Ant Group’s blockbuster dual listing tilts balance in US-China rivalry, helping Hong Kong, Shanghai close in on Nasdaq’s lead

- Ant’s IPO will boost market value of both Shanghai and Hong Kong’s exchanges

- Other Chinese mega new-economy unicorns could follow in Ant’s footsteps, as the US-China trade war moves onto the stock exchanges with apps ban

This is the third in a series of four articles analysing the Hong Kong and mainland stock markets, delving into reforms, emergence of the Star Market as a solid fundraising venue, upcoming technology champions and the way forward. You can read Part one and Part two here.

Ant Group's plan to list in Hong Kong and Shanghai looks set to turn those cities into the top listing venues for companies globally this year.

In the simmering US-China rivalry, there is more at stake than bragging rights in the league table of global IPO rankings. By one account, it will spell the end of the American monopoly over blockbuster stock offerings, especially those of new-fangled technology and new-economy companies, as China’s home-grown champions head to safer harbours at home after more than two years of the US-China trade war.

Ant’s mega IPO will open a new chapter for both markets, helped by a healthy dose of techno-nationalism, after US President Donald Trump attacked Hong Kong’s status as a financial hub by predicting its slump and banning “untrusted” Chinese apps from US markets.

While many banks, manufacturers and smaller tech firms have made such dual listings over the past two decades, this is the first time a new-economy unicorn – a start-up valued at more than US$1 billion – has planned to do so.

Where unicorns roam, Ant Group – an affiliate of Alibaba Group Holding, which also owns the South China Morning Post – counts as one of the largest, along with Tiktok’s parent, ByteDance.

As such, Ant has created a route that its peers may follow. A critical mass of such fast-growing companies will attract more investors and turbocharge Hong Kong and Shanghai's trading volumes, attracting even more companies to list and creating a positive feedback loop.

“Ant’s listing in Hong Kong and Shanghai will boost these markets and bring added liquidity as the stock will undoubtedly be actively traded,” said Claude Haberer, chairman of Swiss investment firm Pictet Wealth Management Asia. “It will also contribute to Hong Kong growing as a trading centre for tech stocks.”

If Ant is listed at a market valuation of well over US$200 billion, it will boost the market value of Shanghai Stock Exchange to US$5.46 trillion, pushing Hong Kong to US$5.09 trillion, approaching Tokyo’s capitalisation of US$5.66 trillion.

Still, they are dwarfed by Nasdaq at US$14.65 trillion and the New York Stock Exchange at US$21 trillion as of June, according to the World Federation of Exchanges.

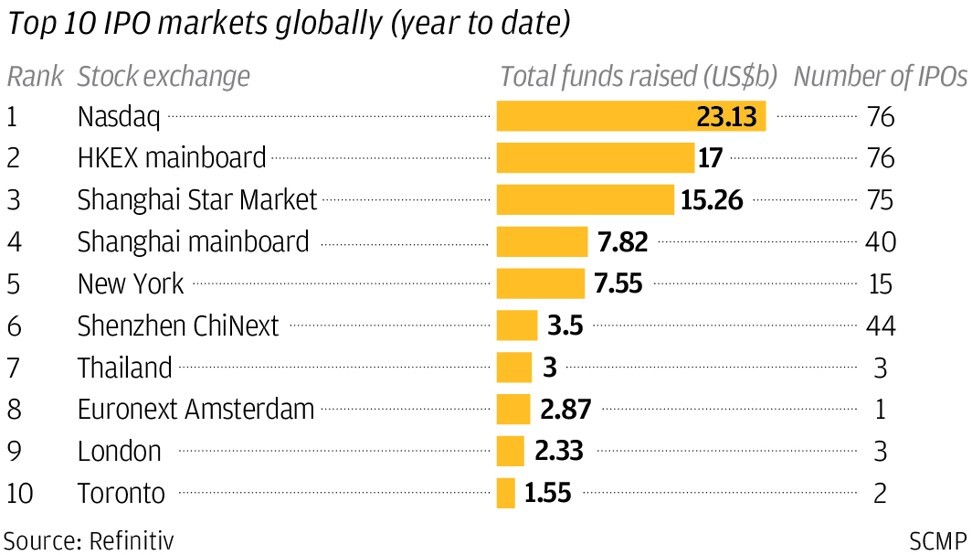

Companies raised US$17 billion on HKEX's mainboard in the first seven months of this year, making it the second-largest IPO market globally. Shanghai's technology board, called the Star Market, ranked third at US$15.26 billion, according to Refinitiv’s data. Nasdaq was top, with US$23.32 billion raised so far.

Trump himself has signed two executive orders banning Tiktok and WeChat, what he described as “untrusted” Chinese-owned apps, from US markets.

Ant has not specified the size of the split of its IPO between Hong Kong and Shanghai. Assuming an equal lot of US$15 billion each, Hong Kong is likely to be the world’s top listing venue again, a feat it has achieved seven times in the past 11 years. Other permutations could swing the title towards the Star Market.

“With deep liquidity, an unrivalled pool of international investors, a robust regulatory framework and a commitment to market innovation, stability and efficiency, I am certain that Hong Kong’s fundraising markets will continue to thrive,” he said in a statement to South China Morning Post.

The trio raised US$20 billion together and have added US$873.54 billion of value to the local bourse as of August 6. Average daily turnover rose 34 per cent year on year to HK$124.8 billion (US$16.1 billion).

The shares of HKEX, which are themselves listed on the bourse, soared 53 per cent year to a record HK$385. The Hang Seng Index, the market barometer, fell 12 per cent.

