Exclusive | Will the global coronavirus outbreak impede or help HNA Group’s debt workout programme to slim down?

- HNA Group is now fraying as the current coronavirus outbreak exacerbates its financial distress

- Hong Kong Airlines, which HNA Group bought in 2006, is in talks for a financial white knight

For four months starting in November 2016, a little-known Chinese company made waves in Hong Kong’s tight-knit real estate market, upending the intricate competition for influence between a handful of the city’s wealthiest and most prominent landowning families.

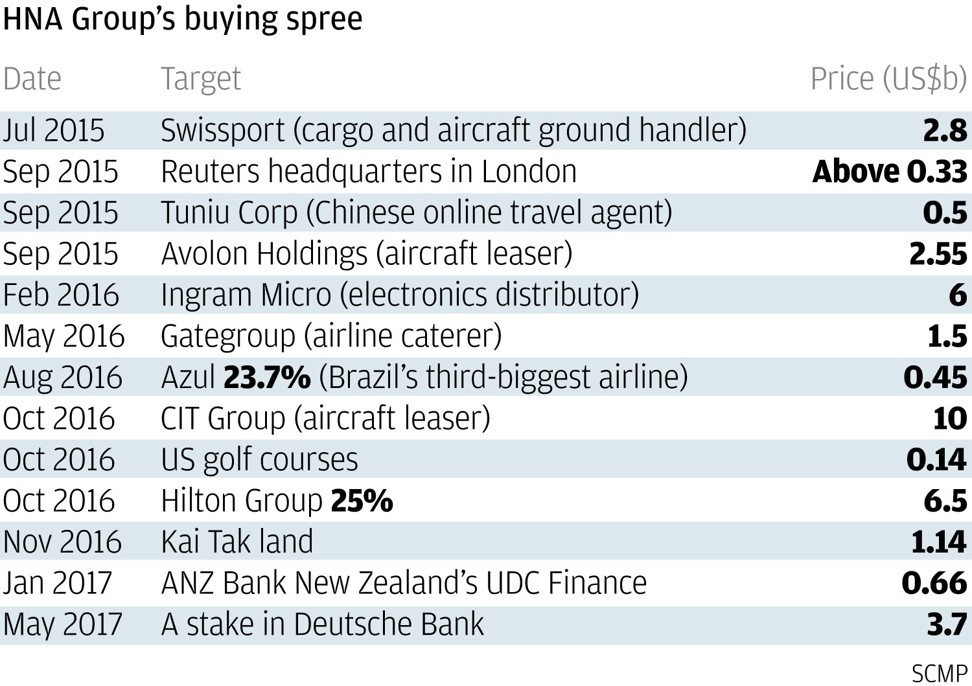

From its core airlines, HNA Group spent US$32 billion since 2015 on Manhattan office towers, stakes in Deutsche Bank and Hilton hotels, even down to a little jewellery producer in Hung Hom called Hifood Group.

As the global coronavirus outbreak keeps tourists, business travellers and aircraft fleets on the ground, it is sapping HNA Group of much-needed cash flow and weighing on a plan to unwind its debt.

“HNA Group’s scale makes it a contagion risk,” says Sean Hung, a senior analyst at Moody’s Investors Service. “Many large financial institutions in China have significant exposure to the group and its subsidiaries.”

Huarong International Financial, a unit of China’s largest bad-debt manager, gave up a HK$146.2 million worth of collateral after HNA Aviation Holdings failed to repay its loans. The receivers are now finding buyers for the Hifood shares.

HNA Group was founded in 1993 by Chen, who worked for the civil aviation authority before going into business. With a handful of aircraft, Hainan Airlines quickly built a business flying holiday makers and Russian tourists from China’s frigid north to the country’s sole tropical island.

The airline, which stood out from its peers for its punctuality, in-flight service and new fleet, quickly expanded. It counted financier George Soros as its largest foreign shareholder, and ventured into logistics, tourism and real estate.

Months still to go in global coronavirus spread, Chinese scientist warns

In 2010, HNA paid US$150 million for Alco Rental of Australia, picking up cheap assets abroad after the global financial crisis. From there, his shopping spree gathered pace into Europe and North America.

“Mainland Chinese developers do not know the rule of the game in Hong Kong, which is different from that of China,” said Stewart Leung Chi-kin, chairman of the Real Estate Developers Association (Reda). “Hong Kong’s developers need to have the financial holding power because interest costs account for a significant part of the development cost.”

Hongkongers still trapped in virus-hit Hubei plead to be brought home

Mainland China’s developers seldom take interest costs into account because the country’s rates seldom move, and the demand from the large population allows developers to sell in bulk, giving them access to easy cash when the market is good, he said.

HNA Group reported a net loss of 1.08 billion yuan in the first-half of 2019, its second consecutive interim deficit. Operating profit, which strips out some non-cash expenses, fell 11 per cent to 11.8 billion yuan – the lowest since the end of 2016.

At its core airlines business, passenger traffic fell 35 per cent in January to 4.6 million from a year ago, while passenger capacity shrank 21.2 per cent, it said on February 17.

Hong Kong Airlines and shareholder sued by HNA Group over HK$1 billion in alleged debt

The reconstituted board could help steady HNA Group’s ship and help reorganise 525.6 billion yuan of debt load at the end of June 2019.

That may include disposing of the troubled Hong Kong Airlines. Its other two quality assets are Ingram Micro, the world’s largest distributor of IT products, and global aircraft leasing firm Avolon.

“If these stakes are sold to entities with better credit profiles, Moody’s believes the change in ownership will reduce uncertainties in operations and financial policies of these two companies, and improve their access to capital,” Hung said.

Analysts said the participation of the Hainan government will help preserve its assets value and in some cases allow HNA Group to maintain control or ownership of some of its strategic assets. That could prevent the group’s core assets from being carved up by China’s three biggest carriers Air China, China Southern Airlines and China Eastern Airlines.

HNA Group controls 14 aviation companies, including the regional carriers Shanxi Airlines, Air Changan and China Xinhua Airlines. They operate a fleet of 601 aircraft as of 2018 for 16.5 per cent share of China’s aviation market. China Southern (23.1 per cent), China Eastern (19 per cent) and Air China (18.8 per cent) lead the industry, according to data by TF Securities.

For now, all eyes are on the three bonds that HNA Group has to come due by March 25, totalling at least 3.5 billion yuan. It deferred a 211.5 million yuan coupon payment on March 9 on 2.5 billion yuan of perpetual bond, a move that does not constitute a default under its covenant.

HNA is facing another challenge by the Hong Kong stock exchange. CWT International, which has been suspended from trading since April 2019, is at risk of being delisted by October 9 if it fails to meet listing requirements in business operations and assets scale.

For Hong Kong’s developers, the exit of HNA Group from the city’s stage was foretold the moment it decided to take on the developers.

“In Hong Kong, we sell flats unit by unit,” said Reda’s chairman Leung, adding that the market had foreseen HNA Group’s financial strife. “It’s a different game.”

Purchase the China AI Report 2020 brought to you by SCMP Research and enjoy a 20% discount (original price US$400). This 60-page all new intelligence report gives you first-hand insights and analysis into the latest industry developments and intelligence about China AI. Get exclusive access to our webinars for continuous learning, and interact with China AI executives in live Q&A. Offer valid until 31 March 2020.