Lessons learned in China are shaping our digital business in the US, Citigroup exec says

- Chinese practices an indicator of where banking is headed, Stephen Bird says

- Citi is using mainland China experience to shape ‘mobile-first’ transformation

Citigroup’s long-time presence in mainland China is paying off as the American lender builds out its digital capabilities in the United States, according to the head of its global consumer banking business.

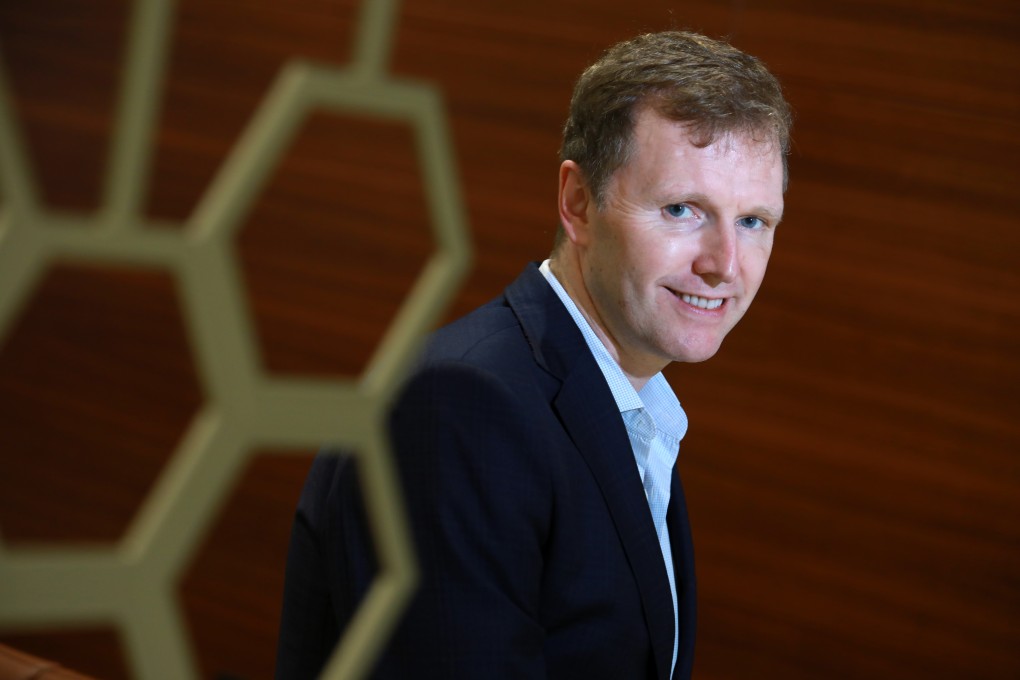

Stephen Bird, the chief executive of Citi’s global consumer bank, said the lender has used the lessons it has learned from the evolution of digital payments and banking services in mainland China as a “clarion call of where the world is going and will go”.

“Through the development of your Alipay and WePay, China has already created a full digital infrastructure where the society has become almost cashless, where you can message, pay, save, transact,” Bird said. “I think that that is a very clear indicator as to the pattern of behaviours we will all live. That means we've had to reinvent our business to be a virtual business. And I think the state of transformation in Citi is, is very, very, very good.”

Citigroup has been licensed to offer yuan services in mainland China since 2007 and has offered its own-branded credit cards in the country since 2012.

Bird, who ran the bank’s Asia-Pacific operations before he was appointed CEO of the global consumer bank four years ago, said the consumer bank has used its experience in China as a catalyst in developing its global “mobile-first” strategy that has changed how it markets products to consumers.

“Today’s consumers don’t distinguish between a bank service and a service they get on Ant Financial or WeChat. They compare us to their best service experience. Speed and convenience have become table stakes,” Bird said. “This is why we have been obsessive about digitising our business front to back. We acquire digitally. We engage and deepen relationships digitally. We service digitally because it’s most convenient for our clients.”