Rather than competitors, companies see Hong Kong and Shanghai's Star Market as complementary listing venues. Given that the Star Market is closed to foreign investors, any international traders or fund managers who want to invest in Ant or other tech firms can only access the Hong Kong-listed shares.

How Ant Group could revive Chinese companies’ dual-listing ambitions

“Ant’s IPO would set a good precedent of collaboration between the two stock exchanges,” said Ivy Wong, Asia-Pacific chair of international law firm Baker McKenzie.

Between Hong Kong and Shanghai, analysts differ on which will benefit more from Ant’s IPO. Hong Kong, with its low tax regime, freely exchangeable currency and big international investment community, will be more attractive to foreign issuers and investors, according to Clement Chan, managing director of accounting firm BDO.

“Shanghai’s market will remain very competitive, particularly for mainland-based companies,” Chan siad. “However, I do think the Hong Kong market will be a better option for those companies with a worldwide footprint. The old days that the US stock market monopolises mega hi-tech IPOs is over.”

Ant could also usher in many of China’s world-beating unicorns, after recent spin-offs from the likes of Alibaba and Ping An Insurance.

Alibaba’s 67.5 per cent unit Alibaba Health Information Technology raised HK$10 billion on Monday in a follow-on new share sale. Alibaba has another Hong Kong-listed subsidiary called Alibaba Pictures, which it took over in 2014.

How China’s Ant is evolving from a payments app into a technology champion

Ping An Insurance spun off Ping An Healthcare and Technology in Hong Kong in 2018. E-commerce group JD.com and NetEase also have indicated in their stock exchange filings that they would spin off their subsidiaries in Hong Kong within next three years.

Tencent has invested in more than 800 companies, including more than 70 listed entities and some 160 unicorns. Sixteen Tencent-backed companies have gone public in Hong Kong, including online reading platform China Literature in 2017, and online movie ticketing company Maoyan Entertainment in 2019.

“These create a pool of technology companies in the ecosystem to list in Hong Kong and hence will attract more investors who are interested in investing in these tech companies,” said Edward Au, southern region managing partner at Deloitte China.

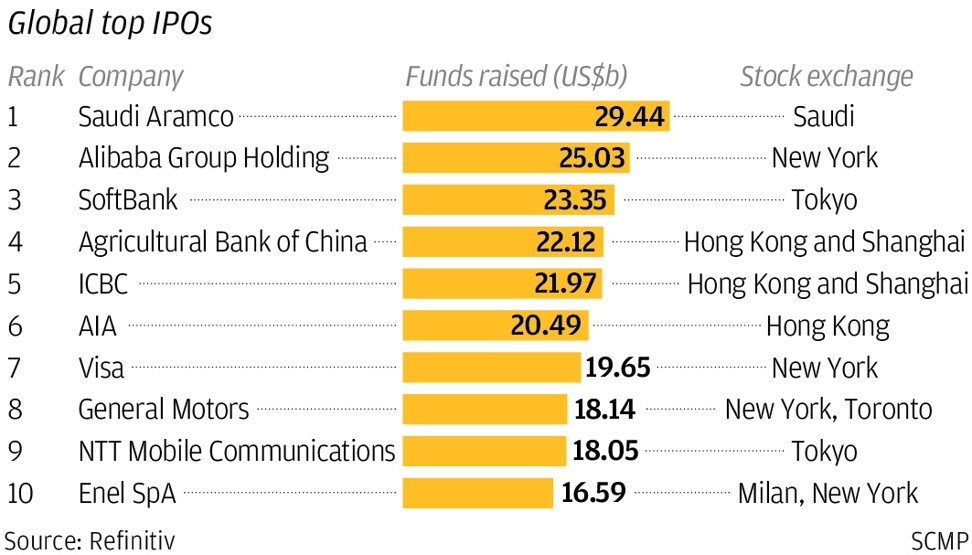

By contrast, Saudi Aramco is a stand-alone giant oil company that has not spun off any affiliates companies so far. The Saudi stock exchange has 195 listed companies with a combined capitalisation of US$2.22 trillion, ranking ninth worldwide.

Hong Kong has enjoyed waves of listings in the past. After Tsingtao Brewery became the first so-called H-share listing in Hong Kong in July 1993, as many as 97 Chinese companies listed within 18 months.

How Ant Group could revive Chinese companies’ dual-listing ambitions

Four years before the return of Hong Kong’s sovereignty to China in 1993, the city had 450 listed stocks. At the end of June 2020, there were 2,487 companies listed in Hong Kong.

Shanghai and Shenzhen, the two major stocks exchanges of mainland China, had 526 listed companies between them in 1996, five years after the first stocks listed. Now, that population has risen sixfold to 3,906 companies.

By contrast, the number of US public companies has dropped by half from its peak at 8,090 in 2016 to a low of 4,102 in 2012.

There are 4,397 domestic companies listed in the US in 2018, according to the latest World Bank data. The decline was a result of mergers and acquisitions, and more restrictive regulations in the US leading to delistings, according to stockbrokers.

About 200 mainland Chinese firms, including many technology companies, have listed in the larger US markets in recent years. Political tension between Beijing and Washington could now trigger an exodus of companies to re-list in Shanghai and Hong Kong.

“The US is currently the largest financial market in the world, without a doubt, but mainland China and Hong Kong are now putting up stiffer competition,” said Joseph Tong Tang, chairman of Hong Kong based brokerage firm Morton Securities.