China EV market: Great Wall Motor opens door to tech partners, days after rejecting news on Xiaomi plan

- Great Wall Motor does not exclude any potential partner for any EV tie-up, investor relations manager Li Hongqiang says

- Stock fell 19 per cent this year amid a major sell-off in Chinese technology and EV makers in Hong Kong and US bourses

The country’s second-largest vehicle manufacturer by market capitalisation, which also ranks as the biggest sport-utility vehicle producer, would welcome any outside parties, it said during a media teleconference on Wednesday.

“We do not exclude any potential partner for a tie-up,” said Li Hongqiang, investor relations manager of the firm based in Baoding in northern Hebei province. “In the IoT (Internet of Things) era, Great Wall will cooperate with more companies to deepen our digitalisation drive.”

In a March 26 stock exchange filing, the carmaker denied a news report that Xiaomi was planning to use its facilities as a base to produce its electric vehicles. The smartphone maker unveiled its EV plan on March 30, without providing any details on its plant or capacity.

Great Wall Motor said it has not set any limit on investment in digital technologies amid a drastic change in the automotive industry, where electrification and digitalisation are increasingly defining the future of mobility.

Great Wall Motor itself has been raising the ante over the past three years. It formed a joint venture with BMW in July 2018 called Spotlight Automotive to produce electric vehicles with an initial outlay of 5.1 billion yuan (US$778 million).

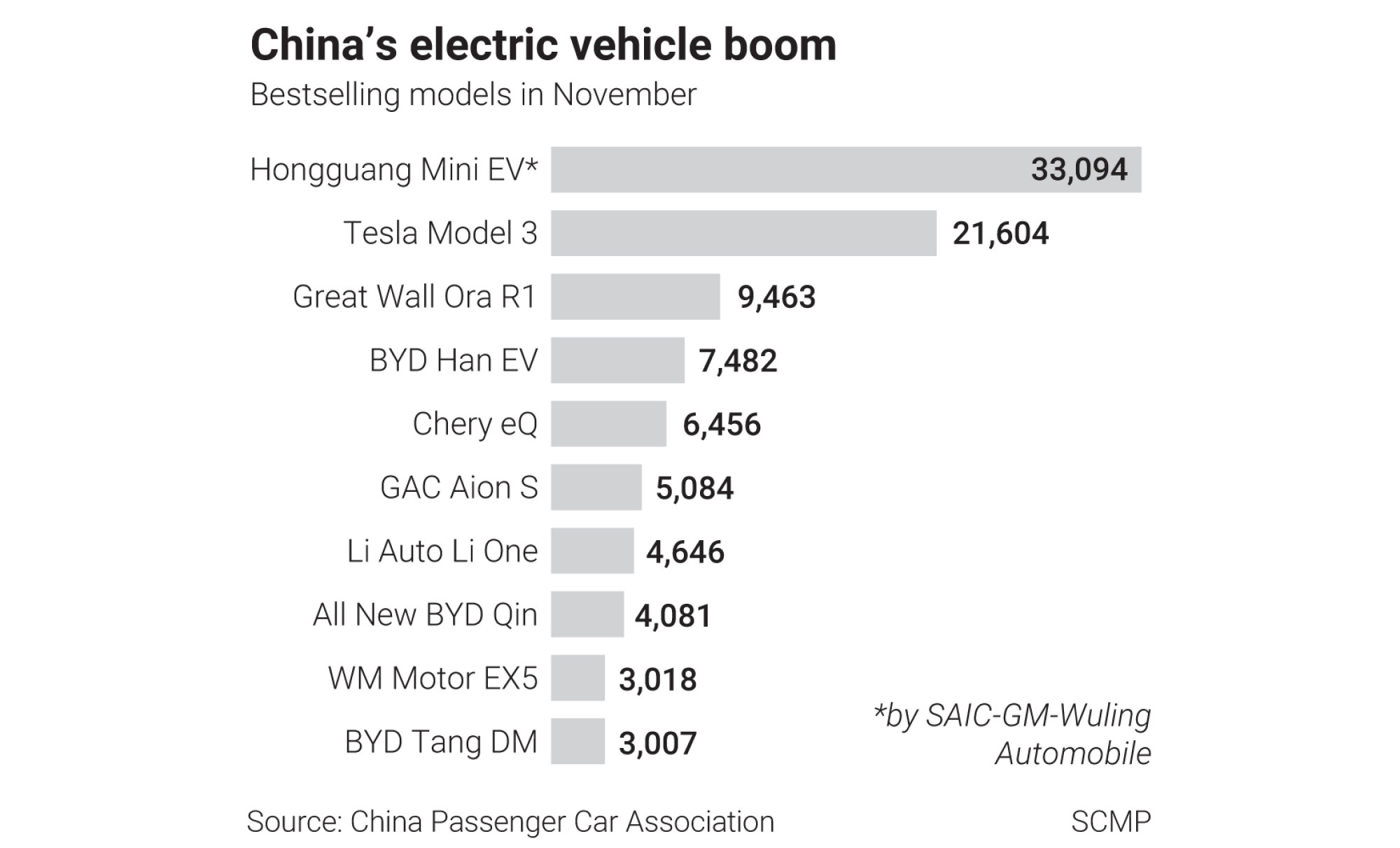

The company’s reported sales of 45,000 Ora Hei Mao-branded new-energy vehicles in 2020. Only Tesla’s Model 3, Hongguang Mini EV by General Motors’ SAIC-GM-Wuling Automobile venture, and GAC Group’s EV marquee Aion S had bigger sales volume.

Great Wall recorded a 19.2 per cent increase in earnings last year to 5.36 billion yuan in 2020.

“Great Wall’s Ora-branded EVs have been attracting more young drivers and it gave the company confidence in moving up the value chain to make its products smarter and expensive,” said Tian Maowei, a sales manager at Yiyou Auto Service in Shanghai.

“Winners in the EV market need to be more intelligent,” Tian added. “Conventional carmakers are likely to form alliances with tech firms to co-develop new models,” intensifying competition.

Competition on China’s EV market is escalating after a clutch of new players including the tech giants and Foxconn, the world’s largest contract maker of consumer electronics, as well as conventional internal combustion engine (ICE) carmakers exhibited their ambitions of tapping the country’s increasing penetration of green cars.

Beijing hopes 20 per cent of new cars will be NEV cars by 2025, or more than 4 million units. UBS predicts NEV sales could top 6.6 million units by that year.