Chinese courier firm SF Holding, Robert Kuok’s Kerry Logistics say US$2.3 billion deal a collaboration, not acquisition

- If the deal is approved, Kerry Logistics will assume the international operations of the combined group

- The deal will reduce the shareholding of Robert Kuok’s Kerry Holdings, Kerry Logistics’ largest shareholder from 63.35 per cent to about 32 per cent

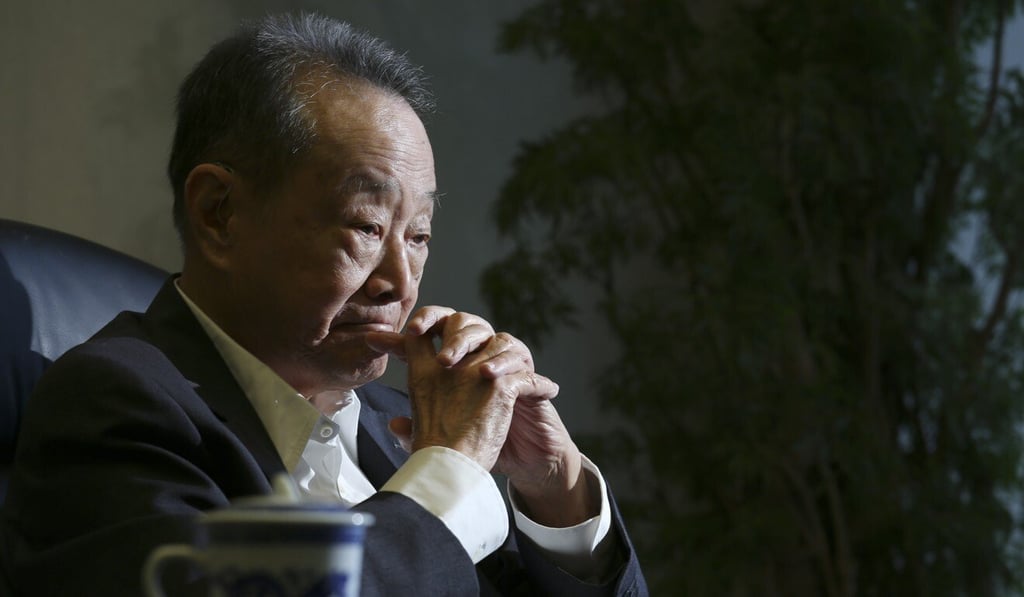

SF Holding, the largest delivery company for online shopping giants Alibaba Group Holding and JD.com, said it plans to acquire a 51.8 per cent share in Malaysian tycoon Robert Kuok Hock Nien’s Kerry Logistics Network.

The Chinese courier, which operates SF Express in mainland China and Hong Kong, will pay HK$17.55 billion (US$2.3 billion) in cash to acquire 931,209,117 shares of Hong Kong-listed Kerry Logistics through a wholly-owned unit, according to a stock exchange filing late on Tuesday.

“SF Holdings is hoping to improve the company’s ability in offering one-stop integrated logistics solutions and to complete its international freight forwarding segment to further strengthen the company’s international business layout,” the company said in the filing.

The company pointed to Kerry Logistics’ international freight forwarding network across Asia, including China, Hong Kong and Taiwan, North Asia, Southeast Asia and South Asia, as well as the United States and Europe, and its experience and resources in Thailand and Vietnam, in its filing.

SF will pay HK$18.8 per share as well as a HK$7.28 special dividend per share to each shareholder of Kerry Logistics. The combined offer, at HK$26.08 per share, represents an 11.2 per cent premium on its last trading price.

If the deal is completed, Kerry Logistics’ public float will shrink to 15 per cent from 25 per cent currently. It will also reduce the shareholding of Kerry Holdings, its largest shareholder, from 63.35 per cent to about 32 per cent. Kerry Holdings is owned by Kuok’s family.