Chinese electric car battery makers out to show the world they have power and quality to go the distance

- Industry observers say Chinese EV battery makers have been striving to improve their technology

- As a result, they have been tying up with foreign companies, investing in R&D and hiring the best overseas talent to match their overseas competitors

Eric Huang is in the market to buy an electric car. The Shanghai native has not yet zeroed in on a particular model, but driving range is a top priority.

“Electric is the new trend, so I have decided to replace my old car with an electric vehicle,” he said. “I need a car with a long driving range because I often drive to neighbouring cities like Suzhou and Hangzhou for business.”

The car, which has a range of 500km on a single charge, meets his requirement, but he isn’t that keen on a Tesla if the US electric carmaker uses batteries from a local supplier, as he is not convinced of their quality.

It has been reported that China’s Contemporary Amperex Technology Ltd (CATL) had reached a preliminary agreement to supply the US carmaker. CATL would not comment on the deal, but said it has big plans, which would be unveiled next year.

Panasonic chief executive Kazuhiro Tsuga has said that the company had no plans to build a new battery plant for Tesla in China as it was struggling to make profits from its existing battery business with the US EV maker.

Tesla’s made-in-China cars to qualify for subsidies

“It is up to Tesla to decide whether it would use Chinese-made batteries from other manufacturers or get batteries from our Gigafactory 1 [in Nevada],” Reuters quoted him as saying in November.

Based in Ningde, China’s southeastern Fujian province, CATL is already the world’s largest producer of EV batteries in terms of installed production capacity. The company rose into global prominence with its US$2 billion investment in a battery factory in Germany in July last year. The plant will supply BMW when it starts operations in 2021.

China is by far the world’s largest new-energy vehicle market and Beijing’s stated goal is to make the country a global industry leader. Under the “Made in China 2025” strategy, China wants 10 key industries, including the NEV sector, to catch up with international leaders and become self-sufficient in core technologies.

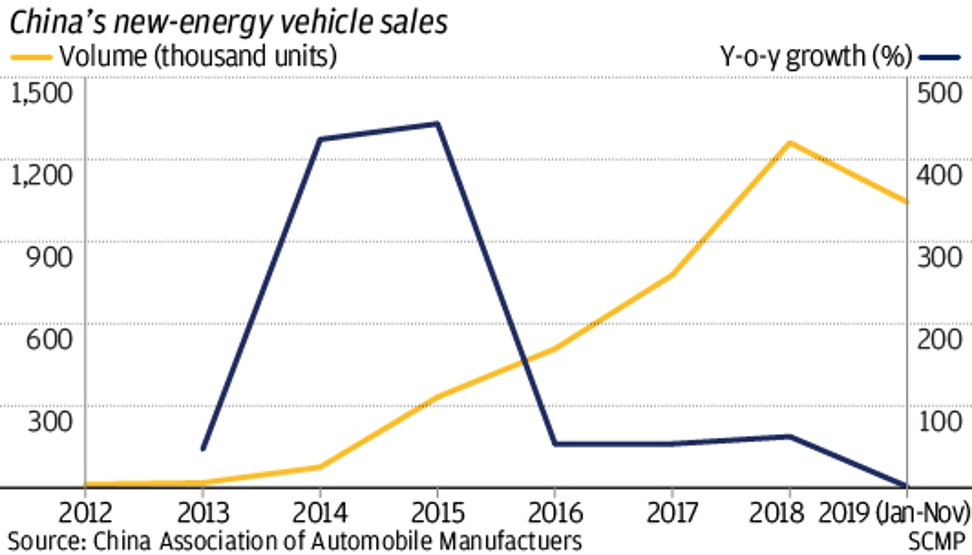

Last year, 1.26 million electric and plug-in hybrid cars were sold in mainland China, accounting for about 60 per cent of the global total. Heavy cash subsidies, with both the central and local governments shelling out massive funds to encourage the purchase of environment-friendly vehicles, has helped to boost sales since 2014.

However, many prospective buyers like Huang are yet to be convinced about the quality, performance and safety of domestically made batteries.

“Battery is the backbone of an electric car … and Chinese-made batteries are still playing a catch-up game and it will take time and money to prove their quality,” said Qian Kang, owner of a Zhejiang-based company that makes car components.

Safety is another concern dogging Chinese-made EV batteries. In August 2018 alone, at least five Chinese-made EVs, including those made by Chongqing-based Lifan Motors and Shanghai-based WM Motor, caught fire.

Zhang Lihua, a vice-president at Webasto, said Chinese EV makers have been striving to improve their technology by partnering with foreign companies. He said that the German company, which makes battery packs that provide electrical connectivity between cells, has been working with Chinese carmakers to improve battery design for their vehicles.

According to UBS analyst Paul Gong, CATL, Panasonic and South Korea’s LG rank among the top EV battery makers.

“In terms of quality, we see these makers have different advantages. CATL has been doing quite well in producing impressive energy density battery cells,” Gong said. “The production scale of CATL is bigger than others and has successfully established its supply chains.”

CATL’s latest NCM 811 battery, which contains 80 per cent nickel, 10 per cent cobalt and 10 per cent manganese, can achieve 340 watt hours per kilogram – a major yardstick for energy density. It also has a longer lifespan and allows electric vehicles to go further on a single charge. It’s a huge improvement over its NCM 622 battery, which can produce 240 watt hours per kg.

“The company’s 811 products are already being mass-produced and the rate of progress will be based on customer demand,” CATL chairman Zeng Yuqun said at a shareholders conference on April 26.

It is worth noting that some 60 per cent of Chinese carmakers use CATL products.

Industry observers believe that the mainland’s leading battery makers, which have made tremendous advances in technology, will soon catch up with the global leaders spurred by their spending on R&D and talent acquisition.

