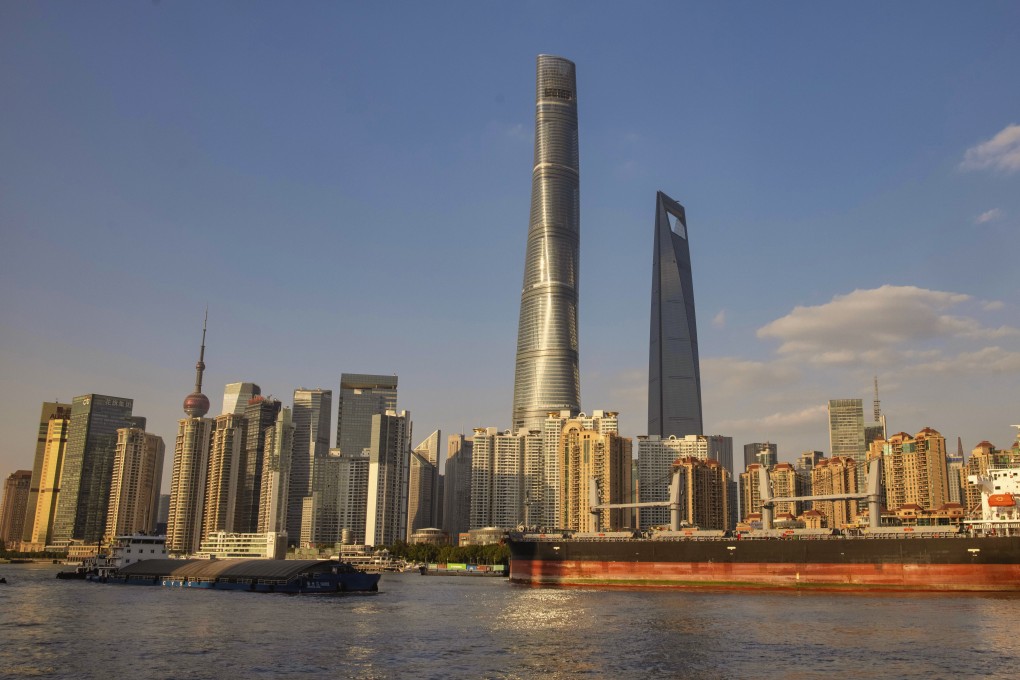

China’s commercial property deals will double in value to almost US$100 billion by 2030, CBRE predicts

- The property services giant forecasts that the transaction value could top 650 billion yuan (US$98.3 billion) in 2030, more than twice the current level

- Growth will be driven by an increase in capital from insurers, the emergence of more investment funds and the creation of real estate investment trusts

The global property services firm forecasts in a research report that the transaction value of commercial properties – which includes office and retail spaces – could top 650 billion yuan (US$98.3 billion) in 2030, more than twice the current level.

The estimates, published during the third China International Import Expo (CIIE) in Shanghai that ends on Tuesday, added weight to bullish forecasts about the mainland’s economy after Beijing successfully contained the coronavirus.

CBRE said insurance funds worth at least 100 billion yuan would be allocated to commercial properties each year in the next decade.

A rising number of real estate investment funds denominated in yuan will be another driving force behind an active property market.

CBRE said the total value of investible commercial properties across China would hit 80 trillion yuan by 2030.