Advertisement

China Mobile outbids Hong Kong tycoons, Singapore rival with record price for Sha Tin industrial land in sign of market revival

- China Mobile offers HK$5.6 billion for a 50-year lease on Sha Tin site, topping bids from Sun Hung Kai Properties, CK Asset, Mapletree and others

- Deal may herald the return of powerful mainland buyers with national security law seen anchoring market stability

Reading Time:3 minutes

Why you can trust SCMP

China Mobile, the world’s largest wireless network operator, has agreed to pay a record price for a parcel of industrial land in Hong Kong to outbid a handful of Hong Kong tycoons, possibly signalling the return of powerful mainland buyers to the city’s property market.

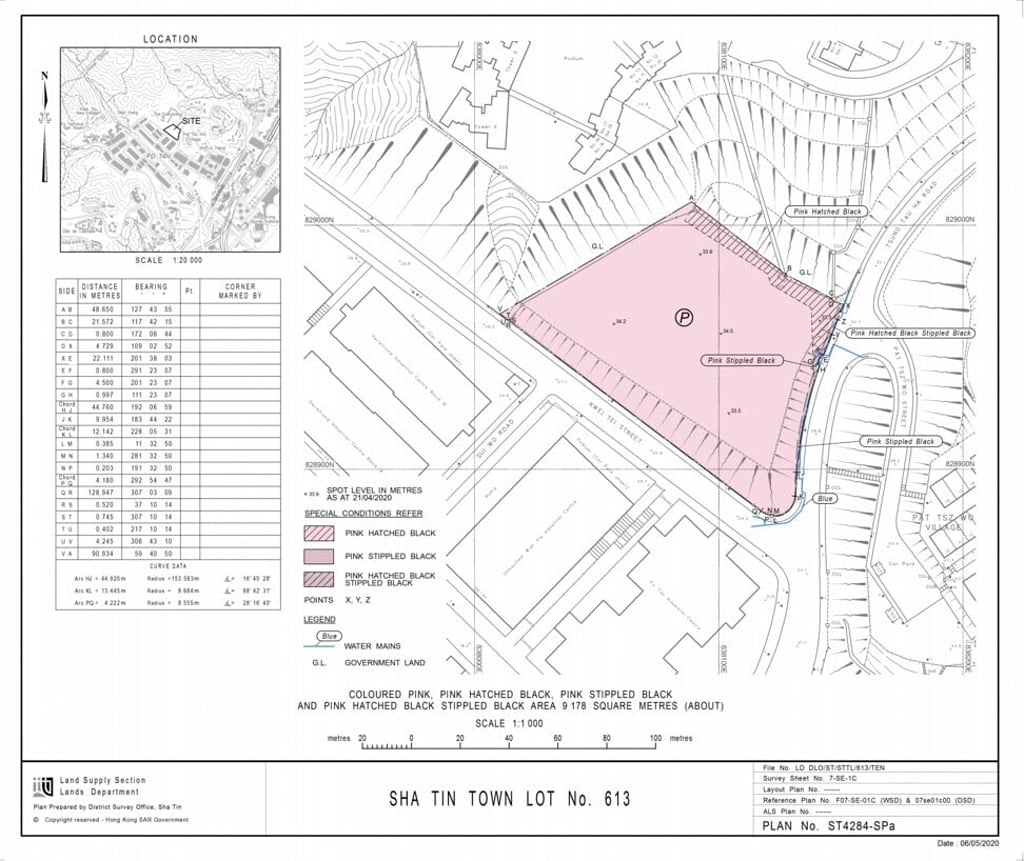

The telecommunications group offered HK$5.6 billion (US$722.6 million) for the 98,792-square foot (9,178 square metres) site in Sha Tin, New Territories with a 50-year lease, according to tender results published by the Lands Department late Wednesday. The plot is also the biggest piece to come to the market since 1998, according to surveyor CHFT Advisory and Appraisal.

At HK$5,967 per square foot, the price tag surpassed the previous record of HK$3,617 psf for a Fanling industrial site in 2018, according to government land sale records. It also exceeded the HK$2.35 billion to HK$3.75 billion range estimated by property analysts before the tender.

Advertisement

“The winning price reflects the hunger for industrial land among developers and corporations,” said Thomas Lam, executive director at Knight Frank property consultancy, who expects the winner to use the land for high-end logistics or data centre. “The government should offer more supply [of industrial land] in future to meet market demand, otherwise prices will further increase.”

Advertisement

The China Mobile transaction heralds the first big bet by a mainland company since the city adopted the controversial security law on June 30 to help quell months of anti-government protests. Before the unrest and US-China trade war in 2018, mainland corporations and tycoons helped drive prices through the roof, turning Hong Kong into the world’s most expensive office and residential markets.

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x