River Tower in the UK.

HNA Group, another big spender years ago, also turned into a seller. They included the US$320 million sale at 33 South Sixth City Centre in Minneapolis in the US in November.

The shift to selling is a trend, the survey expects, as 65 per cent of respondents said that they were severely impacted by the prevailing outbound policy control by Beijing. Meanwhile, the tough lending environment made it hard for them to borrow to invest, with only 18 per cent of respondents saying they believe the lending environment will improve in 2019.

“We expect that Chinese banks' real estate lending may remain tight for much of the year ahead, creating an environment that will clearly continue to restrict deployment of mainland Chinese capital in general irrespective of geographic location,” said James Shepherd, managing director of Greater China research at Cushman & Wakefield.

“In a time of tight liquidity back home in China, Chinese investors are disposing of assets at a global level including [in] China,” he said.

Behind Hong Kong, mainland property buyers were most likely to purchase in the US (US$2.33 billion in 2018), while Australia ranked third (US$1.73 billion).

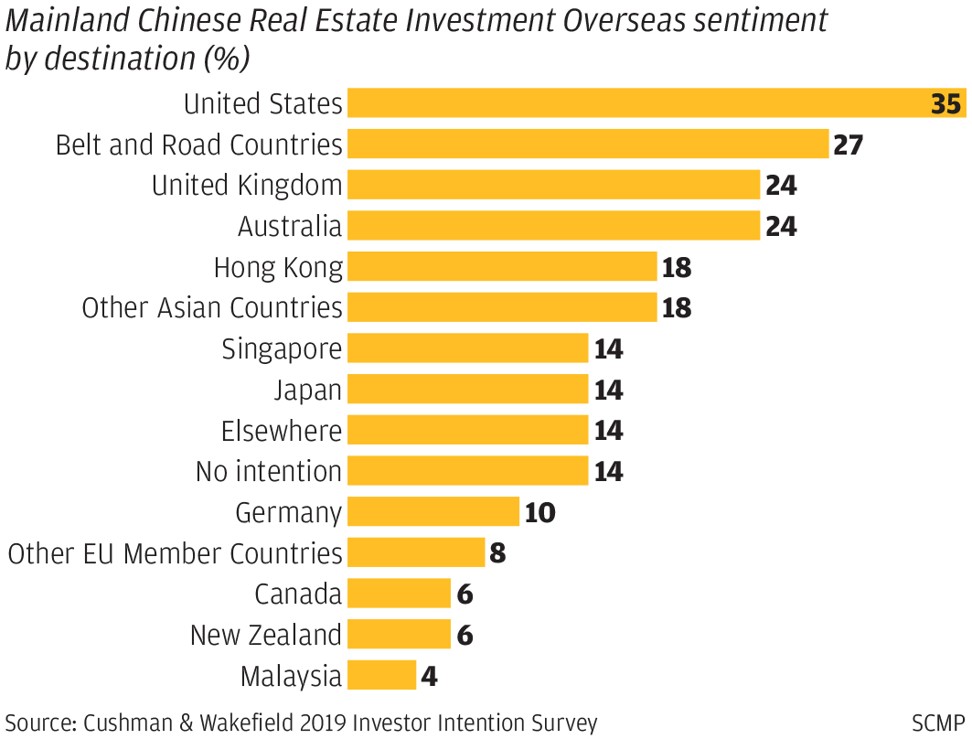

A shake-up in preferences is expected, however, this year.

In the survey for buying plans in 2019, Hong Kong ranked the fifth most favourite destination, with only 18 per cent saying they plan to buy properties in Hong Kong. That compared with first-place US, at 35 per cent, followed by Belt and Road Initiative countries at 27 per cent, and UK and Australia both at 24 per cent.

Offices, residential properties and properties related to senior care services are the top choices of these Chinese investors, the survey showed.

In 2018 in the US, mainland property investors spent US$2.3 billion on assets while selling US$3.1 billion of them, showing a net outflow from the US, according to RCA and Cushman & Wakefield Research data.

“Contrary to some market commentators who have assumed that disposal activity in the US and UK has been a direct result of prevailing political turmoil, the simple fact is that outside China, the mainland Chinese real estate investment overseas’ existing portfolios are heavily weighted to the US and UK, and therefore disposal volumes appear remarkably high in these markets,” Shepherd said.

“Ever popular in the hearts of Chinese investors, Australia had a strong showing, overtaking the UK for third place in terms of real estate investment in 2018.”