Evergrande reprimands insiders for hitting the exit ahead of wealth product clients, forcing redeemers to return proceeds

- Six managers of Evergrande Wealth Management who had redeemed 12 products between May 1 and September 7 ahead of schedule were ordered to return the proceeds, and were reprimanded

- The early redemptions by the six managers were first uncovered on September 18

China Evergrande Group, under siege from creditors, investors and suppliers has taken action against half a dozen company insiders for front-running their wealth management customers, bowing to pressure from furious clients and local authorities across the country.

Six managers of Evergrande Wealth Management who had redeemed 12 wealth management products between May 1 and September 7 ahead of their scheduled dates were ordered to return the proceeds, and were reprimanded, the parent company said in a statement without providing financial details. The early redemptions by the six managers were first uncovered on September 18.

Evergrande “instructed Evergrande Wealth Management to implement the redemption proposals which were announced, and ensure fairness and treat all investors equally,” it said in the announcement.

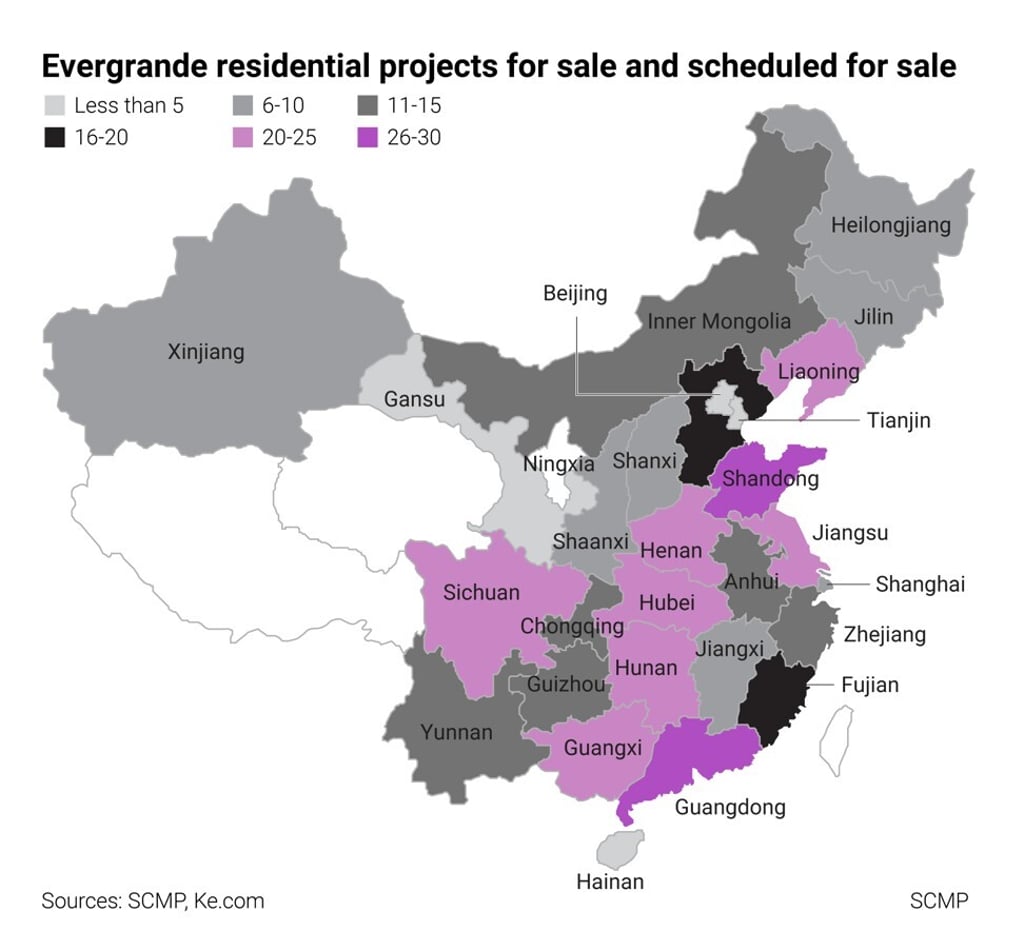

The Shenzhen-based developer, with the dubious honour as the world’s most indebted real estate company with US$300 billion in total liabilities, is acting to repair its tattered image as it teeters on the brink of collapse. Founded by the Chinese magnate Hui Ka-yan in 1996, Evergrande is struggling to sell enough apartments amid China’s slumping property market to pay the hundreds of millions of dollars of interest payments, borrowings and short-term debt due this year.