Explainer | In China’s EV war, here’s how tech giants will shake up the world’s biggest auto market

- The ultimate goal for next-generation cars is autonomous driving, because of which Internet of Things and artificial intelligence have assumed great importance

- Beijing could define the future of mobility, given the enormous amount of resources it is pouring into the EVs sector

Two partnerships forged this week by Zhejiang Geely Holding Group, China’s leading carmaker, have put into the spotlight the country’s fast-changing automobiles industry.

New tech in the driving seat

While some technologies will enhance navigation and link up with other cars or mobile devices digitally, others will improve in-car entertainment for drivers and passengers, who will no longer need to keep their eyes on the road, or their hands on the wheel.

But the role of technology will not be limited to building on younger users’ familiarity with digital connectivity. It will also play an important role in making EVs more environmentally friendly and in improving driving safety.

01:16

Tesla exports first China-made cars to Europe with shipment of 7,000 Model 3 electric sedans

EVs will be big business

Tesla, which currently leads the field in China and globally, is already worth more than century-old Ford Motors.

The sector is expected to become staggeringly huge. Digital services and products slated for China’s EVs industry could reach 1 trillion yuan (US$154.3 billion) a year, according to a forecast by the country’s ministry of industry and information technology, although it did not say by when.

A clutch of Chinese EV start-ups led by NIO, Xpeng and Li Auto have made a mark for themselves at home and abroad.

01:56

Inside Chinese electric vehicle maker Xpeng's factory in Zhaoqing city

The Field is growing as more tech giants enter the fray

Baidu launched its Apollo platform, one of the world’s largest open autonomous driving alliances, in 2017 and has since roped in more than 50 partners, including Ford and Mercedes-Benz parents Daimler.

Other Chinese technology giants have also weighed in. Alibaba Group Holding, which owns this newspaper, last year acquired an 18 per cent stake in a joint venture between China’s largest carmaker SAIC Motors and Zhangjiang Hi-tech Park Development last year. The tie-up will develop EVs under the brand of IM, or Intelligence in Motion. These cars will be able to park themselves.

01:47

Behind the scenes at BYD Auto: China’s biggest electric vehicle factory

Elsewhere, iPhone maker Apple plans to sign a partnership agreement with Hyundai Motors for autonomous electric cars by March and start production around 2024 in the US, according to Korea IT News.

Old Vs New?

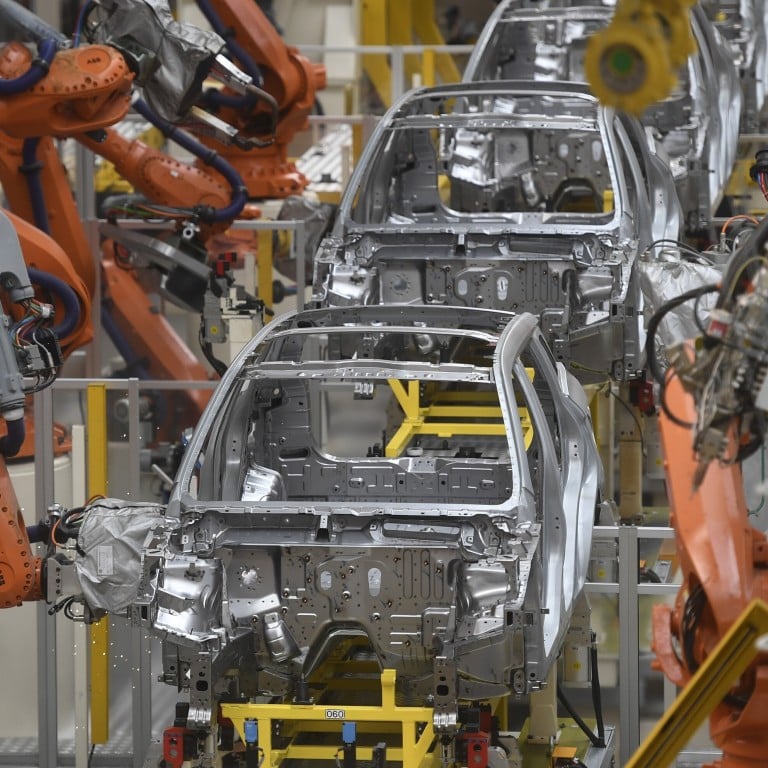

The partnerships between old, established players and the new entrants will involve technology companies bringing ideas such as cloud platforms, digital maps, sensing equipment and big data to the table. The conventional carmakers, with their manufacturing might and supply chain capabilities, will focus on assembly.

China’s role

Beijing could very well define the future of mobility, given the enormous amount of resources it is pouring into the EVs sector along with Chinese private players.

As part of its “Made in China 2025” industrial masterplan, Beijing wants 20 per cent of all new cars hitting the streets to be EVs by 2024. That would translate into more than four million such cars on the road by then.

Moreover, the Geely-Foxconn joint venture will allow more companies to enter the highly competitive market.

He Xiaopeng, the founder and chief executive of Xpeng Motors, says more Chinese technology juggernauts will enter the EVs sector this year, injecting new impetus into the world’s largest EV market.