He Xiaopeng counts on melding technology with transport as he transforms Xpeng’s smart electric cars in his vision of mobility

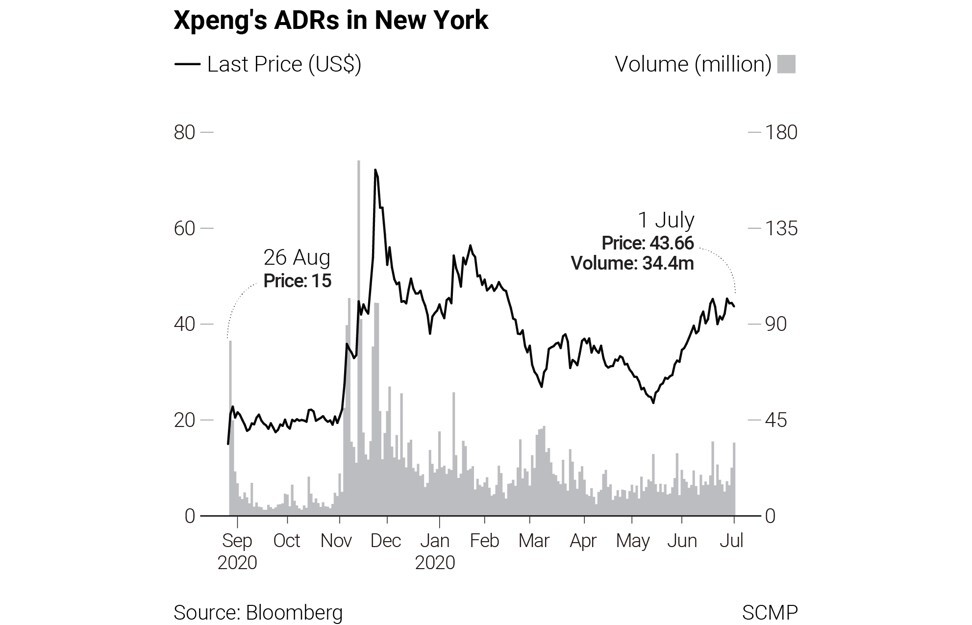

- Xpeng’s shares, offered at HK$165 each, begin trading in Hong Kong on July 7, less than 12 months after their ADRs were offered in New York

- The Hong Kong IPO adds US$1.8 billion of capitalisation to Xpeng, bolstering the value of the six-year-old carmaker to US$36 billion

(Corrects Xpeng’s market value in the sixth paragraph).

He Xiaopeng’s muse for creating one of modern China’s most consequential – and successful, he hopes – technology products was an unlikely source: the line of American toys rooted in Japanese anime culture that first became popular while he was growing up in the early 1980s in central China’s Hubei province.

“The future of mobility is vehicles integrated with robotic science” and artificial intelligence, He said in an interview with South China Morning Post via a video link from Guangzhou, where Xpeng is based. “The number of hours that people spend in the vehicle will only increase, just as they currently spend four to five hours every day on their smartphones. The implications of such [usage] scenarios are tremendous, encompassing transport, technology and finance.”

Founded in 2015, Xpeng has released three production models since its first G3 all-electric crossover rolled off a contract manufacturer’s plant in December 2018 in the Henan provincial capital of Zhengzhou.

