China Evergrande rues speculative attack amid cash woes ahead of January 31 deadline while takeover plan remains stuck

- China Evergrande faces a January 31 deadline to repay 130 billion yuan if its restructuring plan does not get the green light

- Short interest surged to a five-week high as a letter shows Evergrande pleading for government help to approve a takeover plan from 2016. The letter was fabricated, Evergrande said in a ‘solemn declaration’

China Evergrande Group, the country’s largest developer by sales, was forced counter the most brazen speculative attack yet on its financial standing after a letter circulating on the Internet on Thursday set off alarms in the market.

The company’s stock sank to a four-month low on Thursday, erasing almost HK$11.8 billion (US$1.5 billion) in market value, after the letter with its letterhead and company chop went viral, showing the developer appealing for speedy approval for a 2016 business reorganisation plan involving another Shenzhen-based developer.

Short interest, or open positions where traders are betting on Evergrande stock’s decline, had shot up to 9.9 million shares valued at HK$152.9 million, or 38 per cent of the stock’s total turnover on Thursday, according to stock exchange data. That is the biggest daily jump in over five weeks, according to Bloomberg data. The positions only amounted to HK$51.5 million on September 4.

The stock fell 5.6 per cent to HK$15.22 in Hong Kong, bringing the loss in market capitalisation this year to 32 per cent or HK$94.8 billion. Investors also piled out of its yuan-denominated bonds, causing them to fall by about 3 per cent to a record low of 94 yuan.

The latest letter is not the first to question Evergrande’s finances. Despite achieving its annual home sales target every year since its listing, its cash flow and balance sheet continue to attract sceptics. One from independent researcher GMT Research based in Hong Kong, goes back to as far as 2012.

Tesla challenger Evergrande plans Shanghai stock offering in rush for capital to fund electric car ambitions

Yesterday, the letter was circulated online, purportedly beseeching the Guangdong provincial government to approve the company’s corporate restructuring with Shenzhen SEZ. Its cash flow would be broken if the proposal fails, risking its ability to repay up to 300 financial institutions, according to the document dated August 24.

It was unclear where the document originated from. It was widely shared among bankers and analysts in mainland China, even though the WeChat accounts that originally circulated the document, including Yinhang Qingnian, were deactivated within hours.

“The letter’s addressee is a dead giveaway to its inauthenticity” as the Guangdong provincial government is the wrong authority for approving the Shenzhen SEZ transaction, said Morningstar’s senior equity research analyst Phillip Zhong. “Certainly they have better means to resolve the issue if they merely want to push the speed of the listing ahead.”

The concern over Evergrande’s debt load may be the thin end of the wedge for an industry that had been struggling with a ballooning burden of loans amid the slowest economic growth pace in decades. China’s developers are among the heaviest borrowers from the country’s state-owned banks, typically relying on loans to finance the development and construction of their massive projects until completion, when they can commence sales.

The cycle of debt-fuelled development has been broken, as the coronavirus pandemic forced local authorities to stop construction work and showroom sales, driving real estate sales to a standstill.

Chinese developers are facing their biggest liquidity test in more than four years. Among the 50 largest publicly traded developers, short-term borrowings was equivalent to 63 per cent of long-term borrowings, and their cash reserves were just enough to cover loans in the immediate term, according to Bloomberg’s data.

Evergrande had already breached the Chinese central bank’s threshold for indebtedness, known as the “three red lines” in the industry, according to an analysis by Huachuang Securities.

The framework caps debt-to-asset ratio for developers at 70 per cent after excluding advance receipts, net debt-to-equity at 100 per cent, and short-term borrowings at no more than cash reserves. Failing to meet those “red lines” may result in them being cut off from access to new loans from banks, the state-owned Economic Information Daily reported in late August.

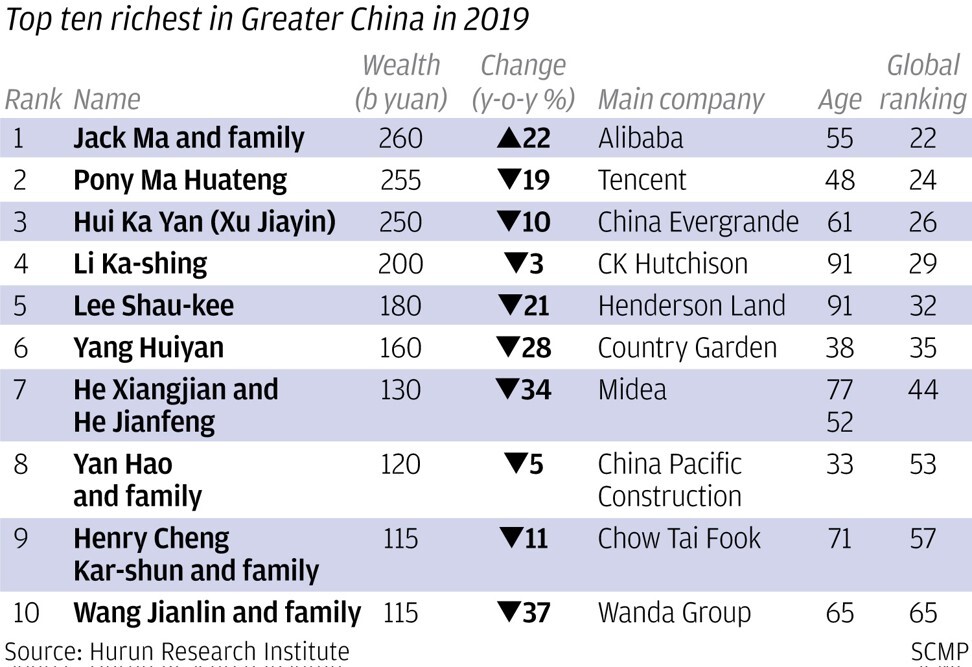

Chaired by tycoon Hui, also known as Xu Jiayin in mainland China, Evergrande harbours ambitions to challenge Tesla for control the global electric vehicle market. It has remade its health subsidiary into a car maker, for which it is seeking a listing on the Nasdaq-like Star Market for technology start-ups in Shanghai.