Advertisement

Hong Kong rolls out welcome mat for US-listed tech stocks to raise capital via secondary listings, spurring exodus from US market

- Bourse plans to allow companies with corporate shareholders of so-called weighted voting rights to raise funds, according to an announcement by the exchange

- The proposed reform would allow Tencent Music, iQiyi and other US-listed Chinese technology companies to qualify for secondary listings in Hong Kong

Reading Time:2 minutes

Why you can trust SCMP

Hong Kong Exchanges and Clearing Limited (HKEX), the operator of the world’s third-largest stock market, said it plans to extend its 2018 rule change to attract more listed companies to raise funds in the city via secondary listings, in a move that’s likely to spur an exodus of Chinese companies from the United States.

The bourse plans to allow companies with corporate shareholders of so-called weighted voting rights (WVR) to raise funds, according to an announcement by the exchange. That would allow technology start-ups controlled by corporate entities to raise funds.

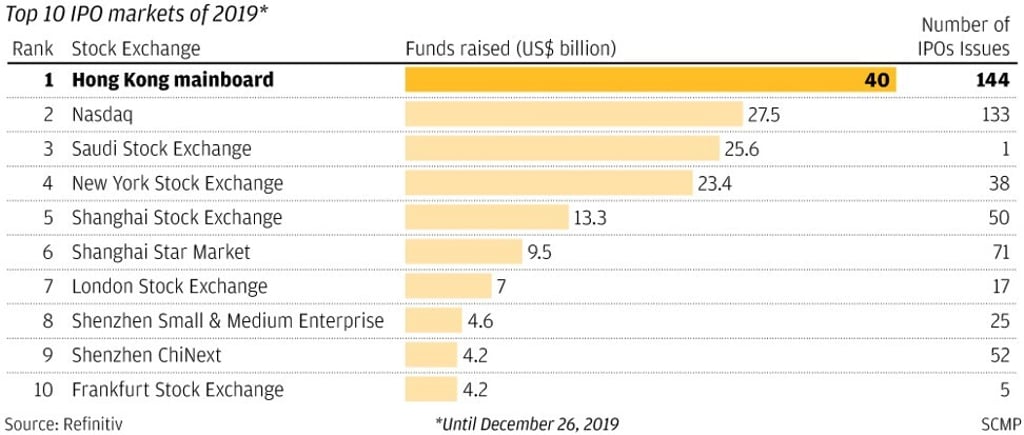

The HKEX, the world’s top destination for initial public offerings (IPOs) in seven of the past 11 years, has already seen a steady march of technology listings since Alibaba Group Holding’s US$13 billion secondary listing in Hong Kong last November. This month, the exchange scored another first by securing half of the biggest fundraising in global finance: the US$39.67 billion dual listing in Shanghai and Hong Kong by Ant Group.

Advertisement

“Today‘s announcement is a breakthrough [that] will make our listing regime more competitive,” said Au King-lun, executive director of the Financial Services Development Council, a government advisory body for the strategic development of Hong Kong as an international financial centre. “The investor mix in innovative companies has changed over time, where mega technology firms are now becoming key stakeholders in other innovative companies.”

Advertisement

About 10 Chinese technology companies that are already listed on US stock markets are owned by corporate shareholders with WVR structure, where the shares have different voting rights between founder-shareholders and others.

Advertisement

Select Voice

Select Speed

1.00x