Chinese regulators summon Evergrande executives, urge them to keep operations stable, diffuse debt risks

- China Evergrande officials were summoned for a meeting by the People’s Bank of China and China Banking and Insurance Regulatory Commission

- Regulators urge Evergrande to follow rules and disclose information in a timely manner to prevent rumours from spreading

China Evergrande Group has become the latest Chinese company to be given a talking-to by the country’s top financial regulators.

“As a leading real estate company, Evergrande must earnestly implement the stable and healthy development strategy of the property market set out by the central government … and maintain the stability of the property and financial markets,” PBOC and CBIRC said in a joint statement.

Evergrande did not immediately respond to a request for comment.

In April, top tech firms that run online financial businesses, including Tencent Holdings, Tik Tok-owner ByteDance and Didi Finance were summoned by the PBOC and three other financial regulators to “step up anti-monopoly measures” and highlighted that “financial businesses should serve the real economy as well as reduce financial risks.”

The PBOC and CBIRC also told Evergrande to follow rules and disclose information of major events in a timely manner to prevent rumours from spreading in the market.

The regulators’ concerns come close on the heels of the executive reshuffling at Hengda Real Estate Group, Evergrande’s closely-held mainland China property unit.

The listed company did not make any public announcement regarding the personnel change, resulting in rumours of Hui’s exit from the group spreading online and causing its shares to fall.

However, an Evergrande spokesperson responding to media inquiries said that it was “a normal personnel change” and it did not have any impact on the management structure or a change in shareholdings.

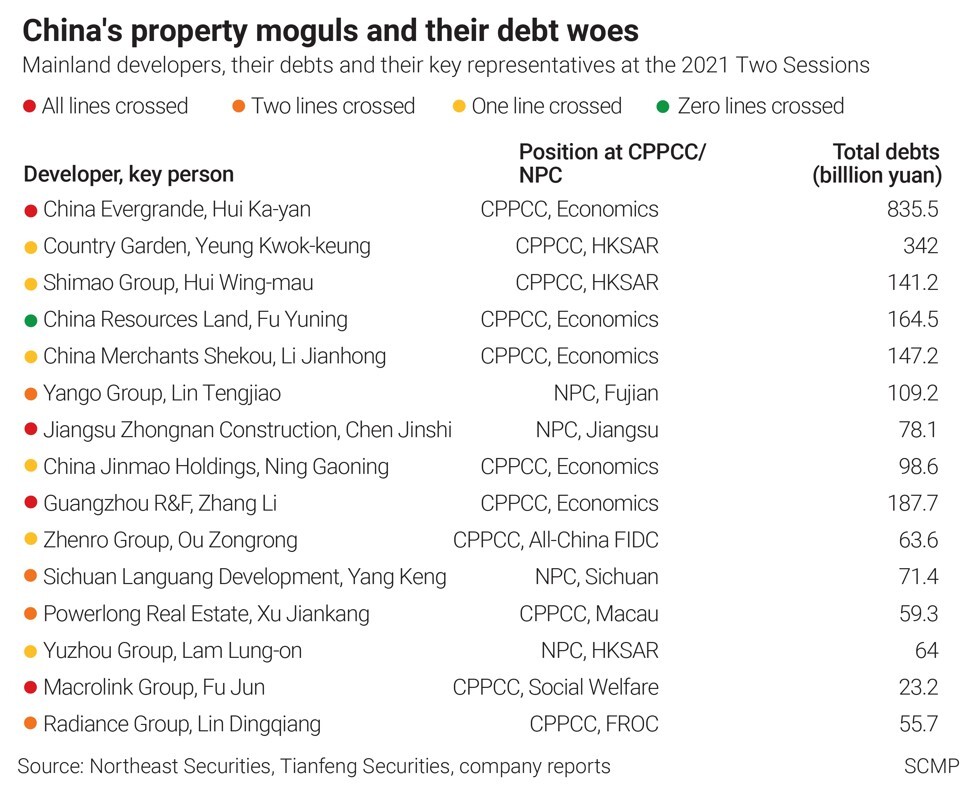

Despite slashing its interest-bearing liabilities by one-third to 570 billion yuan (US$87.9 billion) in June from last year’s peak, global credit-rating firms have downgraded its creditworthiness amid concerns about its debt repayment capacity.