Explainer | What is ESG and why does it matter for businesses and investors?

- Europe-domiciled funds accounted for 81 per cent of all assets scored for ESG performance last year

- Asia excluding Japan reported the launch of 43 sustainable funds last year, up from 27 in 2019

The recognition of the benefits of environmental, social and corporate governance (ESG) disclosures -to companies and their investors – has led to the adoption of some forms of ESG reporting requirements by stock exchanges in most developed markets in recent years.

Fund managers are increasingly taking ESG factors into account along with financial disclosures. Listed companies are typically scored on their performance while managing risks and taking advantage of opportunities arising from a rising global demand for better ESG track records.

About 71 sustainable funds that incorporate ESG factors were launched last year in the United States, much higher than the previous record of 44 in 2017, according to funds researcher and manager Morningstar. Another 25 existing funds changed their investment strategies to become sustainable funds.

Here is what you should know about ESG disclosures.

Sustainable investing is in vogue among wealthy Asians

What is ESG?

Hong Kong Exchanges and Clearing (HKEX), which operates the local bourse, defines ESG as matters related to a listed company’s sustainability, its impact on the environment and the wider society within which it operates.

“With investors increasingly assessing companies in terms of their holistic performance, long-term sustainability and societal impact, ESG cannot be overlooked,” it said in a report on ESG management in December. It first made certain aspects of ESG reporting mandatory in 2017. These were recommended and voluntary disclosures previously.

Why is it important for businesses and investors?

Listed companies that identify and address ESG risks and opportunities are more likely to outperform those that do not, because they are better equipped to tackle the impact from adverse events such as extreme climate conditions. They also better serve new demand, such as that arising from decarbonisation.

Coronavirus strengthens case for sustainable investing as ESG stocks outperform market

For example, fossil-fuel companies can lessen costly assets decommissioning and writedowns if they address their sustainability problems earlier, by cancelling expansion projects and replacing them with renewable or zero-emission programmes.

“ESG practices can help companies become more resilient by getting them ready for the impact of emerging issues, and helping them maintain robust governance, risk management and controls,” said Raymond Ng, vice-chairman of KPMG China.

Of the 23 large-stock funds invested mostly in developed markets globally, 74 per cent beat the benchmark MSCI World Index, compared with just 43 per cent of all funds in the same category, according to a report by Jon Hale, director of sustainable investing research at Morningstar.

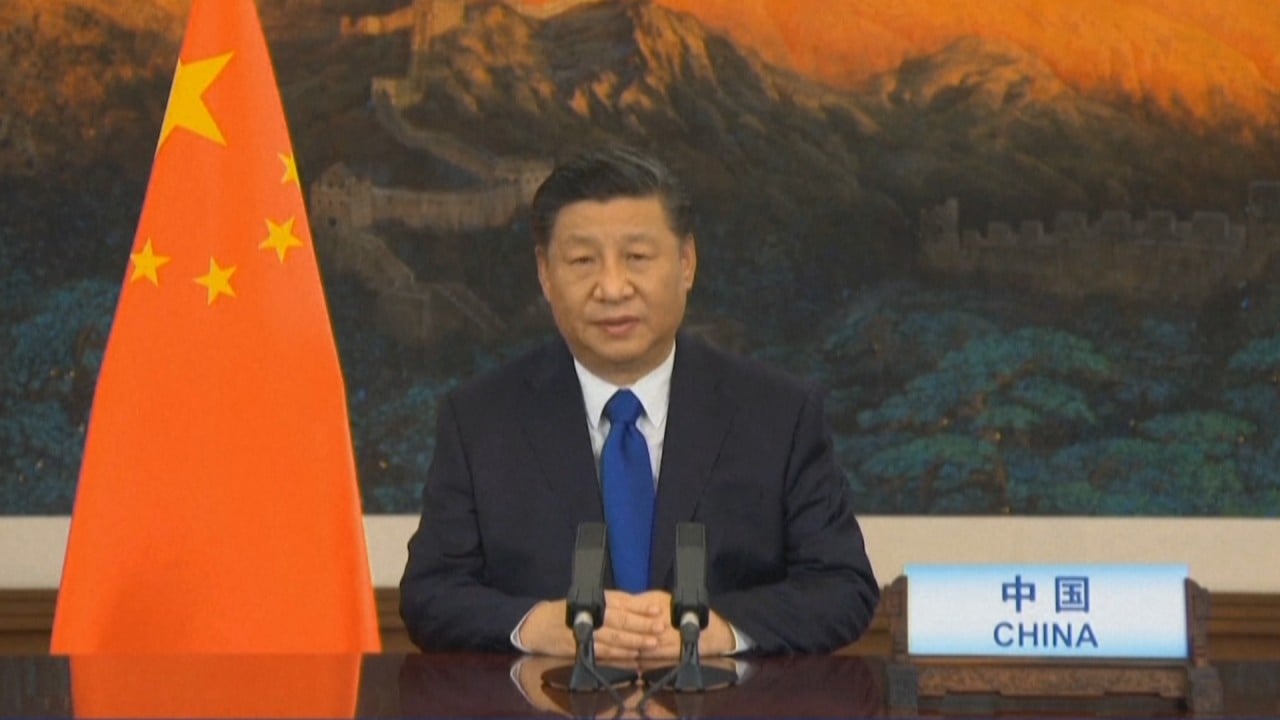

01:24

China to reduce carbon emissions by over 65 per cent, Xi Jinping says

How can investors insure companies make better disclosures?

More stock exchanges are requiring ESG disclosures these days. HKEX, for instance, requires the filing of annual ESG reports by listed companies. Mandatory disclosure requirements include the board’s approach and principles for evaluating and managing ESG related risks and opportunities.

Companies are also asked to disclose their policies and performance on specific key performance indicators, such as emissions, resource usage, labour practices, supply chain and product liability risks, besides anticorruption and internal control practices. Where they fail to comply, they must provide explanations.

Many institutional investors have set up research teams to gather information and analyse listed company’s governance and ESG information, often with the help of third-party providers. They also attend shareholders’ meetings to ask questions about the way a company is managed. Some vote against the re-election of directors they consider to be failing in their duties to ensure satisfactory ESG disclosures.

Hong Kong listed firms get ‘F’ on ESG report card, put on notice

What are the challenges and opportunities in adopting ESG reporting?

The continuous evolution of regulations on ESG matters and reporting requirements mean businesses have to keep updating their disclosures and enhancing their business plans. What is more important and challenging is adopting ESG strategies in their day-to-day operations.

“Delivery on good corporate governance practices and ESG measures is more than a box-ticking exercise. It is important for [securities] issuers to truly appreciate the value of integrating [them] into their strategies and operations,” HKEX said.

Inconsistency and lack of third-party verification remain common problems limiting the usefulness of ESG data for investors. Multiple ESG reporting standards are being adopted currently, limiting the comparability of reports using different methods.

39:35

Sustainability: Green bonds to help drive China's push towards carbon neutrality

Five leading voluntary standard setters said in September last year that they were working together to develop a comprehensive corporate ESG reporting system. They are Global Reporting Initiative, Climate Disclosure Standards Board, Sustainability Accounting Standards Board, International Integrated Reporting Council and Carbon Disclosure Project.