What does the perfect electric vehicle look like in China? It must go far and travel anywhere, without breaking the bank

- Chinese car buyers, relative newcomers since 2000 when it comes to private ownership, are notoriously price sensitive and brand disloyal.

- That means NEVs will have to offer value for money, and provide a good, convincing case for buyers to eschew the time-tested internal combustion engine (ICE) for the new technology

This final instalment of a three-part series on new energy vehicles (NEVs) looks at what constitutes the perfect electric car in China, comprising a balance between sticker price and driving range, battery size and charging infrastructure. The first instalment on rural markets is here, and the second part on battery makers is here.

Tim Gan, who works for a Chinese state-owned financial institution in Shanghai, did not think twice when he heard that harsh restrictions were about to kick in on November 2 to wean the megacity of 25 million people off petroleum guzzling cars that run on internal combustion engines.

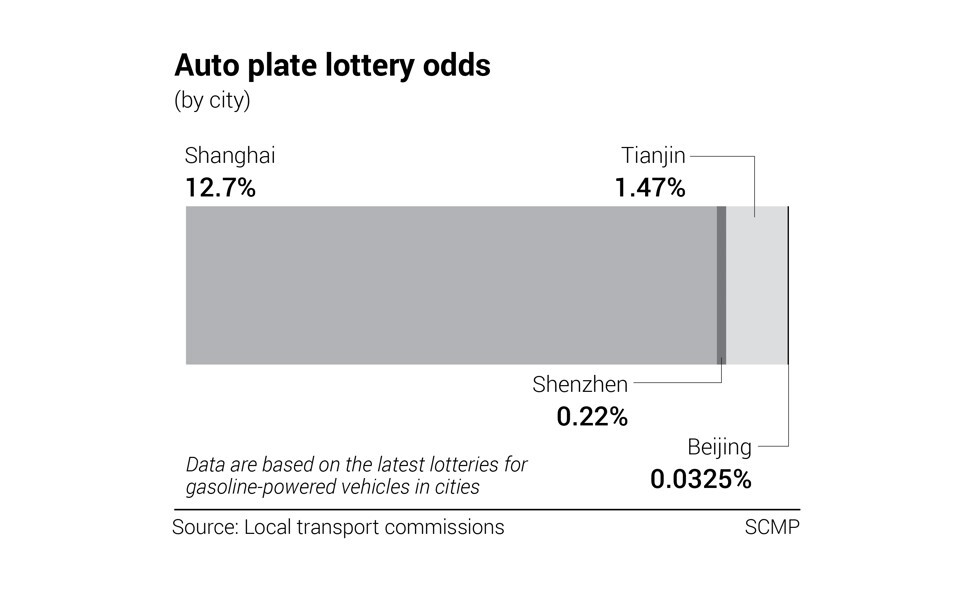

He plans to replace his trusty Honda Civic with a Roewe eRX5 sports-utility vehicle made by the city’s hometown carmaker SAIC Motor, with a free number plate thrown in. The license entitles him to drive unfettered anywhere in China’s premier commercial hub, even the elevated highways that criss-cross the city, in the process saving him valuable time during rush hour, as well as 90,000 yuan (US$13,450) on the plate.

“The new rules force me to buy a new energy vehicle (NEV) if I still want to drive,” said Gan. “The government’s policies to support NEVs are working well. The market is teeming with so many options, and the fierce competition is whetting my appetite.”

Free number plates and unrestricted access are among the bag of goodies being offered by local authorities all over China to spur the conversion to electrification, part of the nation’s goal to achieve carbon neutrality by 2060. The government has divvied out 300 billion in cash subsidies since 2009, extending an exemption on a 10 per cent purchase tax by two years until 2022.

The drive has attracted about 500 companies investing tens of billions of dollars into developing, designing and assembling electric vehicles. Amid the boom, the question arises as to who is better placed to make the perfect EV in China; a decades-old carmaker with a vast portfolio of models like General Motors, or a technology start-up like NIO or Xpeng Motors, who had not spent a single day assembling a car before getting into the industry.

“The key to success in the market lies in how well you understand the price-sensitive Chinese consumer,” said Brian Gu, an investment banker who turned to making EVs at Xpeng in Guangzhou.

Chinese car buyers, relative newcomers since 2000 when it comes to private ownership, are notoriously price sensitive and brand disloyal. That means NEVs will have to offer value for money, and provide a good, convincing case for buyers to eschew the time-tested internal combustion engine (ICE) for the new technology.

