Pin-striped suit banking is so 19th century, as virtual banks of Hong Kong, Singapore demand a new crop of IT-savvy professionals

- The imminent commencement of virtual banks in Hong Kong and Singapore have created more than 1,000 job opportunities for a new generation of bankers

- Competition for talent has sharpened since last year as both cities stepped up their race to spruce up their financial technology (fintech) and online banking offerings

The imminent commencement of virtual banks in Hong Kong and Singapore have created more than 1,000 job opportunities for a new generation of bankers, requiring them to be innovative and tech savvy, according to recruitment experts.

Competition for talent has sharpened since last year as both cities stepped up their race to spruce up their financial technology (fintech) and online banking offerings, said Jerry Chang, managing director of recruiting firm Barons & Company.

“The new [virtual banks] in Hong Kong and Singapore need to hire staff, while the traditional banks are also expanding their digital banking and wealth management services to compete,” Chang said in a telephone interview with South China Morning Post. “The virtual banks want experienced bankers who understand banking regulations, with good technological background who can establish online platforms to serve customers.”

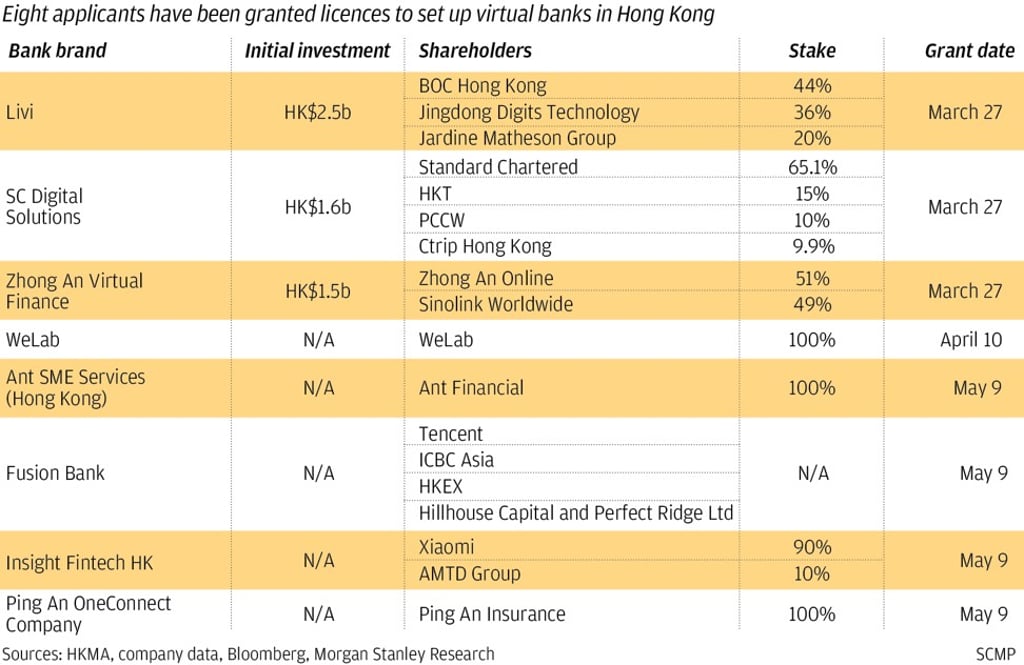

The race for talent is heating up, as eight banking licenses awarded by the Hong Kong Monetary Authority (HKMA) must commence operations in the coming months, each requiring over 100 staff to kick off. In Singapore, 21 technology companies from the ride-hailing service Grab to online payments provider Ant Financial Services have applied bids for five digital bank licenses.

“The demand is strong, but it is not easy to hire bankers of this calibre and with the right skills,” said Chang.