CATL has hired Bob Galyen, a battery expert and long-time GM executive, as its chief technology officer.

The production scale of CATL is bigger than others and has successfully established its supply chains

“For battery technology, it is no secret that Chinese companies have been aggressively looking into South Korea and Japan for top talent in an effort to attract them to China,” said David Nagy, the managing partner for Asia-Pacific industrial practice at DHR International, a headhunting firm.

He added that Chinese companies were not only chasing designers for product development but also going after overseas professionals with manufacturing expertise.

Although CATL is benefiting from the China’s massive market and favourable policies of the Chinese government, it is taking into account the needs of smaller clients and going out of its way to accommodate them.

An official with a forklift firm, who requested anonymity, said CATL was willing to supply the company batteries designed specifically for its products even though the demand appeared to be low initially. The bet is likely to pay off as demand for the forklifts is rising gradually, the executive said.

BYD, the mainland’s leading EV maker and second-biggest battery supplier, had snubbed the company as it thought the production volume was small.

“We all saw it blossom in only three to four years, but actually it had a longer learning curve,” UBS’ Gong said.

Zeng Yuqun, also known as Robin Zeng, is the man behind CATL’s meteoric rise.

Although CATL was created in 2011, it started life as ATL (Amperex Technology Ltd) in 1999, supplying batteries to electronic companies. Later ATL was acquired by TDK with Zeng still at the helm. He saw potential in EV batteries and started to develop it about 10 years ago. TDK spun off the EV battery segment in 2011 as CATL.

Within a year of its launch, CATL received a huge boost. German carmaker BMW picked CATL as its battery supplier for Zinoro, an EV designed specifically for the mainland market.

And even though Zinoro did not live up to its expectations, CATL learned a lot from BMW, building up its supply chain and establishing a standardised production system, according to industry insiders.

CATL’s foreign clients now include BMW, Daimler, Honda, Toyota, Volkswagen and GM.

In the coming years, with big battery makers looking to expand beyond their home market, it is still difficult to say who will rise above the competition.

“At this moment, we still see head-to-head competition,” Gong said.

Driven by substantial cash subsidies by the central and local governments since 2015, China’s NEV sector now has at least 200 players, including a raft of start-ups engaging in assembling electric vehicles and about 100 battery makers.

A total of 100 billion yuan (US$14.2 billion) has been invested in the EV battery industry, according to Eefocus, an online tech consultancy. Additionally, existing plants have a combined annual capacity of 5 million batteries, nearly 70 per cent more than Beijing’s targeted sales of 3 million EVs a year by 2025.

Analysts say the top battery producers will eventually take a lion’s share of the market as they have more financial and technological resources to improve the products and survive the cull.

Carmakers and battery manufactures will definitely feel the impact of dwindling NEV sales over the past four months following a cut in subsidies of up to 60 per cent.

In November, sales of NEVs fell 42 per cent from a year ago to 78,000 units, according to the China Passenger Car Association. It was the fifth consecutive month that the mainland’s NEV industry reported falling sales, following four years of sizzling growth buoyed by the strong subsidies.

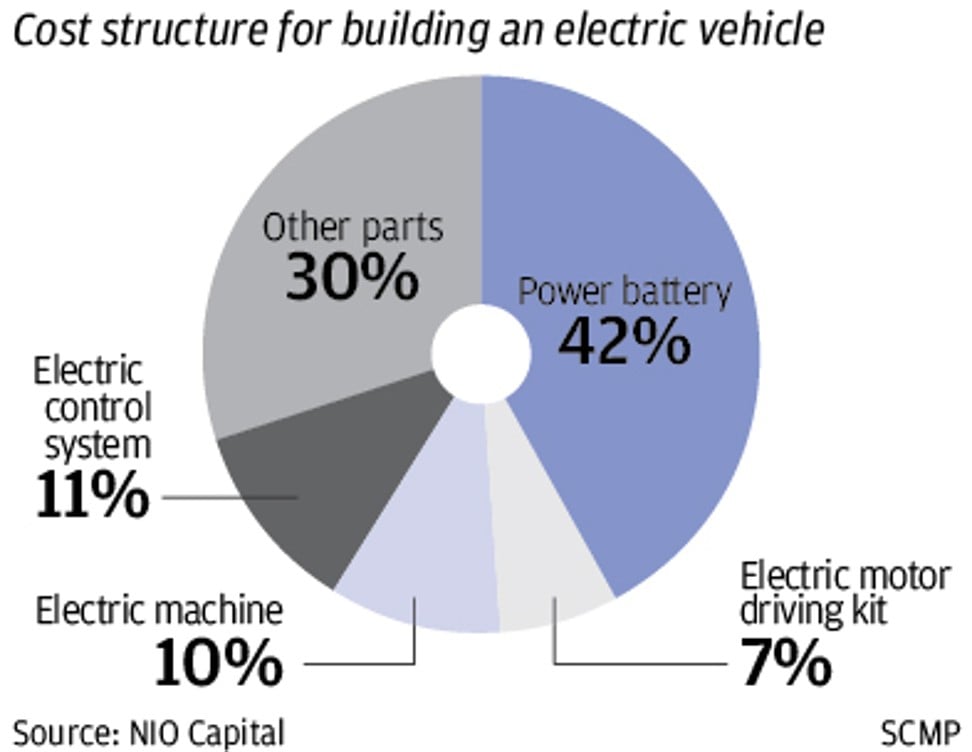

“We will see a large number of NEV makers and suppliers file for bankruptcy in 2020 following the cut in subsidies,” said Yu Ning, a managing partner at NIO Capital, an investment group focusing on NEV technology.

“Taking a long-term view, a shake-up of the industry will benefit the best-performing companies. After all, a healthy NEV industry cannot rely just on government subsidies.”