Chinese companies eye IPOs closer to home as Luckin Coffee, TAL scandals taint path to US markets

- IPO hopefuls debate switching plans to Asia after Luckin Coffee scandal dims confidence in Chinese companies

- Governance issue could also hasten departure of existing US-listed Chinese companies via take-private deals, bankers say

Chinese companies are likely to turn to Hong Kong or Shanghai for capital, after two accounting scandals in a week burned investors and triggered a crisis of confidence in their US-listed peers.

At least two companies are now debating with their sponsors about switching their initial public offering (IPO) plans to Hong Kong from the US, according to a senior investment banker, who declined to be identified because the discussions are private.

While investors have become “accustomed” to decades of tainted accounting books including the Sino-Forest saga in early 2011, the latest lapses could not have come at a worse time when US-China relations are frayed by spats over trade and the origin of the new coronavirus.

Luckin Coffee slumped by a record number on April 2 after it said former top executives inflated its sales figures, while TAL Education also said it discovered the same misdeed. Meanwhile, video streaming firm iQiyi has rejected reports by short sellers that the company made up its revenue.

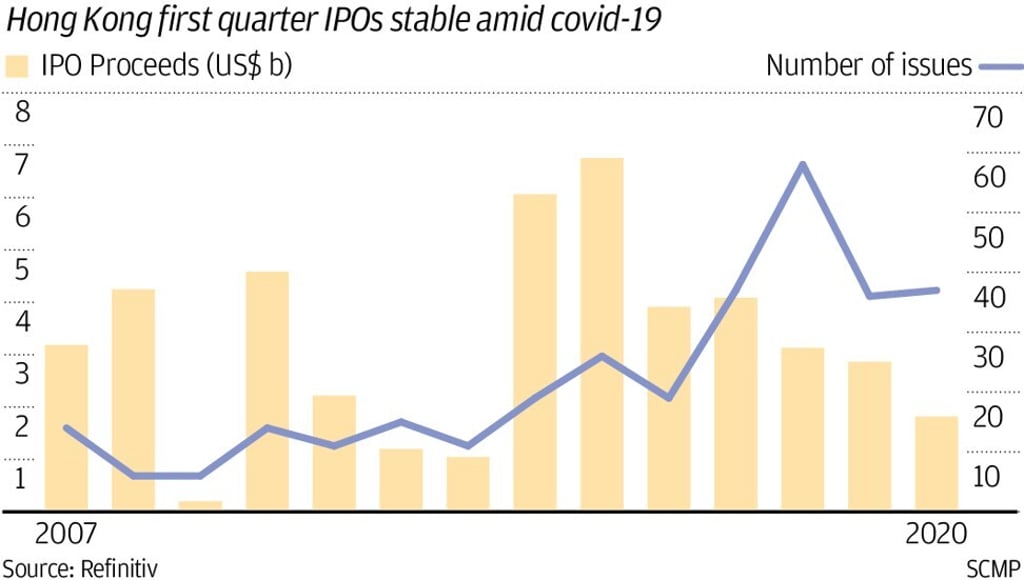

The switch could further dent the outlook for IPO bankers after US equity offerings fell 13 per cent last quarter to US$29.8 billion, the slowest start to a year since 2009, according to Bloomberg data. They fell for a second year in 2019. This may be boon to Hong Kong after being overshadowed by Shanghai as the top IPO venue this year.