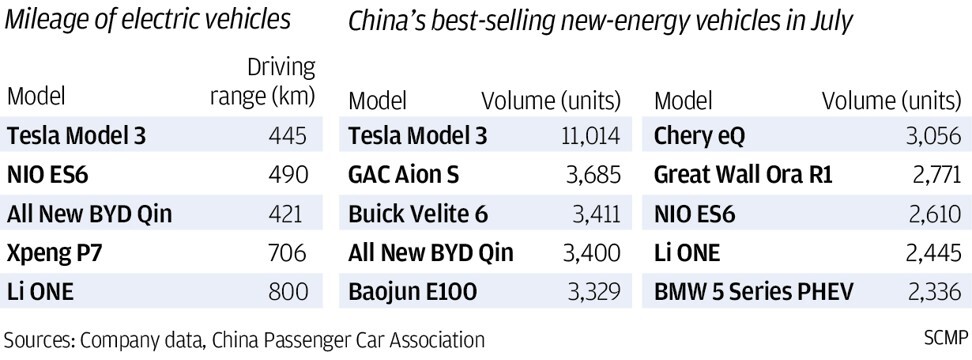

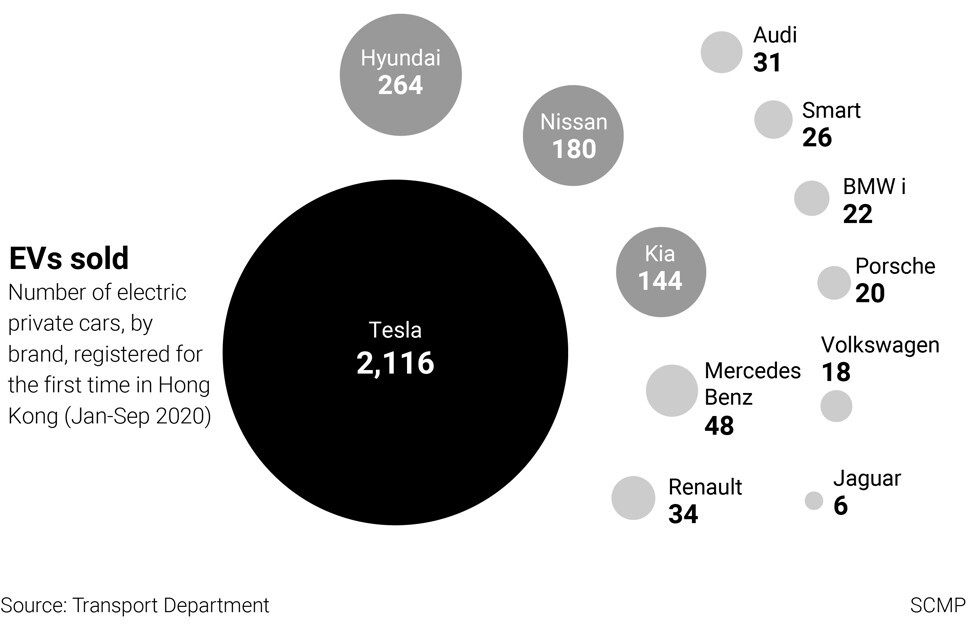

Upping the ante with Tesla, the clear market leader in China’s booming electric car market, is more than bragging rights for Xpeng. The carmaker invests heavily in its own research and development, down to writing its own codes for voice commands that replace manual functions, a valet parking feature that remembers and executes automatic parking, and Level 3 autonomous driving, defined as driving with human presence, but with minimum interference.

Underneath the range of features is He’s belief that modern, smart vehicles are driven by software, in much the same way that the smartphone is the device for millions of applications – constantly launched or upgraded – that manifest the powers of the internet-connected digital age.

Software for powering different applications on the G3 and the P7, from on-board entertainment to climate control and navigation, is sent over the air, has been updated 23 times with 128 new features added as of May, the carmaker said.

“When I first met [He] I was struck by his entrepreneurial passion; he remained passionate about his mission, except he has gained even more credibility and stature over time,” said Primavera’s founder Fred Hu, whose private equity firm owned 2.7 per cent of Xpeng’s American depositary receipts (ADRs) as of March 31. “He has worked so hard to make Xpeng a dream come true [that] he is now one of the rarefied individuals [to be] called a successful serial entrepreneur.”

He, who turns 44 in November, was born in Huangshi, a city of 2.7 million residents according to the latest population census.

His first attempt at entrepreneurship was UCWeb, which he co-founded in 2004. A decade later, UCWeb would serve more than 500 million worldwide users in 11 languages, with the largest market share in India.

Alibaba, which owns this newspaper, bought UCWeb in 2014 for US$4.3 billion. He then worked for the e-commerce giant in its mobile business division for three years before setting forth on his own to fulfil his dream in mobility. He invested his windfall from the UCWeb sale in a start-up founded by two former executives from Toyota Motor’s Chinese partner GAC Group, Henry Xia Heng and He Tao. The trio decided to name their cars Xpeng, after the roc, the mythical bird of prey.

Xpeng delivered 27,041 vehicles last year, about a fifth of the Model 3s sold by Tesla from its US$2 billion Gigafactory in Shanghai. Sales picked up in 2021, with first-half deliveries topping 30,738, more than what Xpeng sold last year.

China’s new-energy vehicle sales are likely to hit 6.6 million units in 2025, a six-fold jump from last year’s 1.17 million, according to UBS.

“The key risk for Xpeng is increasing competition in the price range of between 200,000 yuan and 300,000 yuan, which impose [financial] pressure on its strategy” to go upscale, said Jefferies’ analyst Alexious Lee, who expects the company’s ADRs to decline to US$39.70 with his “hold” recommendation.

“We are confident of the unique smart features of our products,” he wrote on social media at the time.

Tesla reached an out-of-court settlement with an ex-employee who had gone to work briefly for Xpeng, ending a two-year suit that alleged that the former engineer had stolen the US carmaker’s Autopilot system. Xpeng, which was never made a party to Tesla’s suit, said it writes its own codes, and designed its own P7 model from the ground up.

“If EVs were to become the dominant technology of the future, we aim to be one of those companies among the group” over the next decade, He said, declining to provide specific projections and market share.

Now with ample cash from the dual-listing in Hong Kong, He is moving forward making Xpeng’s international foray.

The machine, capable of carrying two passengers to a height of between 5 and 25 metres, is described as an effort to sharpen research into mobility, electrification and digitalisation.

“A lot of people have doubts about a go-global strategy because it would be very challenging and would incur a big cost [in resources],” said the billionaire. “But should we give up just because it is difficult? I do not see it this way, and I think going global is something that Xpeng has to do.”