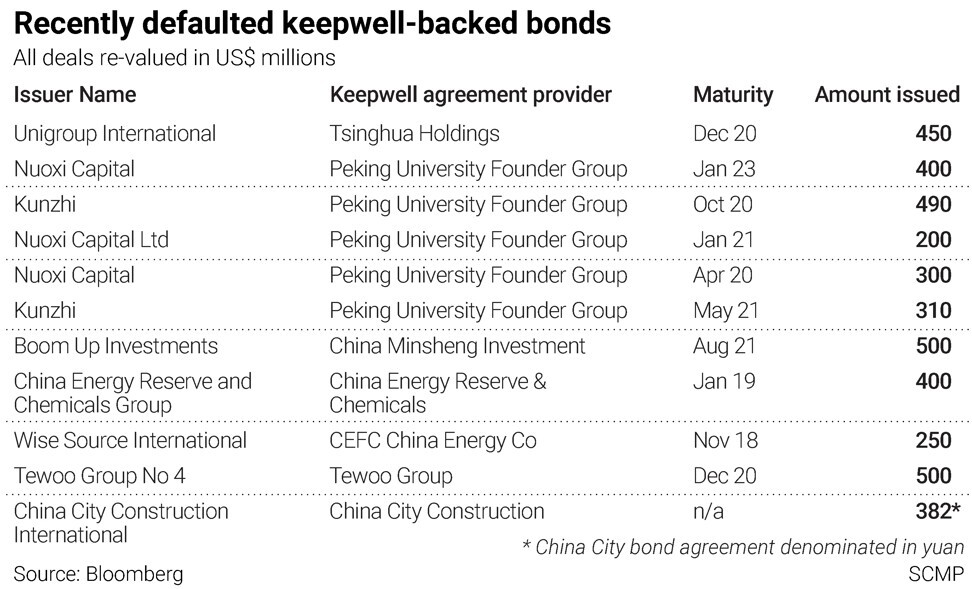

Liquidators pursue Peking Founder’s assets in Hong Kong after ‘keepwell’ storm as US$11.3 billion bailout plan progresses

- Assets include a 60 per cent stake in Hong Kong-listed Peking University Resources and property projects in mainland China

- Beijing court this week approved bankrupt Peking Founder’s US$11.3 billion rescue plan by a Ping An Insurance consortium

Derek Lai Kar-yan, one of the court-appointed liquidators for Founder Information (Hong Kong), said he is trying to raise cash by selling assets in the city and mainland China to repay creditors. They include holders of the defaulted US$300 million 4.575 per cent 2020 notes issued by a unit of the university’s business arm.

Founder Information, which guaranteed several tranches of dollar and euro-denominated bonds, owns 60 per cent of Hong Kong-listed Peking University Resources Holdings, a stake worth about HK$616 million (US$79.3 million). Other valuable assets include its investment and development properties in mainland China.

“We will take action to sell the assets very soon,” Lai, who is also the vice-chairman of Deloitte China, said in an interview with the Post. “Liquidating assets in Hong Kong could start within this month. This is to protect the interest of creditors because there is no certainty that their debt will be repaid.”

The liquidators won a court order in late May to sell the 60 per cent stake in Peking Founder Resources by private tender. Last month, they requisitioned to remove three directors at the company and appoint its four nominees to the board.

Holders of offshore bonds filed to wind up Founder Information in October last year after the group defaulted on its debt. A Hong Kong High Court appointed Lai and two others from Deloitte as liquidators in February.

While small relative to the size of the credit distress, the seizure in Hong Kong could throw a spanner in the works as the assets are part of debt restructuring of Peking University Founder Group. The business arm of the prestigious university reorganised under Chinese bankruptcy laws in what is China’s biggest default in about two decades.

Keepwell provisions are undertakings by Chinese companies to guarantee the solvency of their subsidiaries when they sell debt in offshore markets, giving foreign investors assurance as they have no recourse to onshore assets. They typically contain a clause stating that they do not constitute a guarantee.

The new entity will assume the restructured assets of Peking University Founder Group in the health care, information technology, real estate and finance businesses, among others, including those in Hong Kong.

“We are in talks with Ping An about the arrangement for the offshore creditors,” Lai said, adding they have not yet reached any agreement and declined to elaborate on details of the discussion.

It is still not known if the rescue consortium will ensure the repayment to offshore creditors because they will acquire the Peking University Founder Group’s assets after the restructuring.

Ping An, the world’s biggest insurer by market value, declined to comment on the debt reorganisation.

“Both Ping An and the Founder Group are state-backed giants,” Lai said. “We definitely hope that Ping An can deal with the debts properly. Whether the agreements offshore bondholders signed are protected under the law or not, they were agreed bilaterally. Failing to honour them will affect the reputation of mainland companies.”

Lai is waiting for Founder Information’s management team to provide the liquidators with further relevant information, including an update on the property projects in mainland China.

“They are not very cooperative at this stage,” said Lai. “Without the documents, we can still proceed with the sale of assets. We have received interest from various parties such as listed companies and real estate equity funds.”