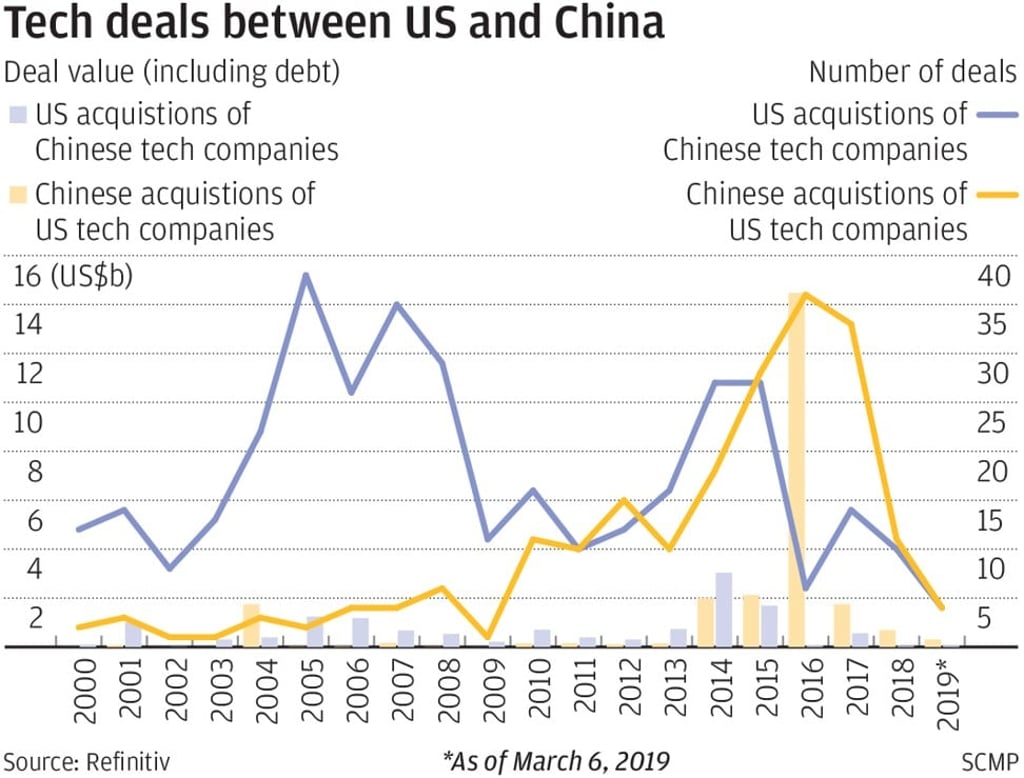

Trade war is killing overseas investment by Chinese, US tech companies, analysts say

- Clash over tech could lead to future research split between Silicon Valley, Shenzhen

- Chinese investment in US semiconductor, hardware segments dropped by nearly five times in 2018

Efforts by the United States to block Chinese access to its latest technology is weighing on cross-border investment in both countries as tensions over trade and technology policies have escalated between the superpowers in the past year.

The stand-off between the world’s two largest economies could ultimately cause a long-term split in future research and development between rival tech leaders based in Shenzhen and Silicon Valley, according to analysts and market observers.

Investments by Chinese firms in the American semiconductor and technology hardware segments dropped by nearly five times in 2018, to US$203.4 million from US$1.03 billion the previous year, according to the latest data from S&P Global Market Intelligence.

Software and services was the only area within the US technology sector to see a significant increase in Chinese-affiliated investment last year – driven primarily by an US$8 billion investment in Uber by a group that included Chinese tech giant Tencent Holdings, according to S&P Global.

Matthew Doull, head of the internet and digital media practice at the investment banking adviser BDA Partners in Hong Kong, said American and Chinese companies considering cross-border mergers are holding back on deals even if they “are not by any stretch sensitive from a military or intelligence perspective.”

“My experience is that on an informal basis it’s creeping into everything,” Doull said. “For us – digital media, travel tech – frankly rather benign consumer oriented businesses, we see people on both sides self censoring.”