Explainer | A survivor’s guide for simultaneous dual listings in Hong Kong and mainland China’s markets

- Stitching together two different regulatory timetables is the riskiest aspect of simultaneous dual listings

- What lessons can companies learn from Ant Group’s jumbo share sale in two jurisdictions at the same time?

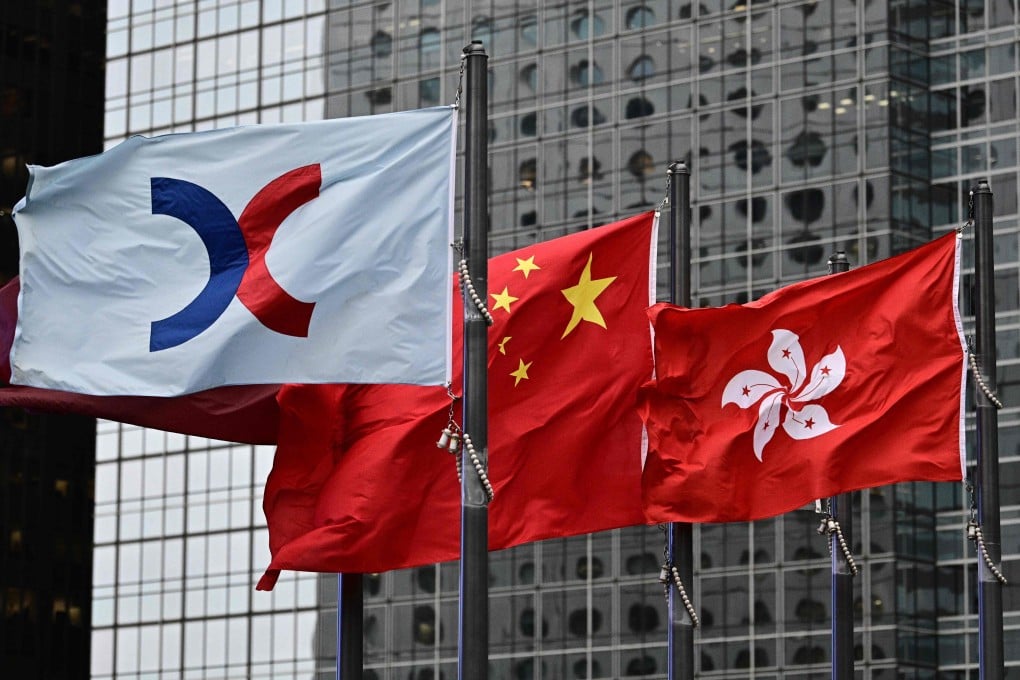

Co-hosting IPOs with mainland markets will help Hong Kong keep pace with the swift development of financial hubs in mainland China. Beijing is steadily opening its domestic financial markets to foreign investors and nurturing neighbouring Shenzhen as a technology and financial hub.

01:12

Ant Group poised to be world’s biggest private firm making public debut, with Hong Kong-Shanghai IPO

What is a dual listing and why does Ant need to list in two markets?

A dual listing refers to a listing of shares by a company in two markets. This is handy for larger listings as issuers can access a deeper pool of potential investors and capital. For Ant, a dual listing is key to success as its bumper IPO is set to smash the record held by Saudi Aramco’s US$29.4 billion IPO last December as the biggest share offering ever.