SenseTime sees its smart-driving technology in 20 million vehicles via tie-ups with Honda, Great Wall, Chery and others

- SenseTime has formed partnerships with 30 carmakers, including Japan’s Honda Motors, and China’s Great Wall Motors and Chery Automobile

- The company’s AI platform is used to power smart driving, intelligent cockpit and autonomous driving features

The Hong Kong-based AI company, founded by a group of professors at the Chinese University of Hong Kong (CUHK), has formed partnerships with 30 carmakers, including Japan’s Honda Motors, and China’s Great Wall Motors and Chery Automobile, said SenseTime’s co-founder and managing director of its research laboratory Wang Xiaogang.

“There is a huge business potential for us to tap in this area,” Wang said in an interview with South China Morning Post before filing their application to list in Hong Kong, citing the combined production of the customers who have signed up for SenseTime’s technology. “The vehicle will become the third major space where people spend the most amount of time, after their homes and their offices.”

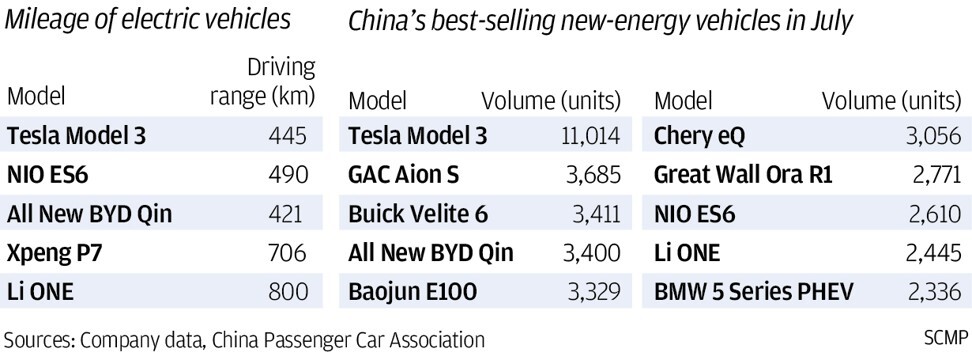

Smart vehicles will become a mutli-trillion yuan market in China, as consumers ditch their petrol-guzzling cars for electric vehicles that now answer to voice commands, park themselves or find their way to preset destinations.

As many as 6.6 million new vehicles, or one of every four new cars, entering China’s roads will be powered by battery by 2025, according to the forecast by UBS.

“As a leading AI company whose computer vision technologies are useful in data analysis and monitoring cars and drivers, the automotive industry offers SenseTime a big opportunity to seek high-revenue growth,” said Ivan Li, a fund manager at Shanghai-based Loyal Wealth Management. “China will be a key market for it, given the fast penetration of EVs.”

It is expected to use the proceeds to finance its research and development into a clutch of computer vision and deep learning technologies from face-unlock features on smartphones to diagnostic tools for X-ray and internal organs.

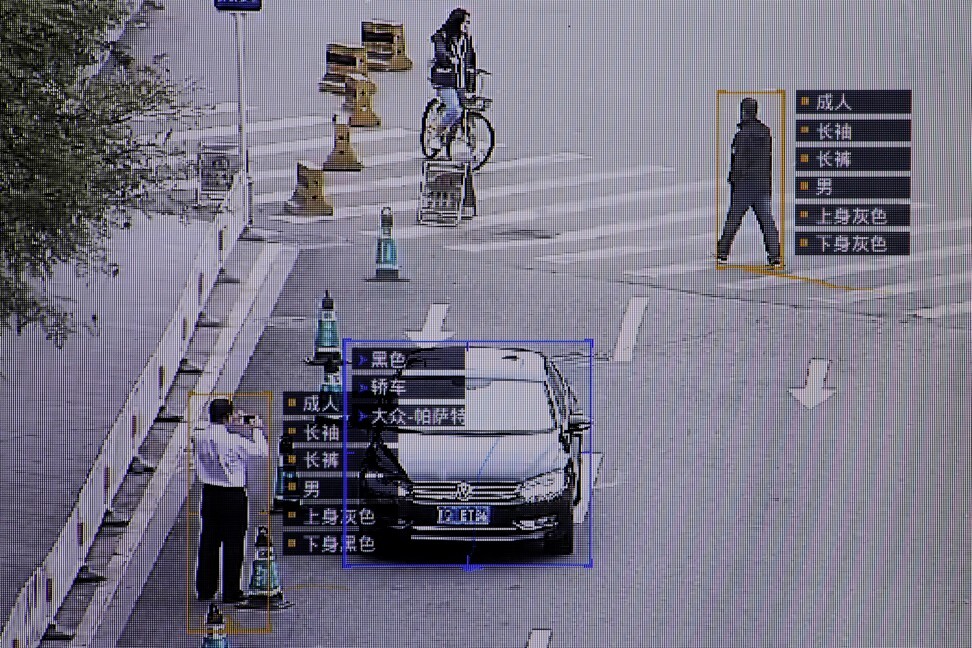

In the automotive industry, SenseTime provides car analysis and behaviour-detection technology to ensure driving safety, such as facial recognition technology that can tell if the driver is drowsy. Its gesture recognition technology can also interact with and the controls in the on-board information and entertainment systems of premium cars. Wang would not disclose the revenue size of SenseTime’s businesses in the intelligent vehicle segment.

Presently, a raft of carmakers including Tesla are building intelligent vehicles fitted with driver-assistant systems – which use algorithms to analyse traffic data collected in real-time by on board sensors and has “environment detection” capabilities.

The company remains unprofitable, reporting a net loss of 12.2 billion yuan (US$1.9 billion) in 2020, following two years of losses in 2018 and in 2019. Revenue rose 13.9 per cent to 3.45 billion yuan last year.

SenseTime filed to go public in Hong Kong on Friday, appointing China International Capital Corporation (CICC), Haitong Securities and HSBC to arrange its stock sale.