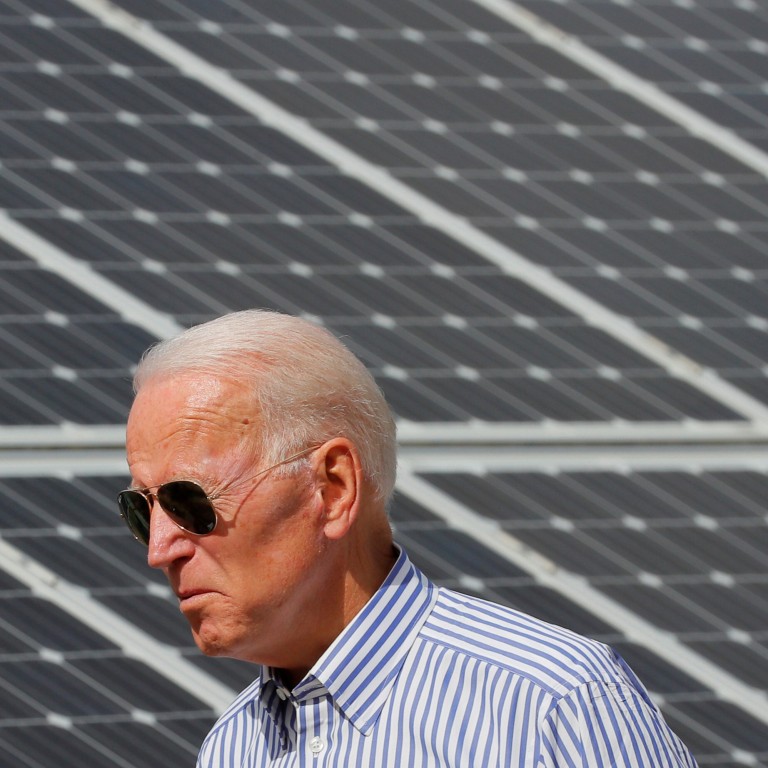

Escalating trade spat over solar panel imports may derail Biden’s 2035 climate goal of reaching a carbon-free power sector

- This week, a major solar-panel maker warned that all imports from China risk being detained by US Customs and Border Protection

- A group of unnamed US solar manufacturers filed petitions to extend import duties to Chinese-owned factories in Vietnam, Malaysia and Thailand

The trade tumult threatens to disrupt the US solar market, potentially upending Biden’s goal of a carbon-free power sector by 2035. The country today depends on foreign manufacturing for most its panels, with Vietnam, Malaysia and Thailand the three biggest suppliers, according to US trade data.

“The disruptive and harmful impact of new trade petitions and Customs and Border Protection enforcement action cannot be understated,” Solar Energy Industries Association President Abigail Ross Hopper said in an email to members hours after the petitions were filed. “The disruption to the US solar market could be severe.”

In some respects, there has never been a brighter moment for solar power in the US Installations are booming. Biden appeared poised to deliver the most progressive climate presidency in history – and on the heels of an administration steadfast on boosting fossil fuels, no less. And yet, the industry’s supply chain has been battered by higher costs, including for modules and freight.

Solar panels already cost about 40 per cent more in the US than the rest of the world, according to Jenny Chase, BloombergNEF’s head of global solar research. “US companies that develop and build projects would certainly suffer in the short term as US module prices would go even higher,” she said.

Domestic Manufacturing

While developers may be hurt, any moves that make imports more expensive would help level the playing field for companies that want to manufacture solar equipment on US soil. That would be a boost to another part of Biden’s agenda – union jobs.

“Trade actions against imported solar products may counter President Biden’s climate agenda,” Timothy Fox, a vice-president of ClearView Energy Partners, said in an interview. “But they also could further his union and domestic manufacturing agenda.”

A spokesman for the White House didn’t immediately respond to a request for comment on the matter.

The American Clean Power group that represents renewable power developers said it is firmly against any forced labour practices, but warned that “responsible enforcement” is critical for meeting climate targets.

“Recent enforcement actions and international trade petitions go beyond the intended goal and risk significantly impacting US solar deployment,” chief executive Heather Zichal said by email.

A Canadian Solar spokesperson said all Chinese shipments were at risk of being stopped at the border. Philip Shen, an analyst at Roth Capital Partners, said in a research note that “multiple” developers and distributors indicated “they will not receive product.”

That was followed on Monday by a group called the American Solar Manufacturers Against Chinese Circumvention filing petitions with the Commerce Department to extend Chinese tariffs to certain factories in the Southeast Asian countries. The group hasn’t identified its members, and First Solar, the largest US-based manufacturer, declined to say whether it’s part of the consortium.

The filings come at a time when some domestic solar manufacturers are seeking an extension of former President Donald Trump’s solar tariffs – and as Democrats advance a US$3.5 trillion tax-and-spending plan that could benefit both solar developers and clean-energy manufacturers.

While a surge of inexpensive imported panels and modules could make it cheaper to deploy solar power in the US – and help meet Biden’s clean energy targets – it could also come at the expense of organised labour and working families. And Biden’s renewable goals don’t automatically trump those concerns.

“It is not and never has been as simple as to say ‘Biden wants renewable energy,’” Height Capital Markets analyst Benjamin Salisbury said. “The Biden agenda is not to reduce domestic union employment and increase Chinese production.”