China Evergrande, hit by a US$2.71 billion stock sell-off, threatens to sue lender as debt controversy turns ugly

- Stock slumped 16 per cent after its onshore deposits were frozen by a lender, wiping US$2.71 billion off its market value

- Developer, China’s most indebted by some yardsticks, has so far kept offshore bondholders happy by paying on time

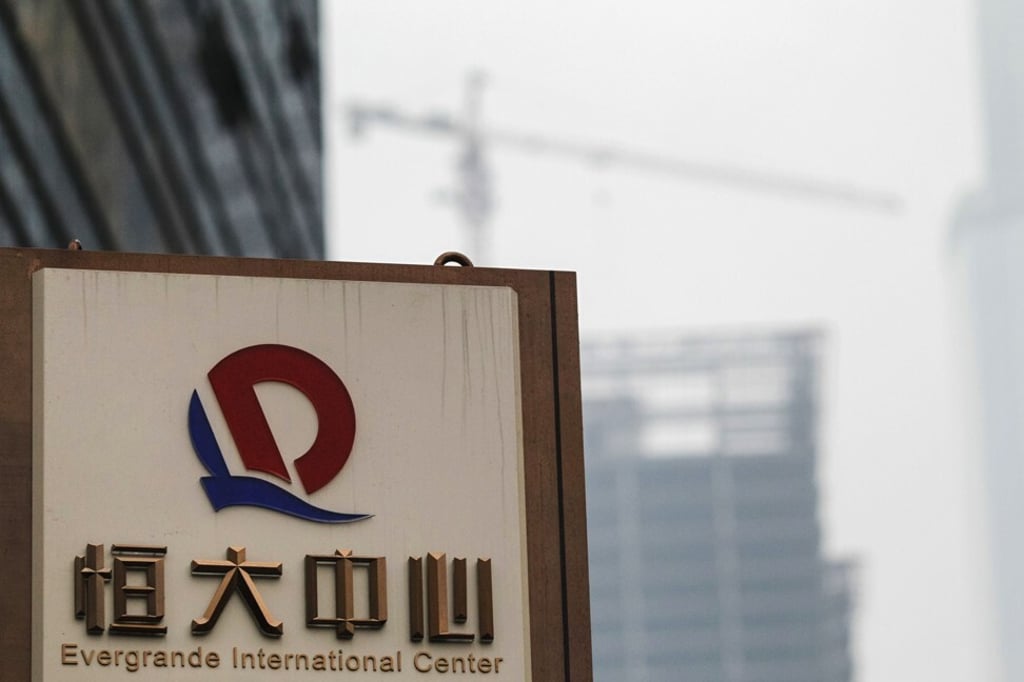

China Evergrande has threatened to take legal action against a local bank after the lender froze some of its deposits onshore to recover a loan, highlighting another episode of market jitters and controversy surrounding the builder’s creditworthiness.

The Shenzhen-based developer, the nation’s most-indebted by some yardsticks, is planning to sue China Guangfa Bank for abuse of law, saying its project loan from the bank’s Yixing branch in the southwestern Chinese province of Jiangsu was not due until March 27, 2022.

“Evergrande will take legal action as Guangfa Bank’s Yixing branch has abused the pre-litigation preservation act,” it said in a terse statement on Monday, after the news pummelled its stock. The developer’s spokesperson declined to elaborate when reached by phone.

Evergrande crashed 16 per cent on Monday to HK$8.21, the most in nine months, sending the stock to the lowest level since May 2017. The sell-off wiped out HK$21.1 billion (US$2.71 billion) of market capitalisation, bringing the value destruction over the past 12 months to US$23.5 billion. Its dollar-denominated bonds also slumped.

“The bank’s move is very rare as banks usually would not have a falling out with major clients like Evergrande,” said Dai Ming, a fund manager at Huichen Asset Management in Shanghai. “Chinese developers rely heavily on banks for funding and when the credit line is questioned, it would be very difficult to raise money in other ways.”

Meanwhile, the housing authority of Shaoyang in southern Hunan province has asked the developer to halt pre-sales of homes at two of its projects in the city.