Global investors swoop in on WuXi Biologics shares as owner trims stakes in worlds largest post-IPO disposals

- Nearly 142 million shares changed hands on Tuesday, almost triple the average daily volume last year, led by sale of stake by Biologics Holdings

- Waiting in the wings to pick up Biologics’ shares were institutional investors including JPMorgan Chase and Los Angeles-based Capital Group

WuXi Biologics (Cayman), a bellwether of China’s pharmaceutical producers, kicked off 2021 this week with a record stock price that took its gains since its 2017 initial public offer to 14-fold.

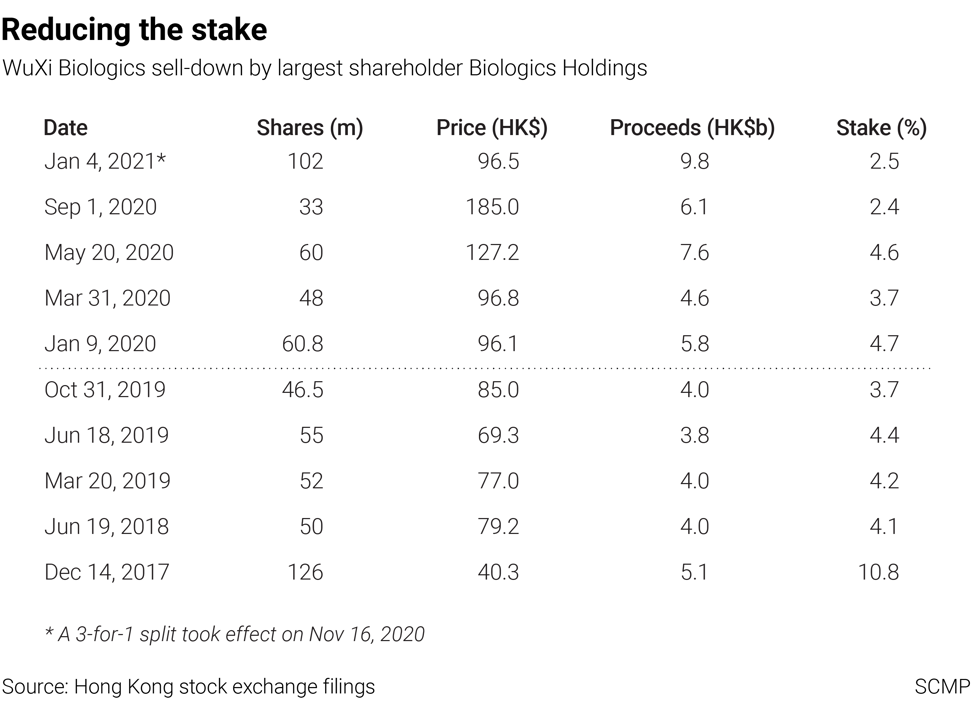

Nearly 142 million shares changed hands on Tuesday, almost triple the average daily transactions last year, led by a 2.5 per cent sell-down that formed part of the disposal programme by the company’s controlling shareholder Biologics Holdings from 73.5 per cent in 2017 to 20.6 per cent.

Waiting in the wings to pick up Biologics’ shares were institutional investors including JPMorgan Chase, Morgan Stanley and the Los Angeles-based private investment manager Capital Group, said Daiwa Capital Markets’ analyst Dennis Ip.

“Only Biologics had been selling shares and most of them were bought by international institutional investors,” Ip said. “Although [WuXi’s] share price has soared, it is still in an early development stage compared with other global peers in terms of capacity and global network.”

The investment party for WuXi Biologics is not about to end any time soon, analysts said, as the Covid-19 pandemic has brought extra opportunities, on top of its ongoing overseas expansion.

SCMP Infographics: The biotech industry under the Made in China 2025 industrial master plan

“WuXi Biologics is one of the main beneficiaries of further breakthroughs on global Covid-19 vaccines development and commercialisation between 2021 and 2023,” wrote Zhao Bing, chief health care analyst at China Renaissance Securities (China) in a December 12 report.

Daiwa’s Ip Tuesday raised his target price on the stock to HK$118 from HK$100, citing potential annual revenue growth of 500 million to 800 million yuan from newly acquired facilities in Germany, which amount to 13 to 20 per cent of its total revenue in 2019.

“The company now owns full manufacturing facilities … to meet the demand for Covid-19-related vaccines and neutralising antibodies with an estimated [order] backlog of US$1 billion,” he wrote in a note, adding its overall order backlog amounted to US$10 billion.

