China’s EV war: Warren Buffett-backed BYD goes after market left open by Tesla with four cheaper models for budget-conscious buyers

- The new Qin Plus is priced between 129,800 yuan and 166,800 yuan, while the Song Plus sports-utility vehicle is priced between 169,800 yuan to 186,800 yuan

- BYD also updated two of its existing models: the flagship Tang SUV and the e2 compact car

The Shenzhen-based company, the second-largest maker of battery-powered electric cars by volume, unveiled the Qin Plus sedan at a price range of between 129,800 yuan (US$19,820) and 166,800 yuan, after deducting for government subsidies to encourage owners to embrace electrification. Continuing its convention of naming vehicle models after the dynastic names of imperial China, BYD priced the Song Plus sports-utility vehicle (SUV) at between 169,800 yuan to 186,800 yuan.

Separately, the carmaker updated its flagship Tang SUV, pricing the 2021 edition at between 279,800 yuan and up to 314,800 yuan. The BYD e2 compact car, often seen zipping around Shenzhen as taxis and hired rides, was given a facelift and upgrade, with the 2021 version priced between 99,800 yuan and 115,800 yuan.

“Unlike Tesla and its Chinese rivals that focus on the upper market, BYD is offering electric cars that are affordable to China’s middle-income wage earners and price-sensitive drivers,” said Gao Shen, an independent analyst in Shanghai. “In terms of sales volume and market share, BYD will be competitive in this fast-growing EV market.”

“Our Tang SUV is the first purely electric SUV with four-wheel drive that is priced at less than 300,000 yuan,” said Lu Tian, BYD’s general manager of its Dynasty.com sales department, during a virtual launch event webcasted from Chongqing.

