Chinese energy giant Sinopec bets future on hydrogen as it looks to reach decarbonisation goals ahead of time

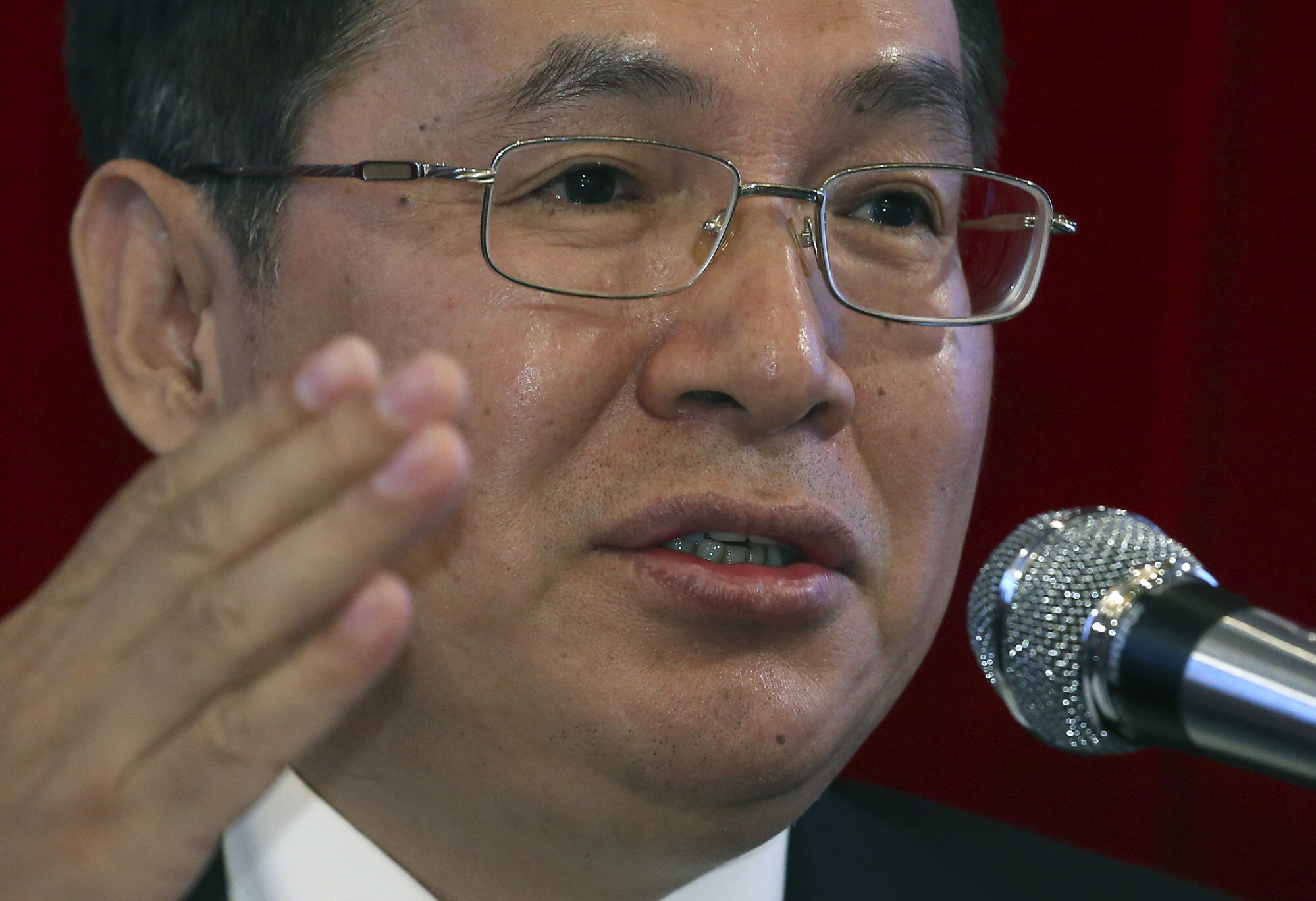

- The world’s largest oil refiner has set a target for carbon emissions to peak by 2025, and will aim to achieve carbon neutrality by 2050, chairman Zhang says

- The company plans to have 100 hydrogen refuelling stations this year, which will be expanded to 1,000 by 2025

China Petroleum & Chemical (Sinopec) has made hydrogen the core of its transformation plan into a lower carbon business, putting it on course to achieve its target well ahead of the nation’s decarbonisation goals.

These include both brand new hydrogen stations, and the modification of existing fossil fuel stations to add hydrogen refuelling capacity.

In the long term, it plans to become a comprehensive energy supply and services provider, supplying petrol, diesel, natural gas and hydrogen, besides electric vehicles charging and convenience stores, Zhang said.

The company has the nation’s biggest and the world’s second largest network of fuel stations, operating some 30,700 branches.

In the next five years, Sinopec will continue to focus on hydrogen production using fossil fuel, but will also start using wind and solar energy to make hydrogen from electrolysis of water, which is already economic in some regions, Zhang said.

Parent Sinopec Group discussed in January with solar power equipment industry leaders – Golden Concord Holdings, Trina Solar, Longi Group and Shenzhen-listed Tianjin Zhonghuan Semiconductor, on potential collaborations on hydrogen projects powered by renewable energy.

Sinopec on Sunday posted a 42.4 per cent fall in net profit to 33.1 billion yuan (US$5 billion) for last year, on the back of lower fuel prices and reduced demand amid the Covid-19 pandemic. It also came in below Bloomberg’s 35.8 billion yuan consensus forecast of 19 analysts.

Sinopec said it expects to post a net profit for the first quarter of between 16 billion yuan and 18 billion yuan – compared to a loss of 19.9 billion yuan in the same quarter last year, amid rising demand for fuel and chemicals and higher prices as a result of global efforts to control the pandemic.

As part of its decarbonisation business development, it aims to complete construction of a demonstration project to capture and store carbon dioxide emitted by its production facilities by 2025.

It also aims to raise output of natural gas – less carbon intensive than petrol and diesel – by 10.5 per cent to 12.6 per cent annually in the next three years. The output stood at 30.2 billion cubic metres last year.

The company also plan to lift crude oil output, but by just 0.4 per cent this year, although throughput of its oil refineries would rise 5.5 per cent after falling 4.7 per cent last year.

Sinopec has budgeted 167 billion yuan for new projects this year, up from 135 billion yuan spent last year.

Most of the increase would be for oil and gas development and production and chemical plants, including one in Russia’s East Siberia that will supply natural gas and chemicals to China.

A final dividend of 0.13 yuan per share was declared, making a full-year payout of 0.20 yuan, a decline from 0.31 yuan in 2019.

Sinopec shares traded 5.5 per cent higher at HK$4.21 at the lunch break.