Hong Kong’s FX interventions lower key interest rate, lifting the burden for SMEs and mortgage borrowers amid economic slump

- HKMA stepped into market five times since April 21 to sell HK$10.03 billion Hong Kong dollars

- One-month Hibor fell 6 per cent after the interventions

Multiple forays by Hong Kong’s monetary authority into the foreign exchange market last week to weaken the local currency have also lowered borrowing costs in Hong Kong dollars, a timely boon for struggling companies and mortgage borrowers.

“A low-interest-rate environment will encourage investors to get bank financing to support start-ups like us,” said Arthur Chan, a director at Hong Kong-based SagaDigits, that helps the government with quarantine monitoring.

The HKMA’s interventions and lower issuance of Exchange Fund bills have injected money into the banking system, pushing down the Hong Kong Interbank Offered Rate (Hibor). The one-month Hibor, a benchmark for mortgages and many corporate loans, fell to 1.46 per cent on Monday, 6 per cent lower than April 20, a day before the HKMA interventions began. It has plunged 28 per cent from the end of March when it stood at 2.05 per cent.

Hong Kong’s dollar has been linked with the US dollar since 1983 and the HKMA uses its HK$4.16 trillion (US$530.25 billion) of reserves to buy and sell the Hong Kong dollar to keep it within a band between 7.75 and 7.85.

“Lower interest rates will help lessen debt burdens, including those of mortgage borrowers who priced their loans pegged to the one-month Hibor,” according to Chi Lo, a senior Greater China economist at French financial firm BNP Paribas Asset Management. As of February, 87 per cent of new mortgages were priced against the one-month Hibor, according to the HKMA.

These Hibor-linked mortgage borrowers will directly benefit from a lower interest rate and hence will be more willing to spend, according to Xu Xiao Chun, an economist at Moody’s Analytics, a financial analysis services provider that is part of US-listed Moody’s Corp.

“Overall, lower interest rates should help cushion the negative impact of the Covid-19 pandemic on the economy,” Lo said.

“We seek to increase overall liquidity in the banking system to ensure banks have abundant liquidity to meet their daily needs and support domestic economic activities,” said HKMA chief executive Eddie Yue Wai-man in a statement on Thursday.

However, some analysts have said they expect banks to use the extra financial flexibility to cope with pressures on net interest margins, higher credit loss allowances and heightened fluctuations in banks' investment valuations given that Hong Kong banks have historically been disciplined with their risk appetite during down cycles.

While SMEs broadly welcomed the lower interest rate, they cautioned businesses still face significant risks.

“However, it will not solve all problems,” said Ian Chan, CEO of Kayamatics, a Hong Kong-based electronics SME who is worried that overseas customers will delay paying bills or cut the orders.

The HKMA should do more to bring the interest rate down amid the economic crises, said Raymond Yeung, chief economist for Greater China at Australian lender ANZ.

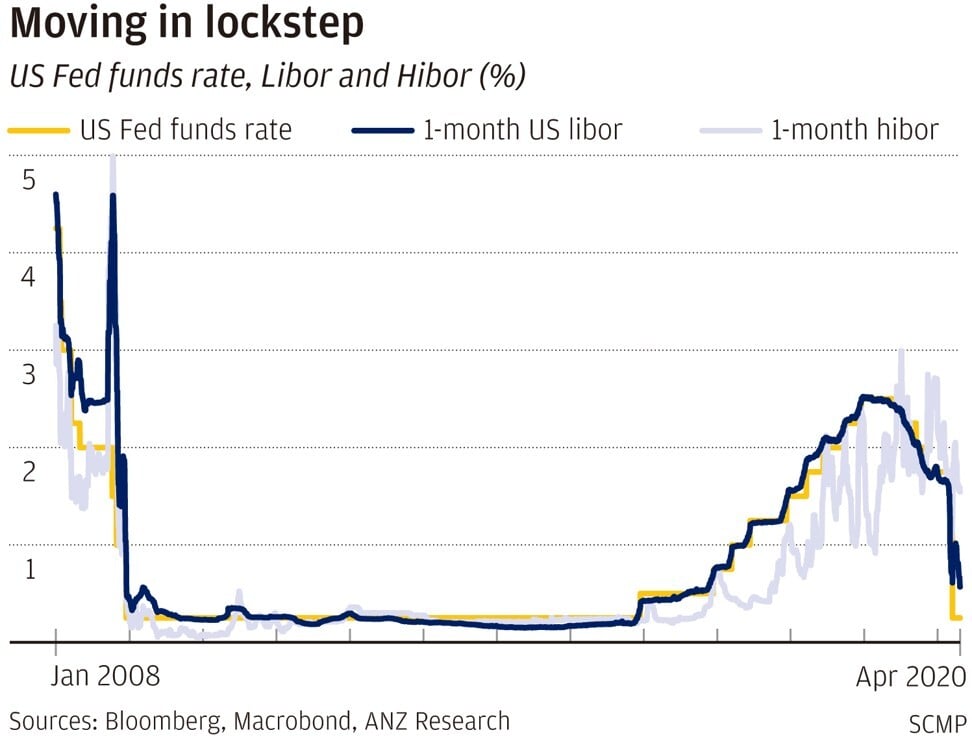

“The HKMA does not need to wait for the Hong Kong dollar to hit the upper limit for it to intervene, It can use other methods to inject more money into interbank markets to push the Hibor lower,” Yeung said, adding US interest rates have been dropping at a much faster pace than the Hong Kong dollar.

Should the one-month Hibor go lower by one percentage point it could save borrowers HK$1,894 a month based on a typical HK$5 million mortgage with a 30-year tenure, according to Eric Tso Tak-ming, chief vice-president of mReferral Corporation, a mortgage consultancy.

Tso believes the Hibor will soon drop below 1 per cent. The Hibor dropped to 0.05 per cent in early 2010. It stayed at around 0.3 per cent between 2009 and 2015, when the US has kept the Fed rate close to zero.

“However, during the current economic crisis, a low borrowing cost may not necessarily buoy the housing market or ease business stress,” said OCBC Wing Hang bank’s economist Carie Li Ruofan.

In March, the jobless rate hit a nine-year high at 4.2 per cent compared with 2.8 per cent mid last year. Li believes the rate will surpass five per cent soon. The record high for unemployment was 8.5 per cent recorded in 2003 during the outbreak of Severe Acute Respiratory Syndrome (Sars).

Eleanor Wan, chief executive of BEA Union Investment, also believes low interest rates alone can lead to Hong Kong’s economic recovery. “The primary driver for Hong Kong’s market recovery is how quickly China and the US resume their economic activities,” Wan said.