Tesla’s Chinese competitor Xpeng completes debut with 41 per cent premium after upsizing IPO to US$1.5 billion

- Strong investor demand enables Xpeng to bump up offer size and price shares above its indicative range

- Chinese start-ups tap markets to prepare for a recovery in the mainland’s electric car sales in the second half

Its shares closed on the New York stock exchange at US$21.22, compared with its initial public offering (IPO) price of US$15, according to Bloomberg data. The stock surged as much as 67 per cent in intraday trading.

The final offer price of US$15 per ADS was well above its indicative range of US$11 to US$13, while the final deal size has been increased to 99.73 million shares from the initially planned 85 million shares. Each ADS represents two Class A ordinary shares in the company.

The joint bookrunners include Credit Suisse, JPMorgan, BofA Securities, ABCI, BOC International, Futu, Haitong International and Tiger Brokers.

Xpeng’s IPO is also the largest flotation by a Chinese company in the US since e-commerce platform Pinduoduo raised US$1.6 billion in July 2018.

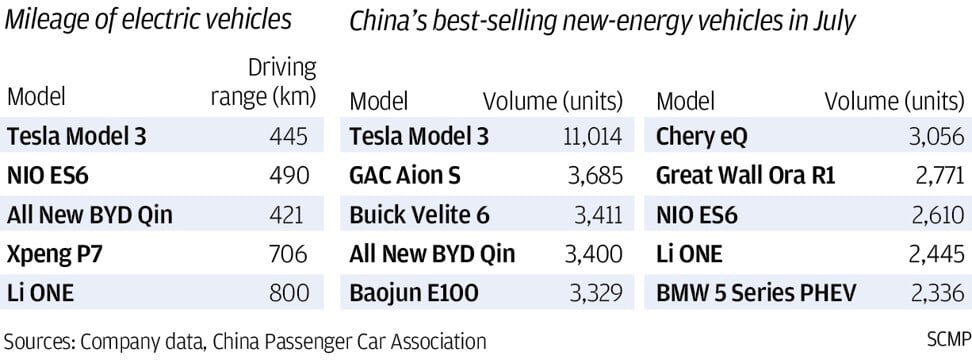

Infographics: Electric dreams in ‘Made in China 2025’ master plan

The enthusiastic reception given to Xpeng’s IPO comes amid strong trading performance of NYSE-listed NIO. The shares of the mainland car start-ups have produced handsome returns for buyers of so-called Tesla challengers. NIO has risen 394 per cent this year and was last traded at US$19.88 on Thursday.

Xpeng plans to use the IPO proceeds to strengthen its R&D capability and expand its sales channels. Tesla, which built a US$2 billion factory in Lingang near Shanghai for its first production plant outside the US, outsells its nearest rival by 3 to 1 at the moment.

Founded in 2015 by entrepreneur and former Alibaba executive He Xiaopeng, the company makes a four-door sports sedan and an SUV under the Xpeng Motors brand in the Guangdong provincial city of Zhaoqing, and with a contract assembler in the Henan provincial capital of Zhengzhou.

The company counts e-commerce giant Alibaba Group Holding, sovereign wealth fund Qatar Investment Authority and smartphone maker Xiaomi among its shareholders. Alibaba owns the South China Morning Post .

00:47

Vehicle number 10,000 rolls off the assembly line for Chinese electric carmaker XPeng

The share of electric cars stood at 4.6 per cent of China’s overall passenger vehicle market during the first half, according to Fitch Ratings’ analysts who see a pickup in momentum in the second half.

“China’s new energy vehicle deliveries are likely to resume rising in the second half, driven by an increase in high-end electric vehicle launches by joint venture brands, and Chinese carmakers’ promotions for low-end electric vehicles in rural areas with regulatory support,” analysts including Yang Jing and Tyran Kam wrote in a recent report.