US-China trade war may have ‘milder than feared’ effect on global growth, Fidelity says

- No ‘imminent risk’ of a global recession next year, according to Fidelity’s Wen-Wen Lindroth

- Trade war drag on business, consumer confidence key indicator to watch, Fidelity says

In a new report, Wen-Wen Lindroth, Fidelity’s lead cross-asset strategist, said that the asset manager does not see an “imminent risk” of a global recession next year as US growth, while slower, remains positive and there appears to be resilience in the global economy through the end of next year.

“The US-China trade war continues to attract the headlines and buffet markets, but the actual impact on global growth could prove milder than feared. Standard economic models show that even in the case of a full trade escalation in the conflict, the direct drag on global GDP growth should be less than 0.3 per cent annualised over 2019/2020,” Fidelity said. “We are monitoring the drag from uncertainty on corporate confidence and consumer confidence as a key signal to watch.”

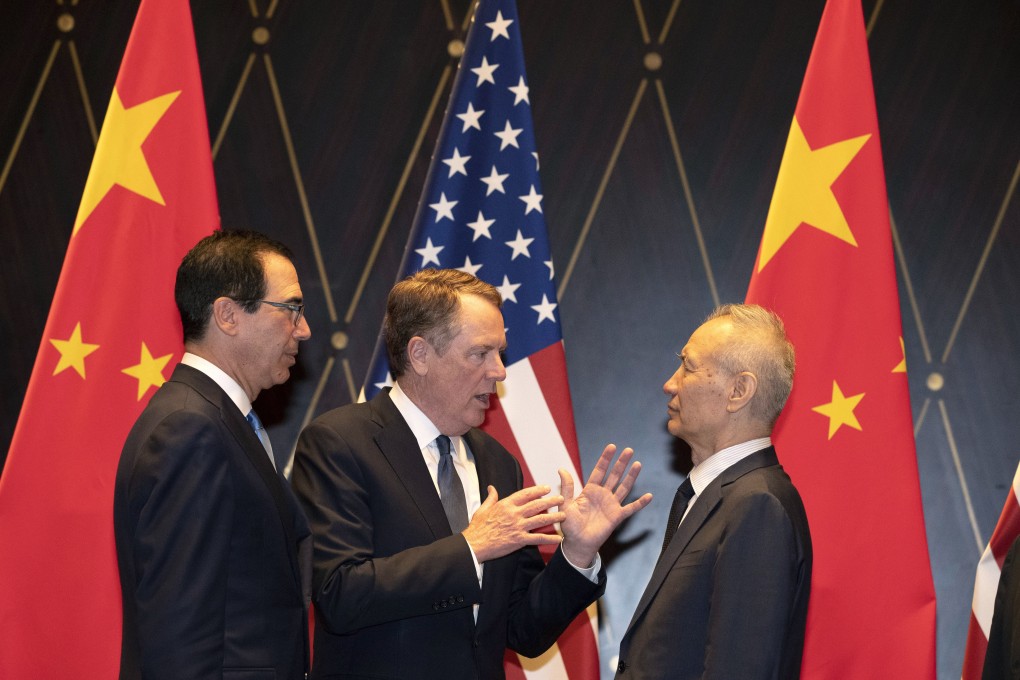

The trade war between the world’s two biggest economies has raged for more than a year as US President Donald Trump tries to force Beijing to change decades of trade and industrial policy. The US has put tariffs on about US$380 billion of Chinese goods and China has responded with its own tariffs.

Hope has built in recent weeks that the two countries might be moving closer to a deal, with Trump delaying an increase in tariffs on hundreds of billions of dollars of products that were set to go into effect on October 1. That increase has been delayed until October 15.