Asia-Pacific companies willing to pay higher rent for green buildings to reach net zero carbon goals

- While 70 per cent of occupiers in the region are willing to pay a rental premium for green space, compared with 62 per cent in Hong Kong: JLL

- Existing supply of green buildings in many regional markets was not enough to meet demand

While 70 per cent of occupiers in the region were willing to pay a rental premium for green space, that ratio was lower at 62 per cent among those in Hong Kong, according to a survey of 550 industry leaders across the region by JLL.

“With 40 per cent of real estate occupiers across Asia-Pacific having already adopted net zero carbon goals and another 40 per cent planning to do so by 2025, green buildings are no longer just ‘nice to have’ if corporates are to follow through on their sustainability pledges,” said James Taylor, head of corporate solutions research for Asia-Pacific at JLL.

He said that companies in the Asia-Pacific were looking to achieve a goal of making 50 per cent of their property portfolios accredited by 2025, but the existing supply of green buildings in many markets was not enough to meet this demand.

02:26

China’s ‘vertical forest’ residential complex offers urban green living

Such growing concern over climate emergency and governments policies around the world were driving companies to take action and transition to net zero carbon, said Mark Cameron, head of energy and sustainability at JLL in Asia Pacific.

Hong Kong companies were not far behind.

“The enquiries around net zero carbon we received in Hong Kong in the first half of this year were more than double the total enquiries received in 2020,” Cameron said.

“Businesses acting now are the ones that will benefit the most as they prepare themselves for inevitable legislation, while meeting growing investor, customer and employee demands while realising savings through operational efficiencies,” he said.

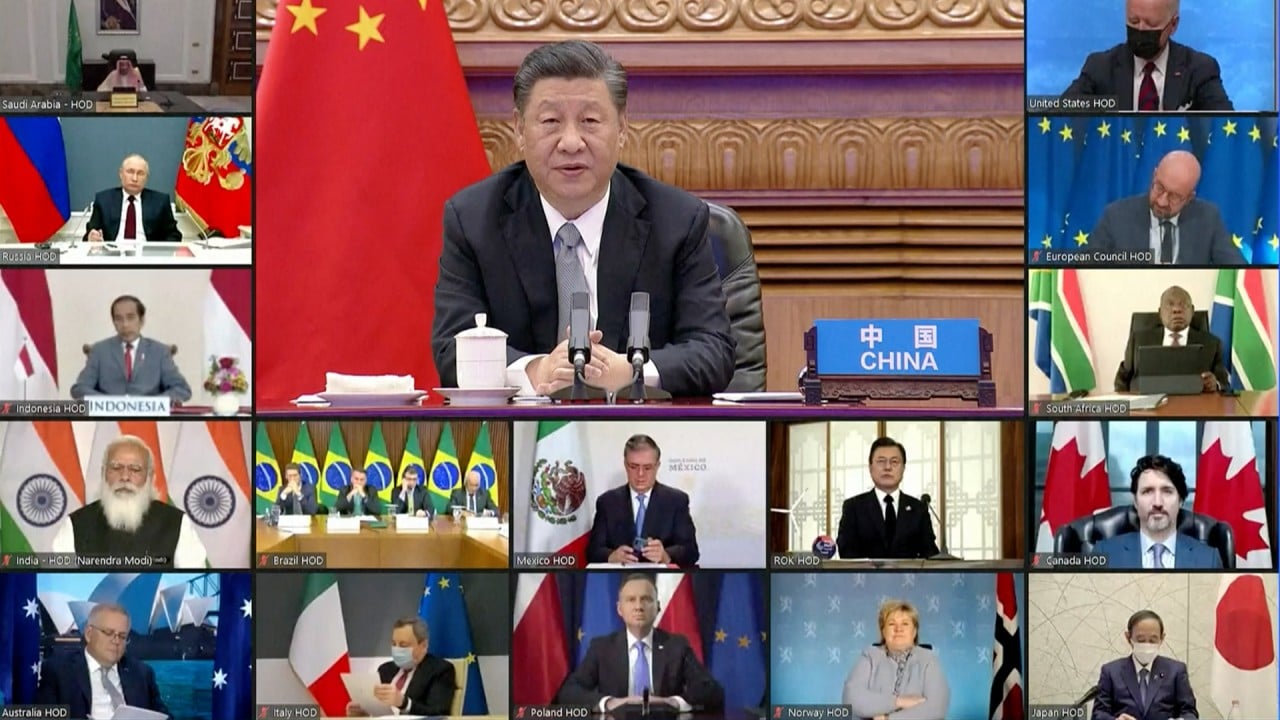

03:27

World leaders pledge to cut greenhouse emissions at virtual Earth Day summit

The regional real estate decarbonisation drive was prompting companies to prioritise locations that help them reduce carbon emissions and focus more on green building investments, JLL said.

Knight Frank said that banks and financial companies were likely to be interested in relocating to so-called green buildings, given their interest in green financing and bonds.

“Banking and finance is the sector that pays highest attention to green space because their own businesses have already got quite a high exposure to environmental, social and governance and green concepts,” said Martin Wong, director and head of research and consultancy for Greater China at Knight Frank.

Additional reporting by Pearl Liu