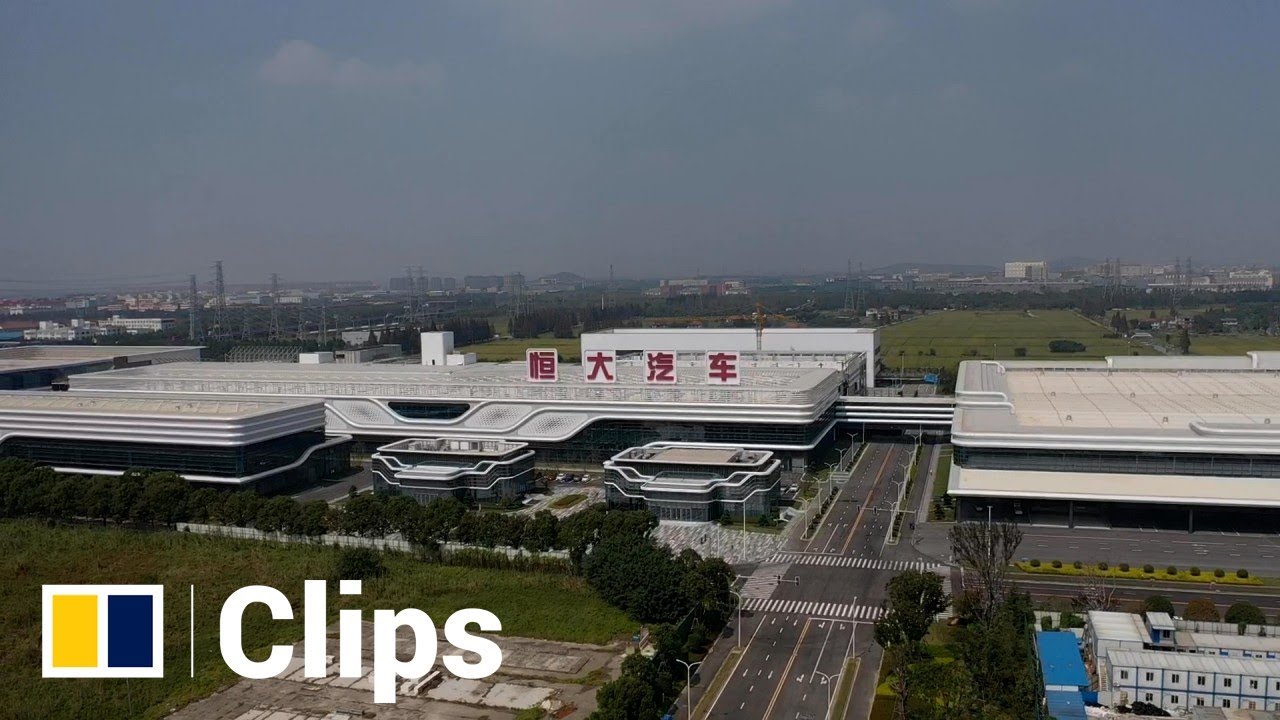

Evergrande’s Shanghai car plant sits idle after electric car unit’s dream turns into a nightmare of ceaseless cash burn

- Evergrande Auto is making an all-out effort to start production of its first Hengchi-branded car as it looks for new sources of funding

- Evergrande Auto’s shares jumped 44.4 per cent to HK$3.35 on Wednesday, on hopes of a white knight investor

Hong Kong-listed China Evergrande New Energy Vehicle Group, also known as Evergrande Auto, is making an all-out effort to kick off production of its Hengchi-branded cars, trying to keep talent and looking for new funding even as its operations have been walloped by the debt woes of its parent, according to two sources with ties to the carmaker.

The carmaker, which briefly topped the century-old Ford Motor in market capitalisation in February after raising HK$10 billion in a top-up stock sale in Hong Kong a month earlier, is yet to deliver a single car. Nevertheless, it is still hopeful that it could obtain fresh funds from new investors soon because of the bullish outlook of China’s EV sector. While it has stopped paying nearly all suppliers and some of its employees because of the cash squeeze, existing staff have been told to get the assembly line ready to produce its first model.

“Evergrande’s EV assets remain valuable,” said Gao Shen, an independent analyst in Shanghai. “It has potential investors but one of the sticking points now is how to price the assets.”

01:00

Evergrande’s uncompleted electric vehicle facility in Shanghai

Evergrande Auto’s shares have lost 96 per cent in value since their February high, wiping out US$88 billion in capitalisation. The stock jumped 44.4 per cent to HK$3.35 on Wednesday, on expectations that a white knight investor could come to its rescue. The company did not reply to a request for comment.