Explainer | What are some of the latest concessions in US-China relations ahead of Hawaii talks?

- China continues to invite US companies like AmEx to access its burgeoning domestic financial market

- Nasdaq remains open to Chinese companies as Dada, Genetron raise fresh capital this month

Recent concessions include wider access to China’s onshore financial market and the removal of some two-way air travel restrictions, despite the uneasy political undercurrents.

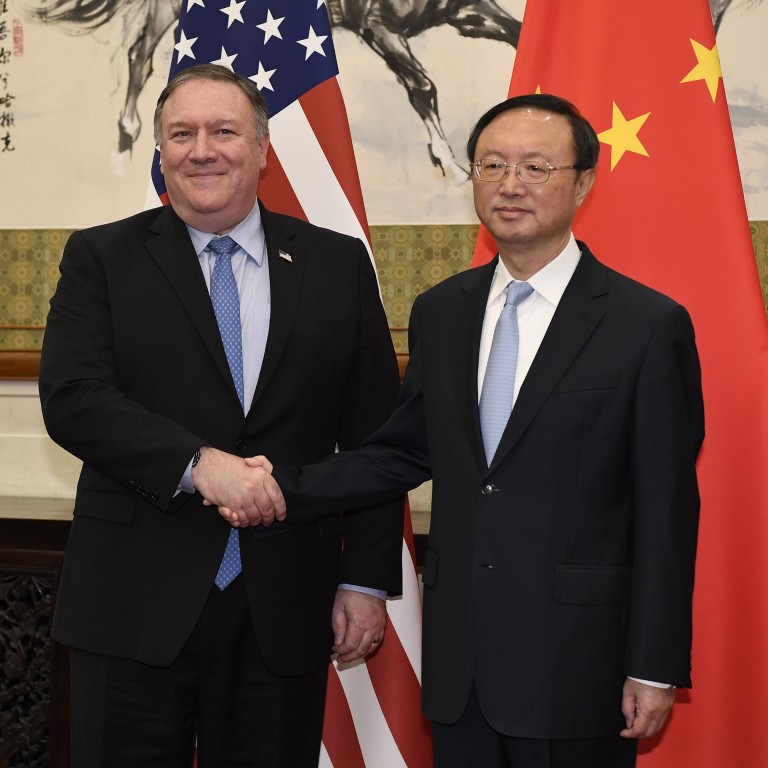

Here are some notable events to consider ahead of a meeting between US Secretary of State Mike Pompeo and China’s top diplomat Yang Jiechi in Hawaii.

China further opens up its domestic financial market to foreign investors

China has given foreign investors wider access to its burgeoning domestic markets even before the US-China trade started. The trade war of the past 18 months or so has seen more efforts towards the goal.

Last January, China agreed to lift restrictions in almost all sub-sectors of its financial markets welcoming foreign financial services providers including banks, asset management, insurance, and payments to enter its US$45 trillion market.

MasterCard and Visa are also eyeing opportunities. MasterCard received approval from the People’s Bank of China in February to set up a bank card clearing business, and was required to be ready within a year. Meanwhile, Visa has formed partnerships with mobile-payments giants WeChat Pay and Alipay.

In fund management, BlackRock, and Neuberger Berman have applied this year to set up wholly-owned mutual fund units onshore. JPMorgan is hoping to have full control of its mutual fund management joint venture. The Vanguard Group and Fidelity have all expressed their willingness to set up 100 per cent-owned subsidiaries.

China and US ease restrictions on two-way flights after months of stand-off

01:39

Trump administration bans Chinese passenger airlines from flying to US destinations

The US expects to see flight levels return to the levels before the coronavirus outbreak, if the Chinese authorities relax restrictions further, the Department of Transportation said.

The number of weekly flights between the two countries has fallen to less than a dozen in late March from as many as 325 in early January before the viral outbreak worsened.

Nasdaq remains open to Chinese companies

Elsewhere, companies deemed to have a mainland Chinese flavour have continued to encounter no barriers in raising funds in the world’s deepest capital market.

Earlier this month, cell therapy firm Legend Biotech raised US$424 million in its initial public offering, while online grocery platform Dada Nexus’s IPO yielded US$320 million. Next in line, cancer treatment developer Genetron could raise up to US$176 million.