Exclusive | China’s government mulls special stake in wallstreetcn.com as it looks to control the flow of information on trade, economics

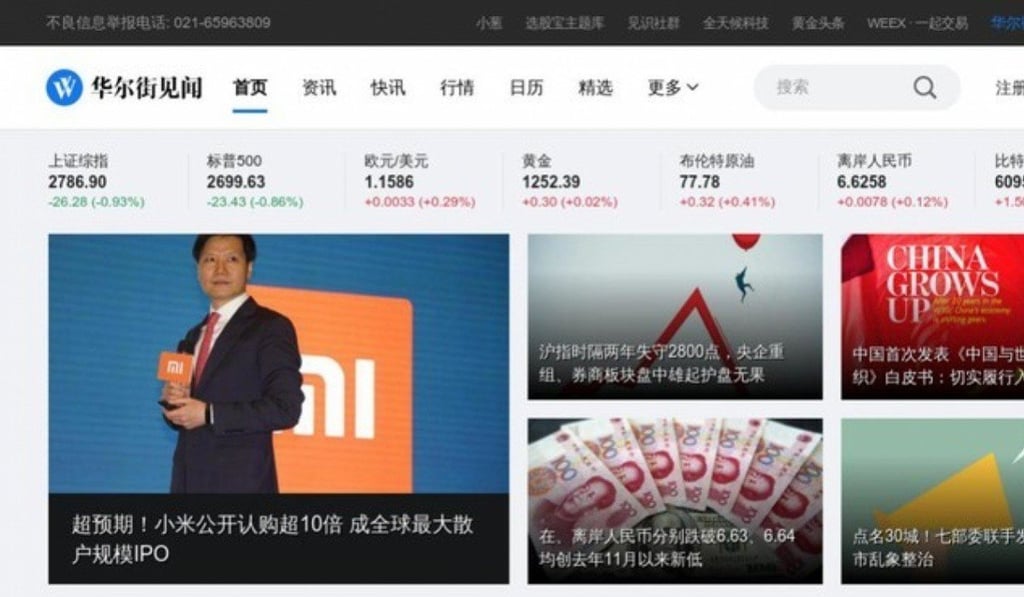

- China’s internet regulator is in talks to take up a stake in wallstreet.cn, whose financial news aggregation service had been suspended since June 10

- The regulator’s stake, known as ‘special management shares’, may be held via a local state asset supervision authority or a government-backed fund, sources say

The Chinese government is trying to extend its oversight of sensitive subject matter to trade, economics and business – in addition to politics, religion and race – by muscling in on the ownership of private media organisations.

The Cyberspace Administration of China (CAC), which regulates the country’s internet, smartphone applications and websites, is working on a plan to take a minority stake with super voting power in Shanghai Aniu Information Technology, the operator of the wallstreetcn.com service, according to several sources familiar with the matter.

The wallstreet.cn aggregation site, which provides free news and information about finance, trade and business, has been suspended since June 10 by the CAC for violating cybersecurity laws.

The stake, known as “special management shares” may be held via a local state asset supervision authority (SASAC) or government-backed investment fund, said the sources who declined to be identified for speaking about a matter under deliberation.

Aniu, founded in 2013 by a former financial reporter, counts CMC Capital Partners - a unit of one of the country’s biggest media conglomerates China Media Capital (CMC) - as a shareholder. Aniu and CMC would not comment. Calls to the CAC’s office in Beijing went unanswered.