Geely gets nod to raise capital on Shanghai’s Nasdaq-like Star Market as carmaker remakes itself into tech company

- Geely aims to raise as much as 20 billion yuan (US$2.94 billion) on the Star Market to develop new technologies and car models

- The carmaker plans to sell 1.73 billion shares, or 15 per cent of its enlarged capital, according to its offering prospectus

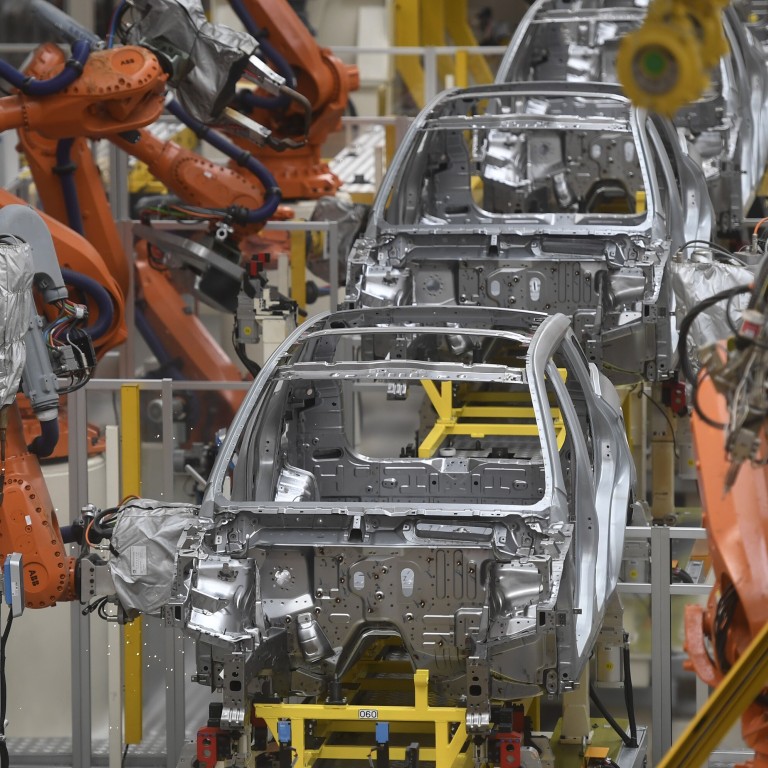

Geely Automobile Holdings, China’s largest private carmaker and owner of Volvo Cars, has obtained regulatory approval for a secondary listing on Shanghai’s Nasdaq-like exchange for start-ups, as it redefines itself as a technology company with its line-up of 10 electric cars by 2025.

The Hangzhou-based carmaker aims to raise as much as 20 billion yuan (US$2.94 billion) on the Star Market to finance its development of new technologies and models, according to an announcement by the Shanghai Stock Exchange.

“The green light for Geely underscores the important role of the carmaking industry in China,” said Ding Haifeng, a consultant with Shanghai-based financial advisory firm Integrity. “Regulators hope that companies like Geely would use the funds to propel technological development in next-generation cars.”

The approval for Geely on the Science and Technology Innovation Board, as the Star Market is formally known, is significant for another reason: the exchange is the test bed for a new registration-based listing regime that cuts waiting time, providing a more timely fundraising avenue for China’s private sector as they occupy the driver’s seat of entrepreneurship and innovation.

Geely, which began as a maker of refrigerator compressors during the late 1980s founded by Zhejiang entrepreneur Li Shufu, said it plans to sell 1.73 billion shares on the Start Market, or 15 per cent of its enlarged capital, according to a September 1 prospectus. The carmaker was requested to clarify its growth potential and strategies of its new-energy vehicle segment during its Star Market listing hearing, the exchange said.

China Evergrande New Energy Vehicle Group, a car unit of the mainland’s largest property developer, has also unveiled its plan to float shares on the Star Market.

Brian Gu, president of US-listed electric vehicle Xpeng Motors, told the South China Morning Post on Saturday that the Guangzhou-based carmaker was also studying the feasibility of offering shares on the Star Market in Shanghai, but it would take some time before making a final decision. The electric car maker last month raised US$1.7 billion in New York to replenish its research and development on new cars.

At present, Tesla, banking on its locally built Model 3 cars, was ahead of its Chinese rivals with strong sales on the mainland.

Geely which has a 6.8 share of the mainland car market, delivered 530,446 cars in the first half of this year, down 19 per cent owing to Covid-19 pandemic. Its profits dropped 43 per cent to 2.3 billion yuan.

The company’s Geometry cars are also closely monitored by analysts and industry officials who believe it has the potential to become one of the top-selling NEV brands.

Geely’s shares gained 0.5 per cent to HK$15.26 (US$1.98) on Monday on the Hong Kong exchange. It advanced by as much as 25 per cent to a year-high of HK$19.06 on July 13, as it accelerated its plan to raise additional capital in Shanghai. Citigroup raised its target price for Geely by 20 per cent to HK$20 after the company made public the Shanghai listing plan in June.