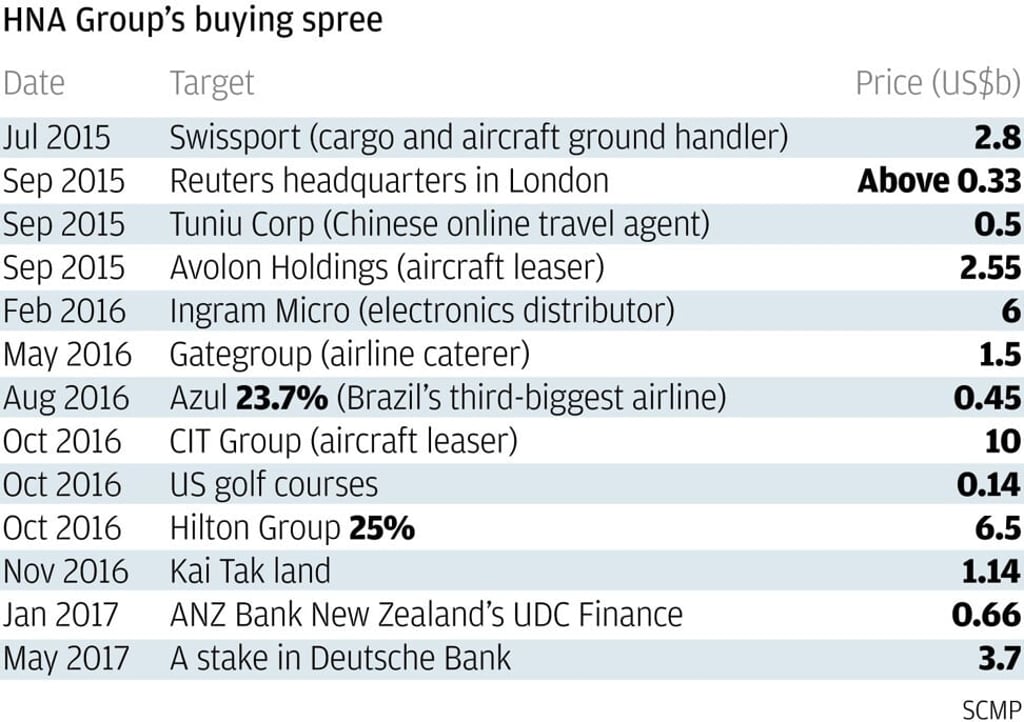

HNA Group risks losing Swissport as distressed funds initiate debt restructuring for rescue financing

- Apollo, SVP Global and Cross Ocean Partners have amassed a majority of Swissport’s senior debt, Reuters reports

- Swissport, an airport cargo handling company, is talking to lenders for financial support to ride out the coronavirus crisis

Distressed-debt investors led by Apollo Global Management have bought Swissport’s senior-ranking securities and are holding talks with the company to help it pull through the coronavirus health crisis, Reuters reported on Wednesday, citing people familiar with the matter.

Apollo, SVP Global and Cross Ocean Partners now own a majority of Swissport’s senior secured bonds, term loans and revolving credit facilities, according to the report, putting the trio in the driving seat to reorganise the company, analysts said. Debt reorganisation typically diminishes or displaces the position of equity holders.

“It’s a good bet that HNA is going to have its position maybe wiped out, or at least substantially reduced,” said Brock Silvers, chief investment officer of Hong Kong-based alternative investment fund Adamas Asset Management. “It’s not realistic to think HNA [would] inject a lot of capital into its investment in some companies right now as HNA does not have enough capital of its own.”