Chinese carmakers ride rising share prices, sales to challenge global bigwigs

- BYD was the world’s fourth-largest automobile company in terms of market value as of November 5, according to a report by China Merchants Securities

- Xpeng Motors reports more than 342 per cent increase in third-quarter revenue

China’s car market – the world’s largest – has been boosted by soaring sales at companies such as Xpeng, and rising stock prices.

A host of Chinese electric car manufacturers are, in fact, threatening to upend the global pecking order, as surging share prices have pushed them up alongside established peers in terms of market capitalisation.

BYD, China’s largest electric carmaker, trailed only Tesla, Toyota and Audi as of November 5, and was the world’s fourth-largest automobile company by market value, according to China Merchants Securities. Its mainland Chinese shares have surged by more than 330 per cent this year, and the Shenzhen-based carmaker is valued at US$73.4 billion.

The jump in share prices comes as Beijing pushes for more green vehicles. It wants one in every five new cars on its streets to be either purely electric, petrol-electric hybrid or fuel cell powered by 2025, according to a development plan for new energy vehicles (NEVs) for 2021 to 2035.

“The Chinese government’s strong support for the growth of NEVs does bode well for the carmakers,” said Gao Shen, an independent analyst of the manufacturing sector in Shanghai. China, the world’s second-largest economy, is granting cash subsidies to buyers, giving out car plate licences for free and spending big on charging networks to promote use of environmentally-friendly cars.

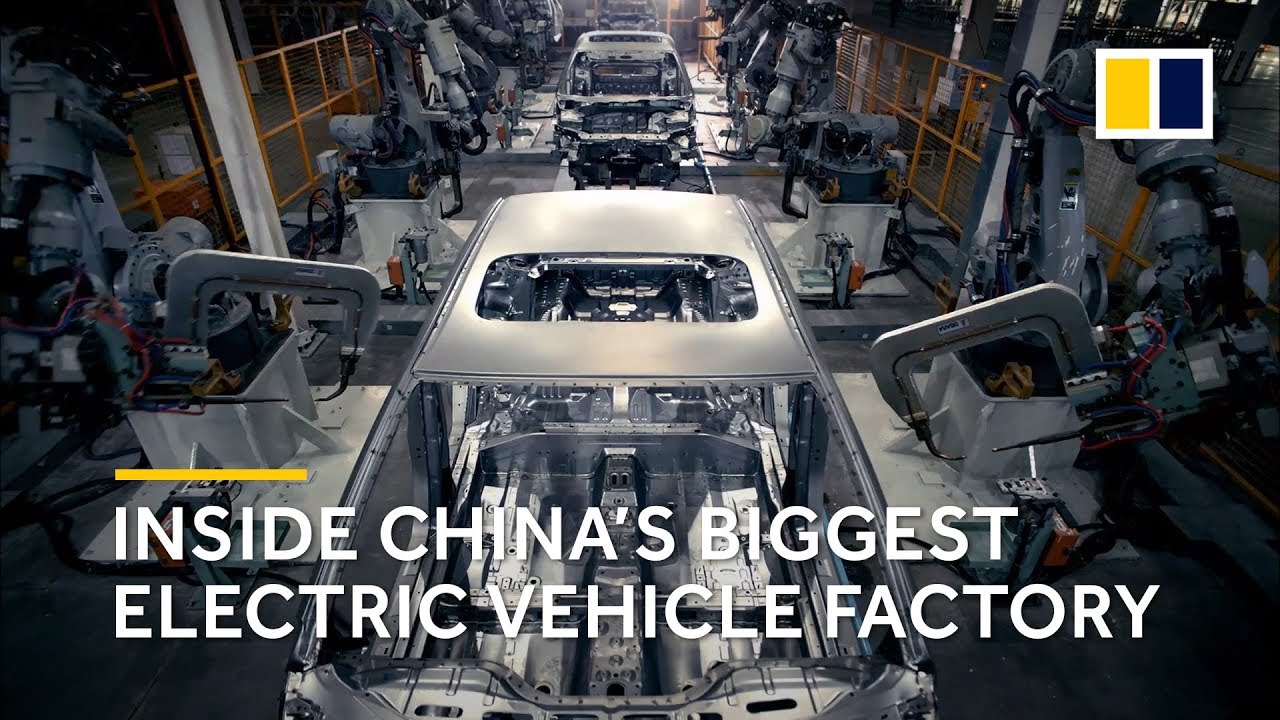

01:47

Behind the scenes at BYD Auto: China’s biggest electric vehicle factory

“The production and sales volumes of Chinese companies might jump by several times in the coming years – and that is the reason why they attract investors,” Gao added.