Two more companies set to raise up to US$250 million as Hong Kong marches ahead in retaining IPO crown

- SinoMab BioScience, a home-grown Hong Kong biopharma company, is aiming to raise up to HK$1.75 billion

- China PengFei Group, the world’s largest supplier of rotary kilns used to make construction materials, is seeking to raise up to HK$197.5 million

A Hong Kong biopharma company and the world’s largest supplier of rotary kilns used to make construction materials have unveiled plans to tap up to HK$1.95 billion (US$250 million) from the city’s stock market to fund their business plans.

SinoMab BioScience is aiming to raise up to HK$1.75 billion by selling 182.1 million shares at HK$7.6 to HK$9.6 each, while China PengFei Group aims to raise up to HK$197.5 million by selling 125 million shares between HK$1.05 and HK$1.58 each.

The pair has joined a string of other companies to launch initial public offerings in the city, at a time when its economy – especially tourism and hospitality related sectors – has been battered by nearly five months of anti-government protests.

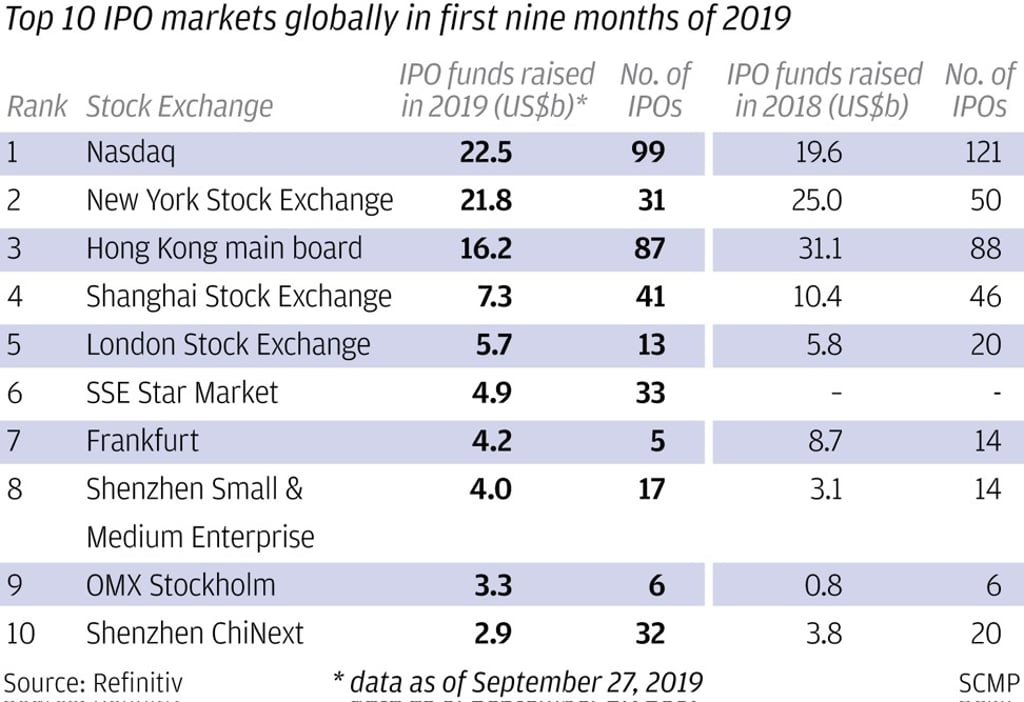

Their fundraising plans come after Hong Kong regained its top position in the global IPO ranking league table in this year’s third-quarter, edging out Nasdaq and New York Stock Exchange in first-time share sales.

However, Hong Kong’s deal volume of US$20.5 billion trailed Nasdaq’s US$24.1 billion and NYSE’s US$22.5 billion so far this year, based on data provider Refinitiv’s tally. Hong Kong was No 1 last year.