Climate change: investors with US$8.8 trillion of assets lean on CLP, Tenaga, Asian utilities to come clean on carbon emission cuts

- Five power generators including CLP, China Resources Power and Tenaga Nasional are initial targets of a shareholders engagement programme

- New investor group backed by 13 money managers overseeing US$8.8 trillion of assets globally

The other three utilities are Tenaga Nasional in Malaysia, and Chubu Electric Power and Electric Power Development in Japan, according to the Asia Investor Group on Climate Change, the coordinator of the programme.

03:27

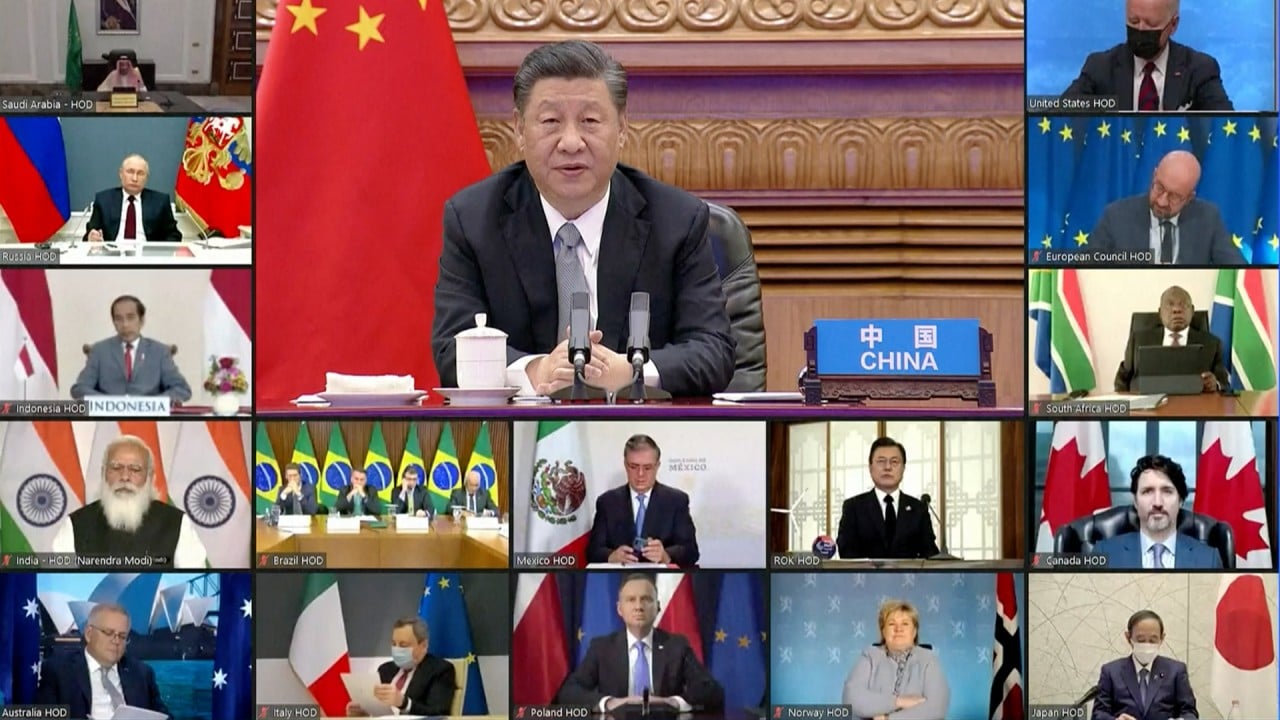

World leaders pledge to cut greenhouse emissions at virtual Earth Day summit

Asia’s power sector contributes about 23 per cent of global greenhouse gas emissions and has a young asset age profile of 13 years versus an average economic lifetime of 40 years, the group said. The five Asian utilities alone emitted 285 million tonnes of carbon dioxide in 2019, roughly the same amount generated in Spain, it added.

The group joins other global coalitions pressuring power-generation firms to protect the earth from hazardous pollutants and halt global warming. Climate Action 100+, a coalition backed by more than 570 investors managing US$54 trillion, has targeted Korea Electric Power, NTPC in India and Hong Kong-based Power Assets Holdings for similar engagement.

Coal-fired power generation is one of the biggest sources of carbon emissions. In China, whose 1,058 coal plants account for half the world’s generating capacity, the power sector alone contributes some 40 per cent of the nation’s total carbon emissions.

The nation accounted for 27 per cent of the world’s carbon dioxide emissions in 2019, compared to 11 per cent in the US, 6.4 per cent in India and 6.4 per cent in the European Union, according to US-based think tank Rhodium Group.

04:17

Free-diving ‘sea women’ of South Korea fight climate change threatening their fishing tradition

For its part, China last September unveiled a goal for carbon emissions to peak before 2030 and to become carbon neutral by 2060. In April, President Xi Jinping said the nation will gradually phase out industrial coal usage from 2026. Japan and South Korea have separately set their net-zero goal for 2050.

Almost 200 countries have become signatories to the 2015 Paris Agreement, which seeks to keep global warming well below two degrees Celsius by 2100 from pre-industrial levels, under which they would make national decarbonisation commitments.

Earlier this year, over 110 countries responsible for 65 per cent of global carbon dioxide emissions committed to reaching carbon neutrality between 2040 and 2060, according to the United Nations. They also account for about 70 per cent of the global economy.

The Asia Investor Group on Climate Change said work by its members is consistent with their fiduciary duty to investors. They intend to hold the boards of companies accountable for climate-change risks and opportunities, and for actions to cut emissions in alignment with the Paris Agreement.

01:57

US, China put aside differences for pledge to work together on climate change

“Strong climate commitments from these companies, including clear plans to exit coal and align their carbon intensity with the objectives of the Paris Agreement, are essential for [us] to invest or stay invested in them,” said Paul Milon, the Asia-Pacific head of stewardship at BNP Paribas Asset Management, part of the investor group.

“We welcome the engagement and look forward to discussing our decarbonisation plans” with the group, a CLP spokesman said. “We plan to strengthen our climate targets this year and we are actively engaged in that review process now.”

China Resources Power did not immediately reply to a request for comment from the Post.