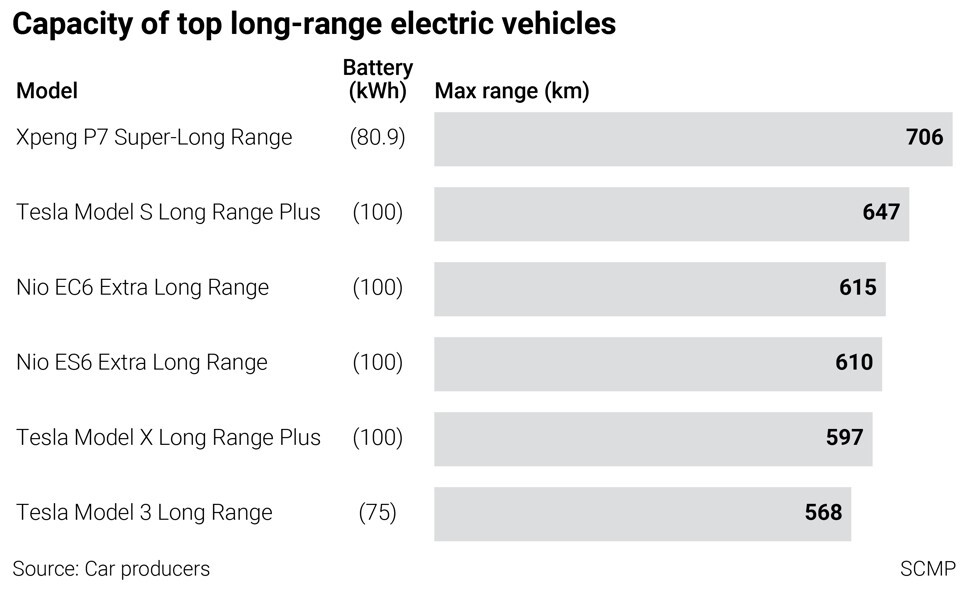

Because of the economies of scale, NEVs cost more to produce, which translate to higher prices in the showroom. White collar executives like Gan in top-tier cities like Shanghai would not hesitate to pay 200,000 yuan for an NEV that can drive for 500 kilometres (310 miles) on a single charge, even if that is a 50 per cent premium over an oil guzzler of the same size and class, said analysts and sales agents. For low-income buyers and consumers in China’s rural countryside and villages, price is everything.

“To achieve higher sales, Chinese companies will have to offer discounts or give free services like electricity charging to make their products competitive in terms of pricing,” said Tian Maowei, a sales manager at Yiyou Auto Service in Shanghai. “Price is important in China.”

The Chinese government wants EVs to go far, and be affordable. Only EVs costing less than 300,000 yuan are entitled to subsidies. NEVs that can drive between 300km and 400km on a single charge are entitled to 16,200 yuan of subsidies. Cars with more powerful batteries with ranges of more than 400km enjoy subsidies of 22,500 yuan.

