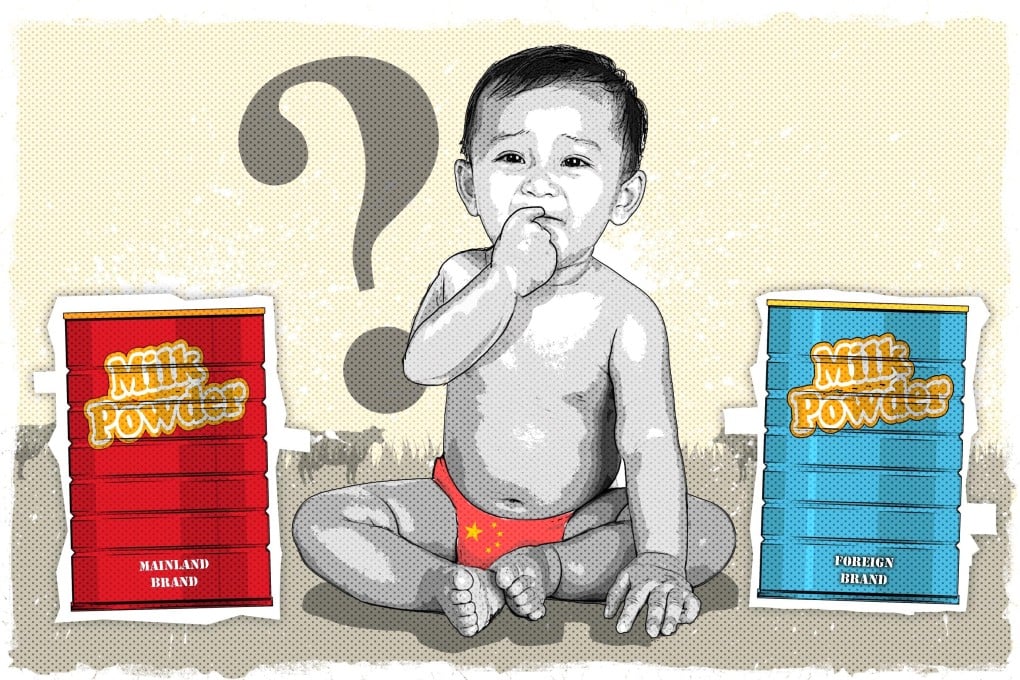

China’s parents haunted by melamine baby milk scandal still favour foreign brands

- Domestic makers of baby powder rebuild their market share to 44 per cent, all down to Feihe which was not caught up in the 2008 tragedy

- Foreign brands are seen as “way more trustworthy” and this reputation is likely to last for very long time, EIU says

Twelve years ago, 300,000 children in China were poisoned after drinking infant milk formula that contained melamine, a chemical used in plastic. Six babies were killed by the toxic substance, which was used by 22 companies to artificially boost the protein levels that showed up in nutrition tests.

Those responsible were punished with sentences ranging from lengthy prison terms to the death penalty.

Dubbed the ‘melamine scandal’, the tragedy rocked China’s baby milk formula industry. Many parents lost their trust in domestic brands, paving the way for foreign companies to charge ahead in a market Euromonitor predicts will be worth US$32 billion by 2023. Only about a quarter of Chinese mothers breast feed.

More than a decade on, China’s dairy industry is still shrouded in mistrust. Its largest infant milk producer, China Feihe, is the only domestic baby powder company that has emerged largely unscathed, touted as the brand to take on international giants like Nestle and Danone. Feihe did not have any melamine in its products.

Analysts say there is still a way to go before consumers fully trust and actively choose domestic producers over foreign rivals, and that gains in overall market share by local companies in recent years are almost entirely down to Feihe’s success. Foreign brands say China is a hugely important market they intend to continue expanding in.