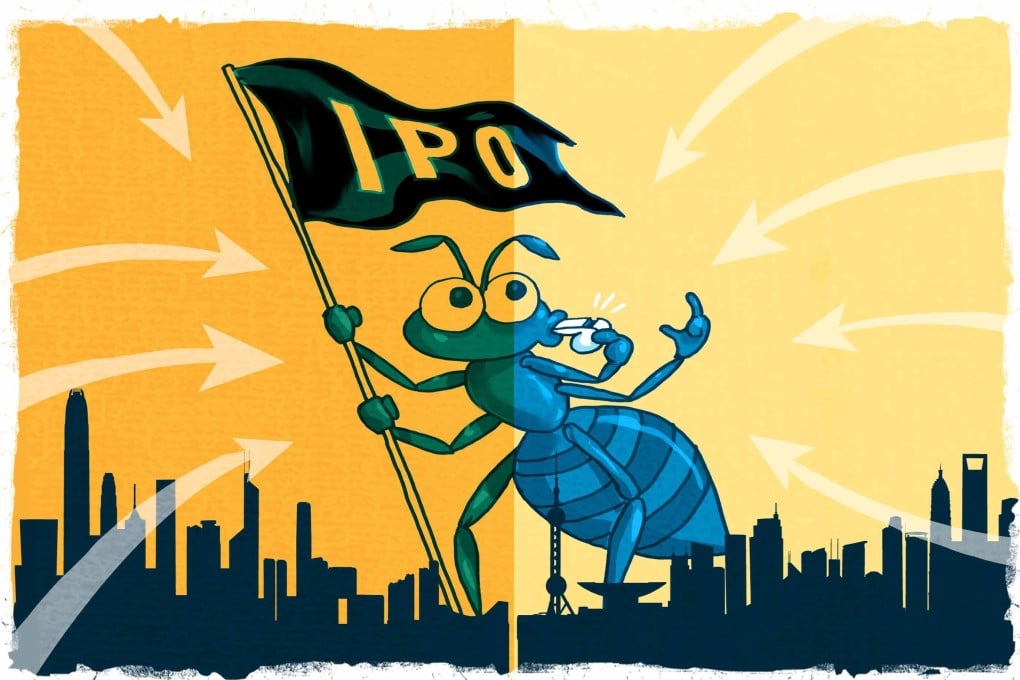

Ant Group’s blockbuster dual listing tilts balance in US-China rivalry, helping Hong Kong, Shanghai close in on Nasdaq’s lead

- Ant’s IPO will boost market value of both Shanghai and Hong Kong’s exchanges

- Other Chinese mega new-economy unicorns could follow in Ant’s footsteps, as the US-China trade war moves onto the stock exchanges with apps ban

This is the third in a series of four articles analysing the Hong Kong and mainland stock markets, delving into reforms, emergence of the Star Market as a solid fundraising venue, upcoming technology champions and the way forward. You can read Part one and Part two here.

Ant Group's plan to list in Hong Kong and Shanghai looks set to turn those cities into the top listing venues for companies globally this year.

In the simmering US-China rivalry, there is more at stake than bragging rights in the league table of global IPO rankings. By one account, it will spell the end of the American monopoly over blockbuster stock offerings, especially those of new-fangled technology and new-economy companies, as China’s home-grown champions head to safer harbours at home after more than two years of the US-China trade war.

Ant’s mega IPO will open a new chapter for both markets, helped by a healthy dose of techno-nationalism, after US President Donald Trump attacked Hong Kong’s status as a financial hub by predicting its slump and banning “untrusted” Chinese apps from US markets.

While many banks, manufacturers and smaller tech firms have made such dual listings over the past two decades, this is the first time a new-economy unicorn – a start-up valued at more than US$1 billion – has planned to do so.