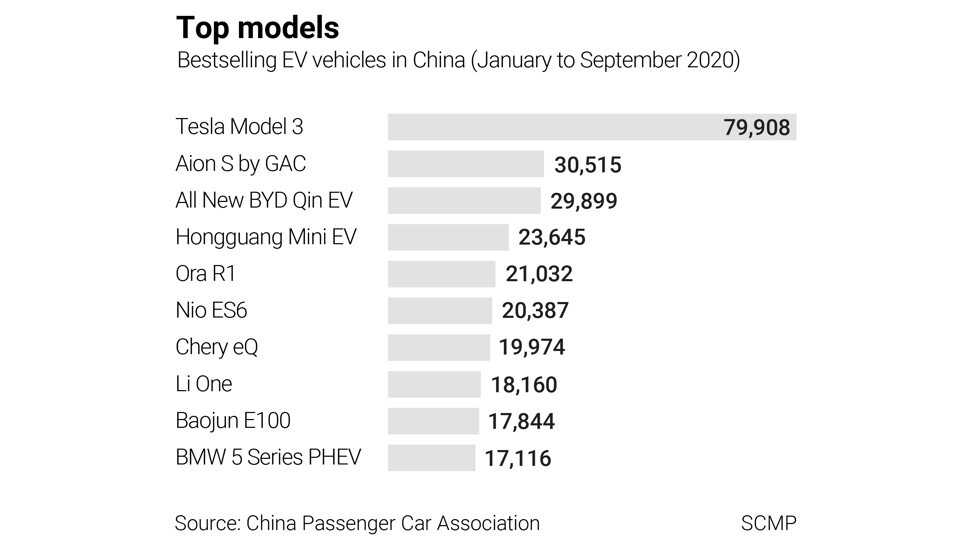

Small NEVs that travel less than 300km on a charge do not qualify for rebates. Still, that has not stopped carmakers like General Motors’ SAIC-GM-Wuling Automobile venture from developing the Hongguang Mini EV for low-income car buyers. The three-door micro car, with a driving range of 170km on a charge, starts at 28,800 yuan. The company sold 30,000 units of the electric minicar in August and September, handily beating the likes of Tesla and Xpeng in sales volume.

“We are confident that consumers would want to reach into their pockets to buy cars with attractive prices and comprehensive after-sale services,” said Zhou Xing, marketing director at SAIC-GM-Wuling.

Tesla was the undisputed leader in the first three quarters among the 500 companies that offer NEVs in China, with its Model 3 – made in a new US$2 billion Gigafactory in Shanghai – outselling the nearest competitor two to one. The California-based carmaker delivered 79,908 Model 3 cars in the first nine months, more than double Guangzhou Automotive’s Aion S model.

The California-based carmaker is also facing competition on the low end of its price range from Xpeng, NIO and LiAuto with a selection of models. Xpeng’s P7, which can go as far as 562km (349 miles) on a single charge in the standard model, probably poses the biggest challenge for Tesla. The P7 starts from 229,000 yuan, 8 per cent cheaper than the entry-level Model 3 but for 58 per cent further in range.

Li Auto’s Li One SUV sells at 328,000 yuan for a range of 800km and the Nio ES6 sports-utility vehicle costs 358,000 yuan for 510km.

“Tesla’s price cuts are ratcheting up pressure on its Chinese rivals to make their products cheaper,” said Yale Zhang, managing director of industry researcher Automotive Foresight in Shanghai. “Without a larger sales volume, the Chinese companies are unlikely to mount a real challenge to Tesla.”

Most of Tesla’s Chinese competitors are yet to make a profit. They have raised a combined US$8 billion in fresh capital from the stock market and investment funds to accelerate new model development and enhance their manufacturing might. Their primary goal is to increase sales volume to grab a bigger market share.

However, the additional expense of an NEV can be recouped in two to three years’ time as the ownership cost of an electric vehicle is about 0.3 yuan lower per km than a petrol-driven car, they added.

Brian Gu, the president of electric car start-up Xpeng Motors, felt that price was a key factor, pointing out that a tight control over development and production costs would help to reduce the overall unit price.

Besides the price point and driving range, battery life and the infrastructure of nationwide charging stations are also top considerations for weary buyers who need a boost of confidence to take their electric cars in a market with the world’s fourth-largest land mass.

As part of its sales and marketing strategy, NIO has teamed with Contemporary Amperex Technology Ltd (CATL), the country’s biggest producer of electric-car batteries, to set up battery-swapping stations nationwide. Wuhan Weineng Battery Asset, formed with an initial capital of 800 million yuan, will also lease battery packs to car owners.

The battery-swapping plan allows customers to buy an electric car while subscribing to a separate battery-leasing plan for a fee, which can help lower the upfront cost of owning an electric car by about 20 per cent. Under this plan, a NIO ES6 SUV priced at 358,000 yuan would cost 287,000 yuan plus a battery-leasing fee of 980 yuan a month.

“Tesla used to be my dream electric car, but the [battery-swapping] package offered by NIO convinced me to buy a domestic brand,” said Wang Liang, who owns an ES6. “Tesla is an established brand worldwide, but it is also advisable to look at some Chinese companies and their products.”

The boom in EVs has attracted the attention of even property developers, including the world’s most indebted real estate builder. China Evergrande New Energy Vehicle Group, a unit of the China Evergrade Group, unveiled six models under the Hengchi brand in August to spearhead its aspiration of becoming the world’s largest NEV manufacturer over the next five years.

“We have set our eyes on the whole NEV market and any potential NEV buyer is our target customer,” the company said in a written reply to queries by South China Morning Post, adding that it has 14 models under development. “Our products will cover all categories, from sedans and SUVs to MPVs.”