WuXi Biologics recorded revenue of US$301 million and a net profit of US$113 million in the first half of 2020. The company bought a second production facility in Germany from the pharmaceutical firm Bayer for €150 million in December.

Construction of its first self-built overseas facility in Ireland is about halfway finished, while its facility in Massachusetts, US is expected to be completed in 2022.

It has also leased facilities in Pennsylvania and New Jersey. In Wuxi, it is building the world’s largest single-use quality-certified bioreactor-based biologics facility.

The sell-down programme by Biologics has raised HK$54.9 billion in funds over 10 disposals since 2017 for the controlling shareholder, whose investors includes Boyu Capital, Temasek, Ally Bridge and Hillhouse Capital, some of the most prominent private equity and venture capitalists in China’s health care industry.

The sale was the second largest stake sell-down in the global pharmaceutical sector in the past 12 months – after a US$6.7 billion sale last May of US biotech firm Regeneron Pharmaceuticals shares by French pharmaceutical giant Sanofi – and the ninth biggest on record, according to Refinitiv.

Global health care shares sell-down amounted to US$28.9 billion in 71 transactions in 2020, of which US$13.8 billion involved pharmaceutical firms in 19 deals. All four measures are their highest in two decades, according to the data provider. An MSCI index tracking 267 global health care firms gained 13.5 per cent in 2020.

WuXi Biologics shares fell 3.8 per cent on Wednesday to HK$98, or 239 times its consensus forecast earnings per share in 2021. It surged 213 per cent in 2020, making it the top performer among the 50 stocks of Hong Kong’s Hang Seng Index.

An MSCI index tracking 81 Chinese health care stocks with a combined market value of HK$1.15 trillion advanced 61 per cent in 2020, the biggest gain since 2003.

One analyst sounded a note of caution on the biotech segment that has seen particularly impressive gains.

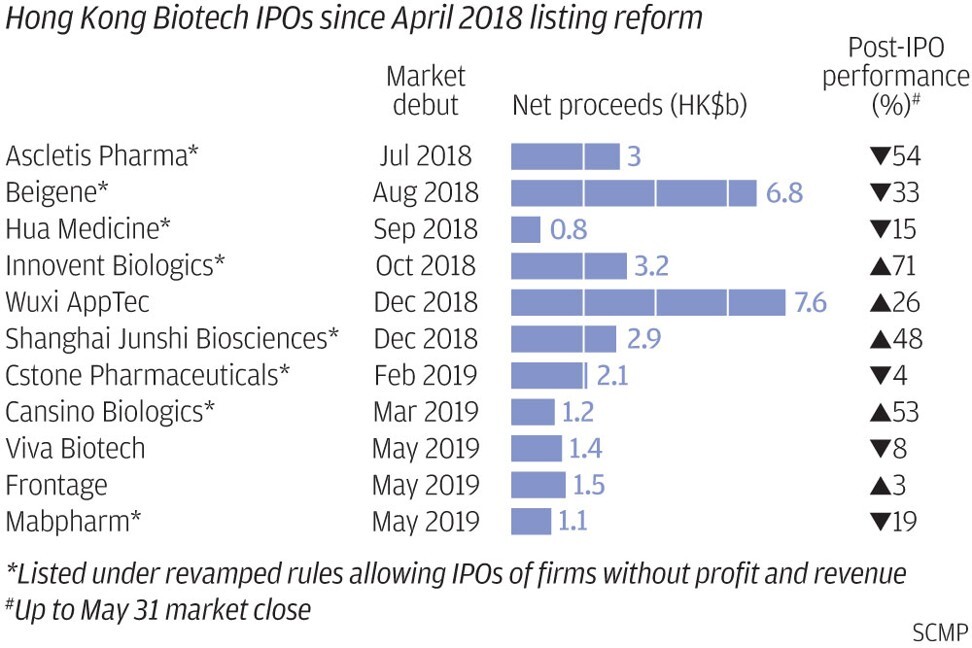

“Amid a flood of excess liquidity due to the pandemic-driven ultra-loose monetary policies, more investors are willing to take on greater risks for returns on technology stocks as the old economy stocks performed poorly amid the pandemic” said Gordon Tsui, chairman of Hantec Pacific and president of the Hong Kong Securities Association. “Many biotech stocks, profitable or not, have accumulated huge gains in the past year.”