Is Hong Kong’s most expensive property ever to go up for sale too costly for any single developer?

- Site atop the West Kowloon high-speed rail terminus is expected to sell for about HK$100 billion

- Developers may join consortiums to come up with enough cash and spread risk – and that may put a lid on final sales price

Is Hong Kong’s most expensive property ever to go up for sale too costly for any single developer?

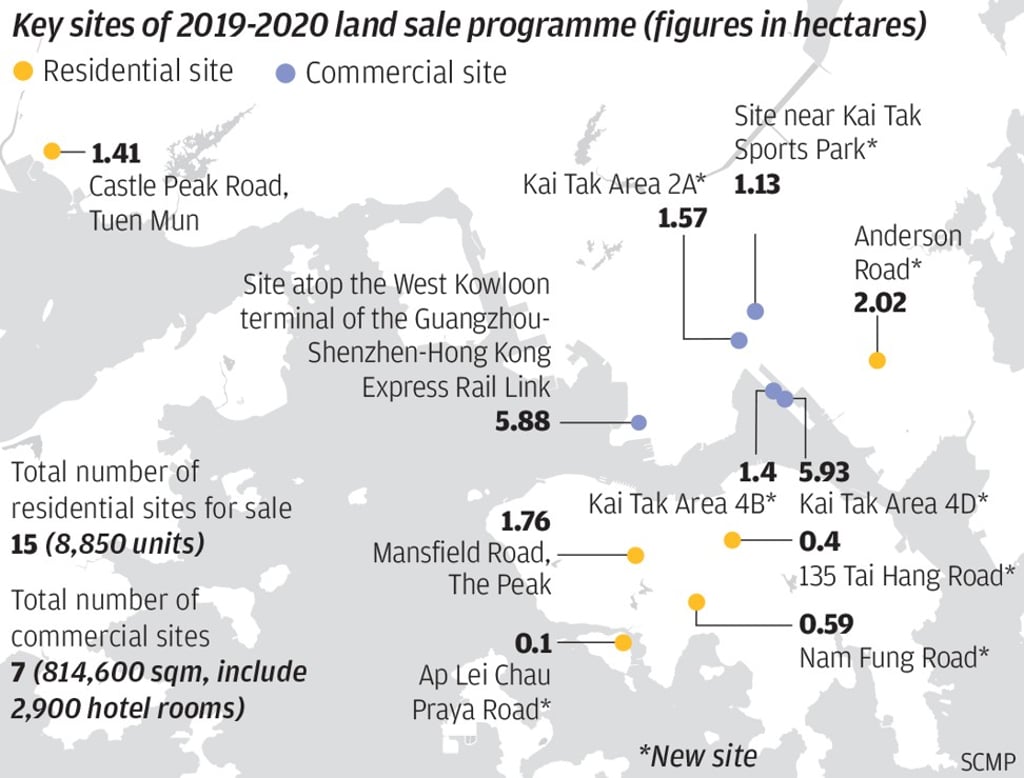

The city’s hottest prime commercial site – sitting atop the West Kowloon high-speed rail terminus – is expected to sell for roughly HK$100 billion (US$12.7 billion). That is likely to spur developers to form one or two consortiums, property experts say, to spread risk and simply come up with the staggering sum of money.

Sun Hung Kai Properties (SHKP), the city’s top developer with about HK$26 billion in cash reserves, confirmed to the South China Morning Post that it is open to either bidding individually or as part of a consortium in the as yet-to-be scheduled tender. The government intends to sell the plot above the new Guangzhou-Shenzhen-Hong Kong Express Rail Link as a whole.

“Developers are probably going to join together to participate in the bidding for this site as it requires a huge amount of capital. In the absence of competition, the plot is hardly going to sell for a high price,” said Mico Chung Cho-yee, the chairman of CSI Properties.

Under current lending requirements, he said the winning bidder could only borrow up to 40 per cent of the land cost, or HK$40 billion assuming the lot sold for HK$100 billion, for example.

Interest expenses could cost about HK$800 million to HK$1 billion per year, if lenders charge about 2 to 3 per cent per annum, he said.