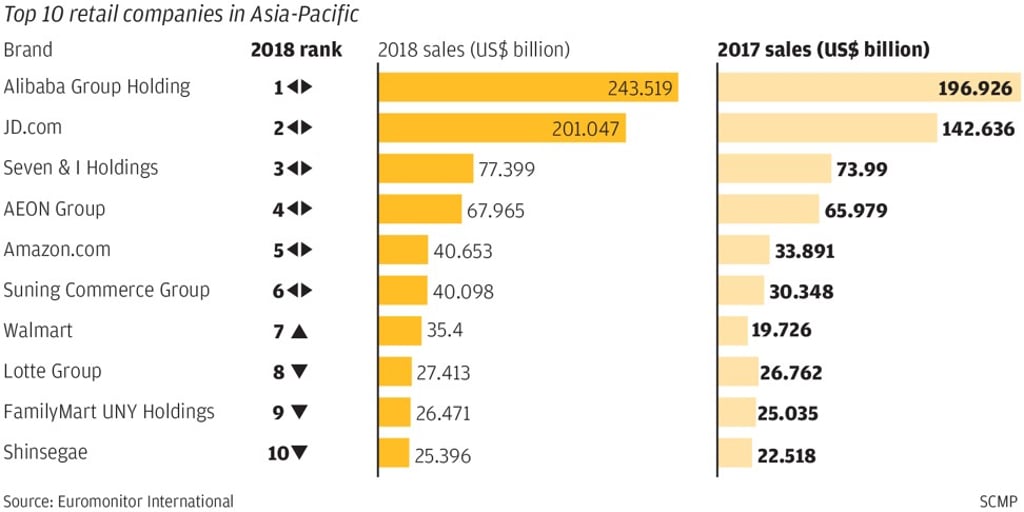

E-commerce giants Alibaba and JD.com by far the dominant retailers in Asia-Pacific, Euromonitor study finds

- Alibaba’s sales rose nearly 25 per cent last year to US$243.5 billion, while JD.com’s sales increased by 40 per cent to US$201 billion

- Euromonitor expects retail sales to grow in the low single digits next year because of the US-China trade war

Chinese e-commerce giants Alibaba Group Holding and JD.com were Asia-Pacific’s top retailers by sales last year, with combined revenues of US$444.5 billion, dwarfing Hong Kong’s GDP of US$363 billion.

According to the Top 100 Retailers in Asia-Pacific report by global market research company Euromonitor International, Alibaba generated sales of US$243.5 billion last year, up by about a quarter from US$196.9 billion in 2017. Alibaba owns the South China Morning Post.

JD.com, China’s second-largest online retailer, raked in US$201 billion, up 40 per cent from US$142.6 billion in the previous year.

Japan’s Seven & I Holdings, which owns the 7-Eleven convenience stores, AEON Group and US online retailer Amazon.com rounded out the top five.

“Four out of the top 10 retailing companies derive the entirety of their sales from China only, speaking volumes about China’s existing lead in Asia-Pacific’s e-commerce and also the amount of growth potential left,” said Ivan Uzunov, research manager at Euromonitor.