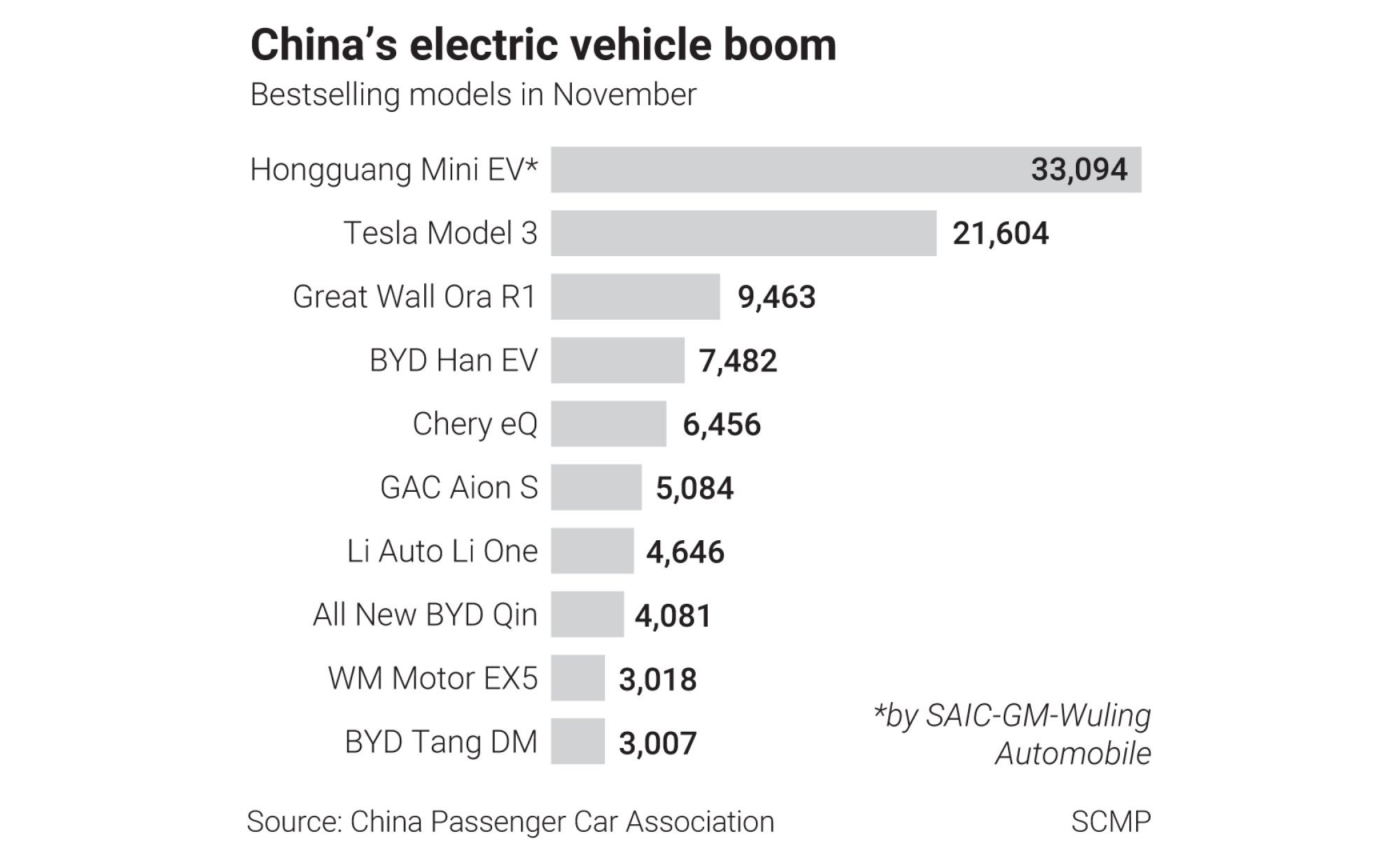

BYD had 12.9 per cent of China’s market for NEVs in 2020, producing 144,200 vehicles last year, trailing the 14.7 per cent share by SAIC-GM-Wuling and ahead of Tesla’s 12.4 per cent, according to data provided by China Association of Automobile Manufacturers (CAAM). BYD’s first-quarter NEV sales jumped 147 per cent to 22,192 units, faster than the 26 per cent rise in the sales of petroleum-powered vehicles at 39,081 units. Just 80 per cent of the NEVs sold were battery-powered cars.

“We expect BYD’s sales volume to ramp up significantly in the second-half, led by the capacity expansion of its battery for the DM-i series plug-in hybrid electric vehicles,” said Daiwa Capital Markets analyst Kelvin Lau in a note.

The battery maker separately said it would deploy so-called blade batteries in all its purely electric vehicles, betting on the lithium-iron-phosphate (LFP) technology as the future for powering NEVs. This BYD-developed battery packs cells in a more efficient array to increase their energy density, enhancing their resistance to overheating. LPF is a cheaper alternative to lithium-nickel-manganese-cobalt (NMC) batteries, which have higher energy density and contain expensive metals and are more prone to overheating.

“From today onwards, all pure NEVs under the BYD brand will adopt blade battery,” the company’s chairman Wang Chuanfu said in Chongqing where the blade battery is made. “I hope safety will no longer be a barrier to the proliferation of new energy vehicles.”

The company that Wang founded in 1995 may be on to something. Worldwide installations of NMC batteries among NEVs fell 4.1 per cent to 38.9 gigawatt-hours last year for a market share of 61 per cent, according to Jefferies research. LFP installation grew 20.6 per cent to 24.4 GWh, for 38.3 per cent of the market.

To meet Beijing’s goal for new energy vehicles to make up a fifth of all vehicles sold by 2025, a compound annual growth rate of 37 per cent is needed, Wang noted. They accounted for just over 10 per cent of sales last month, up from 5 per cent in 2018 and 1 per cent in 2015.

Berkshire owns 21.5 per cent of BYD’s Hong Kong-traded H shares, a stake valued at HK$40 billion (US$5 billion). The stock has jumped fourfold in the past 12 months, rising by as much as 1.7 per cent to HK$179.20 on Thursday.