Advertisement

Ant Financial disrupts old school health insurance in China, attracts 50 million users to its newly launched protection plan

- Plan pays out up to US$45,000 to members who fall critically ill

- Ant will take an 8 per cent administrative fee out of every payout

Reading Time:2 minutes

Why you can trust SCMP

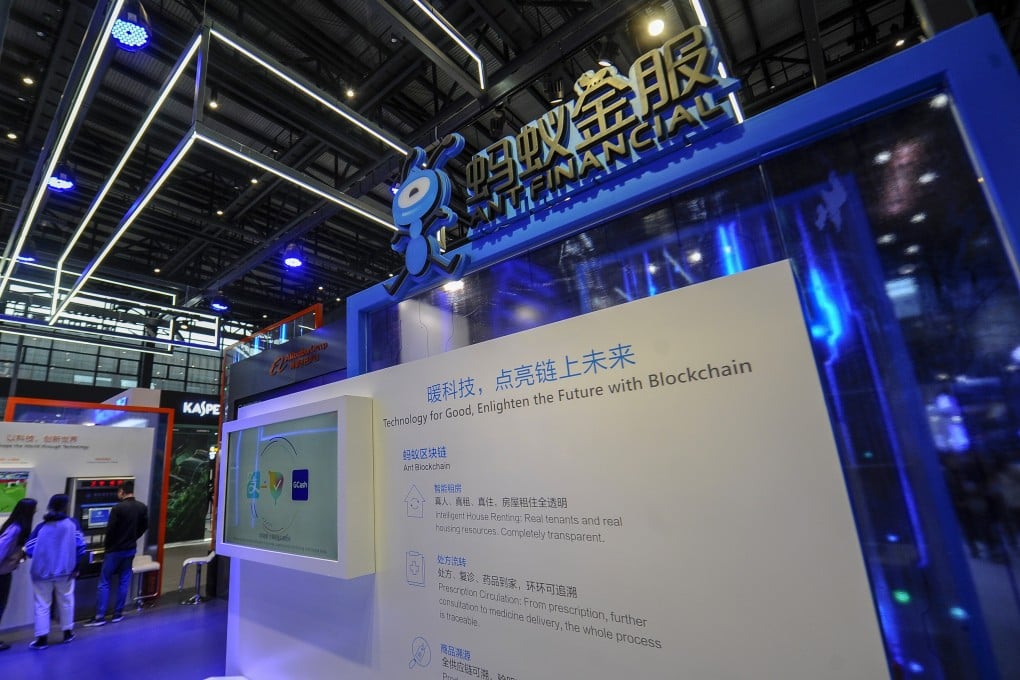

Billionaire Jack Ma’s Ant Financial has done more than perhaps any company to disrupt China’s massive banking and asset-management industries. Now it’s trying to reimagine health insurance.

Ant’s Xiang Hu Bao, which means mutual protection, has attracted 50 million people since its October inception, or more than five times the population of New York City.

The product operates somewhat like a collective, in which members contribute evenly to payouts of as much as 300,000 yuan (US$45,000) when a participant falls critically ill. It’s free to sign up, there are no premiums or upfront payments, and disputes about claims are adjudicated by volunteer members, according to a statement from the company on Thursday.

Advertisement

In return for managing the process, Ant will take an 8 per cent administrative fee out of every payout.

Advertisement

Ant, best known for the Paypal-like Alipay service that underpins Alibaba Group Holding’s online shopping platform, is redesigning financial products from money market funds to consumer credit that have long been dominated by state-owned Chinese behemoths.

Advertisement

Select Voice

Select Speed

1.00x