Unconvertible yuan is a drag on Shenzhen’s race to supplant Hong Kong’s unique role as China’s offshore financial centre

- Hi-tech hub is likely to play a larger role in making yuan a global currency, analysts say, but mainland Chinese capital controls will keep it from becoming a magnet for global investment

- Hong Kong’s freely convertible currency ensures its unique position as China’s window to the world

On August 30, China’s central bank announced a new rule to be tried out in Shenzhen. Non-banking financial institutions were allowed to convert hard currency into yuan without prior approval, a move that was seen as further easing of the yuan’s convertibility.

Far from it, said Joseph Yam Chi-kwong, the founder and first chief executive of Hong Kong Monetary Authority from 1993 to 2009.

Yam, a member of Chief Executive Carrie Lam Cheng Yuet-ngor’s Executive Council, does not think the current protests in Hong Kong would influence China’s plan to develop the convertibility of the yuan, adding that the city’s role as an offshore yuan centre would not be affected by those plans.

China’s regulator relaxes currency conversion rules throughout Shenzhen

The interpretation by some people of the August 30 initiative as “more convertibility of the yuan” is a little misleading, Yam said, adding that people are unnecessarily worried that China was planning to allow the yuan to be freely convertible without any restriction.

“This question [about free convertibility] mistakenly assumes that the mainland financial authorities have a policy objective of making the renminbi ‘freely’ convertible. The policy objective, as far as I can appreciate, is ‘full convertibility’ of the renminbi rather than ‘free convertibility’,” the former de facto central banker said in an exclusive interview with the Post.

If the yuan becomes fully convertible, it would still require approval from the authorities in terms of which capital account items are convertible. In the case of free convertibility, no approvals are required.

“The distinction is a subtle but an important one,” Yam said.

“This [full convertibility] is a less risky model of convertibility that is appropriate for the mainland, given the stage of development of its financial markets. Whatever convertibility model is adopted, the key to success, or rather the yardstick for measuring success is, of course, currency and financial stability, which the mainland has.”

Whatever convertibility model is adopted, the key to success, or rather the yardstick for measuring success is, of course, currency and financial stability, which the mainland has

The hi-tech hub surpassed Hong Kong’s gross domestic product for the first time in 2018. Shenzhen’s economy grew by 7.6 per cent to HK$2.87 trillion (US$361.24 billion) versus 3 per cent for Hong Kong to HK$2.85 trillion.

But capital control in China is what differentiates Hong Kong from Shenzhen and other mainland Chinese cities.

Article 112 of the Basic Law states that “No foreign exchange control policies shall be applied in the Hong Kong Special Administrative Region. The Hong Kong dollar shall be freely convertible.”

Tight capital control in China is why international banks, brokerages and insurance companies like to set up businesses in Hong Kong so as to access mainland China. Even with China starting to allow easy convertibility of the yuan, some control remains in terms of both bringing money in or taking it out of the country.

Jacob Dahl, leader of consulting firm McKinsey’s banking and securities work in Asia, said that international investors were unlikely to shift away from Hong Kong to Shenzhen any time soon, as it takes several decades of experience and trust to establish an international financial centre.

“Shenzhen has established itself as an advanced tech centre, but it has not yet established itself as a global financial centre. In contrast, Hong Kong has been leading banking, insurance and wealth management centre as an entrepot to invest in or out of China. Such a position would not be easily replaced by any financial centre,” Dahl said.

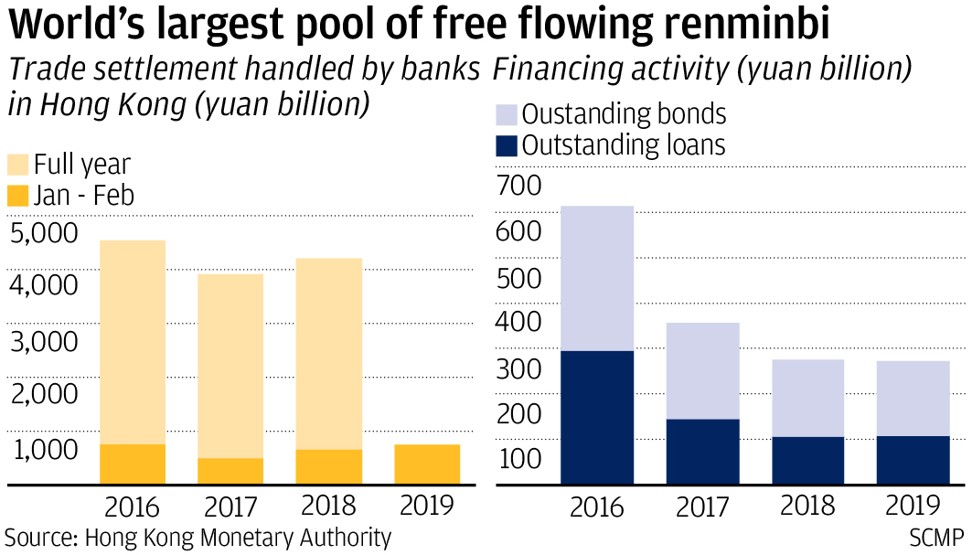

While China wants to keep capital controls in place, it also wants the international financial community to increase the use of the yuan for trade and investment. It is because of this conundrum that Hong Kong’s role as an offshore yuan trading centre stands out.

It was during Yam’s tenure as HKMA’s CEO that Hong Kong rose to prominence as an offshore yuan trading centre.

