GeneHarbor plans Hong Kong IPO to fund new medicinal products, widen anti-ageing supplements line

- GeneHarbor, which produces anti-ageing supplements, wants to diversify into medicines, CEO Wang Jun says

- Firm added new production line this year in Zhejiang province to produce NMN, which has potential to treat Alzheimer’s

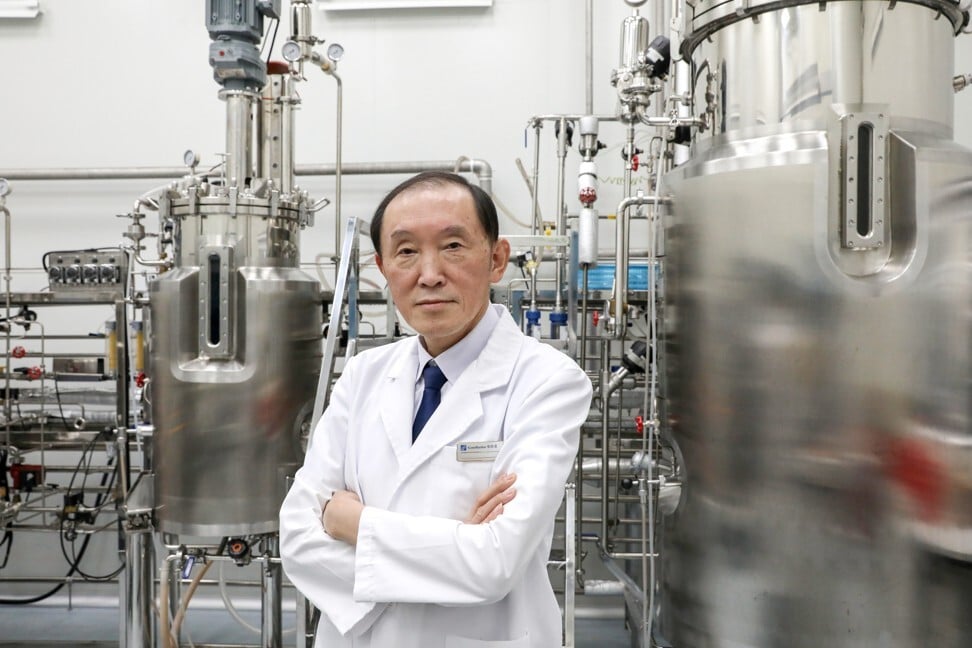

GeneHarbor (Hong Kong) Biotechnologies, which produces anti-ageing supplements, plans to make an initial public offering before June next year for funds to develop compounds to treat neurological diseases such as Alzheimer’s, chief executive officer Wang Jun said.

“We are [already] a profitable company,” he told the Post in an interview. “The reason we want to raise money is to extend our product line and diversify from supplements into medicines.”

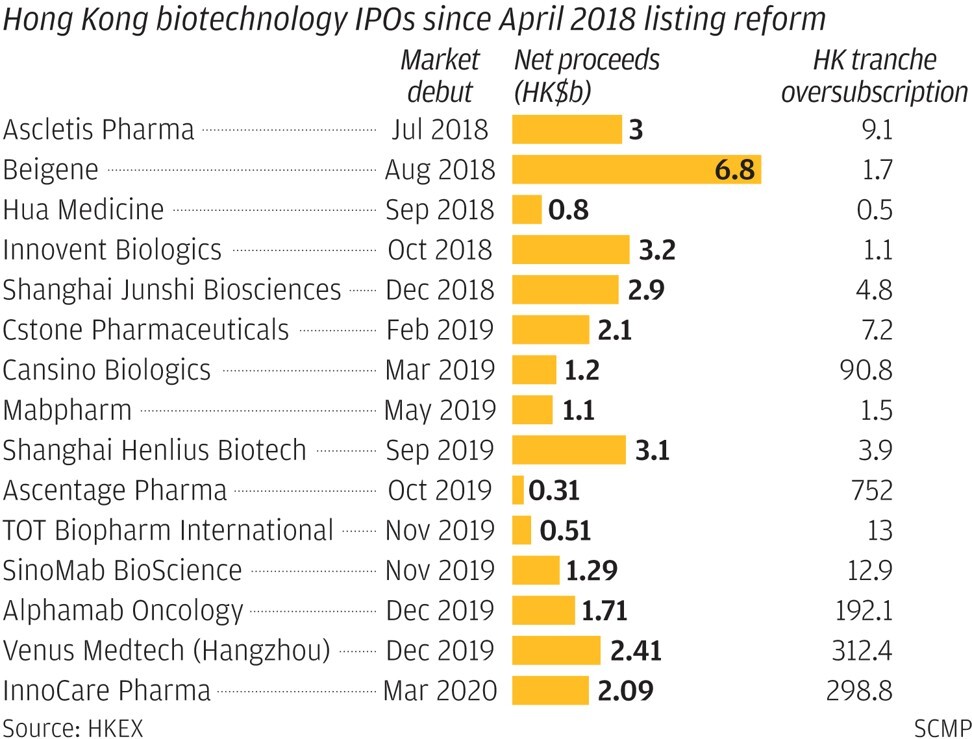

Some 20 such entities have raised more than US$5 billion since then, many chalking up tremendous price appreciation since their trading debuts. GeneHarbor has more than 20 investors who have each put in “a few million US dollars” to fund its operations, Wang said, but declined to name them.

It derives around two-thirds of its NMN sales from mainland China via cross-border e-commerce sales and 15 per cent from Hong Kong market. Its revenue has grown “100-fold” since 2017 after it launched NMN, Wang claimed, declining to disclose the figures.

The company is working on technology to enhance the purity and reduce the cost of cannabidiol, a compound extracted from cannabis plants and used as a medicine for neurological diseases.

“We have the technology to make this very expensive compound into a better quality medication at a fraction of the cost, as we did for NMN,” said Wang, who is an adjunct biochemistry professor at the Chinese University of Hong Kong.

The US Food and Drug Administration in 2018 approved Epidiolex, which contains a purified form of cannabidiol for treating severe seizures associated with rare Lennox-Gastaut and Dravet syndromes.

Global cannabidiol sales totalled US$1.74 billion in 2019 and may surge at a compound annual average rate of 24.3 per cent through 2025, according to ResearchAndMarkets, as more countries legalise cannabis for medical, recreational and research applications.

Hong Kong has research talent, great stock market but nees to unshackle growth constraints

NMN was discovered a century ago, but its anti-ageing benefits were only identified by Harvard Medical School’s genetics professor David Sinclair in 2013, Wang said.

GeneHarbor has invested HK$1 billion (US$129 million) on manufacturing technology that allows it to reduce the cost to US$2,500 per kg from about US$2.5 million several years ago, Wang said. As a result, GeneHarbor can price its product 95 per cent cheaper than its rival, Tokyo-based Shinkowa Pharmaceutical, he added.

Still, it is not possible to objectively measure ageing and the benefits of NMN, which unlike drugs, are not required to go through human clinical trials to prove efficacy, Wang conceded.

Deep Longevity, another Hong Kong Science Park-based start-up entity recently acquired by Regent Pacific Group, is seeking to fill the gap.

It recently launched artificial intelligence tools to help track “biological age” and the pace of ageing by collecting and analysing data from body scans, laboratory tests and genetic sequencing.

“The future of medicine lies in treating ageing as a condition,” chief executive Alex Zhavoronkov told reporters recently. “There are already ways, some we have invented, that can help slow down ageing and promote healthy longevity.”