In 2004, Beijing loosened restrictions on the yuan for the first time, allowing Hong Kong banks to accept yuan deposits and to remit money. Then in 2009, it opened up to the world, allowing the use of the yuan to settle trade. A year later it allowed the use of the yuan in bonds, insurance policies and mutual funds.

At its peak in December 2014, yuan deposits in Hong Kong stood at 1.004 trillion yuan (US$140.1 billion), according to HKMA. It fell to 644.1 billion yuan at the end of August, but the city still remains the largest offshore yuan centre worldwide, far ahead of Singapore, London and New York.

Yam said that the protests in Hong Kong were irrelevant to the convertibility of the yuan. The trade war, which was taking on a financial dimension, was more important.

“China’s response should be to accelerate the internationalisation of the renminbi, so as to reduce China’s dependence on the US dollar as a medium of exchange in its international transactions and therefore the leverage of the US in its attempt to contain China.

“The current difficulties experienced in Hong Kong, thankfully, have not affected such utility, as the performance of our financial markets and importantly the stability of our monetary and financial systems testify. Hong Kong as an international financial centre and specifically as the largest offshore renminbi market has not lost the trust of anyone, let alone Beijing,” Yam said.

Other bankers and bureaucrats noted that instead of worrying about the yuan’s convertibility, there are greater advantages if the two cities work together.

Peter Wong Tung-shun, Asia-Pacific head at HSBC, said Hong Kong and Shenzhen’s complementary strengths mean they both have an important role to play in the internationalisation of the yuan.

“Shenzhen is a global centre for innovation and advanced manufacturing in the heart of the ‘Silicon Delta’. It plays a prominent role in driving greater use of the yuan in trade settlement and in the use of new technology.

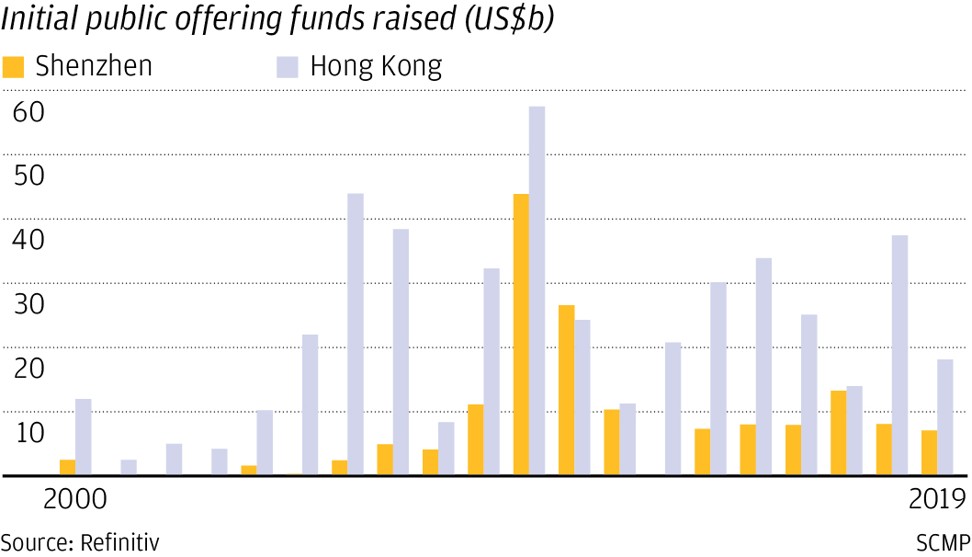

“Since the launch of the Shenzhen-Hong Kong Stock Connect in 2016, the two cities have worked together to bring more global investment into China’s domestic capital markets, enabling new economy hi-tech companies to be included in global benchmark indices,” Wong said.

During the first half of this year, international investors on average invested 20.4 billion yuan a day in Shenzhen-listed shares via the connect scheme, up 137 per cent from a year earlier.

International investors’ interest in mainland-listed equities has grown after index compiler MSCI added the A shares into its benchmark index, with Hong Kong acting as a gateway for these investors via the connect schemes.

He Jie, director general of Shenzhen Municipal Financial Regulatory Bureau, said that although Hong Kong and Shenzhen have different roles and serve different investors, the stock connect showed that the two cities could work together.

“Hong Kong and Shenzhen stock markets are both very active and successful. Shenzhen serves domestic companies and local investors, while Hong Kong serves companies that want to go global and is widely traded by international investors,” He said.

Is China trying to replace Hong Kong with Shenzhen?

Witman Hung Wai-man, principal liaison officer for Hong Kong of the authority managing Qianhai free-trade zone in Shenzhen, said cooperation between Hong Kong and Shenzhen could yield greater benefits for everyone.

“As Shenzhen serves as a financial centre for the Greater Bay Area, and Hong Kong for international investors, funds from other parts of China could first flow into investment products or companies in Shenzhen, and then channelled into the offshore market in Hong Kong such as H shares or other products,” Hung said.

But Edmond Hui, chief executive of Bright Smart Securities, Hong Kong’s largest brokerage, said that Hong Kong has nothing to fear about the emergence of Shenzhen as the new financial star.

Hui said that one of Bright Smart’s 20 outlets was in Sheung Shui, close to the border with Shenzhen. Although it takes only 15 minutes to walk across the border over to Shenzhen, it that makes a world of a difference when it comes to capital controls.

“Even if China were to relax the yuan convertibility to nearly a level of full convertibility, it would still not be freely convertible and that is why Shenzhen cannot replace Hong Kong.”