Evergrande scraps US$2.6 billion sale of property services unit to Hopson, suffering a second rebuff to its asset disposal in a week

- An October 1 bid to buy 50.1 per cent of Evergrande Property Services for HK$20.04 billion failed to materialise, Hopson Development Holdings said

- Evergrande rescinded the sale on October 12 amid a dispute over the payment of the sales proceeds, Hopson said

China Evergrande Group scrapped the sale of its property management unit to a rival, as its asset disposal plan was rebuffed for the second time in a week just before a 30-day grace period runs out for declaring the world’s most indebted developer in default.

Hopson said it “does not accept that there is any substance whatsoever to [Evergrande’s] purported rescission or termination of the agreement and has refuted [its] notice,” according to the statement, adding that while Hopson “is prepared to complete the purchase of [the Evergrande unit], there is no certainty that the sale as agreed will be completed.”

The deal may have blown up because of a disagreement over the payment of the purchase price, Hopson said. Evergrande wanted immediate payment, while Hopson wanted to pay only after completing a due diligence to assess the payable accounts and receivables with suppliers, according to the statement. Evergrande did not comment.

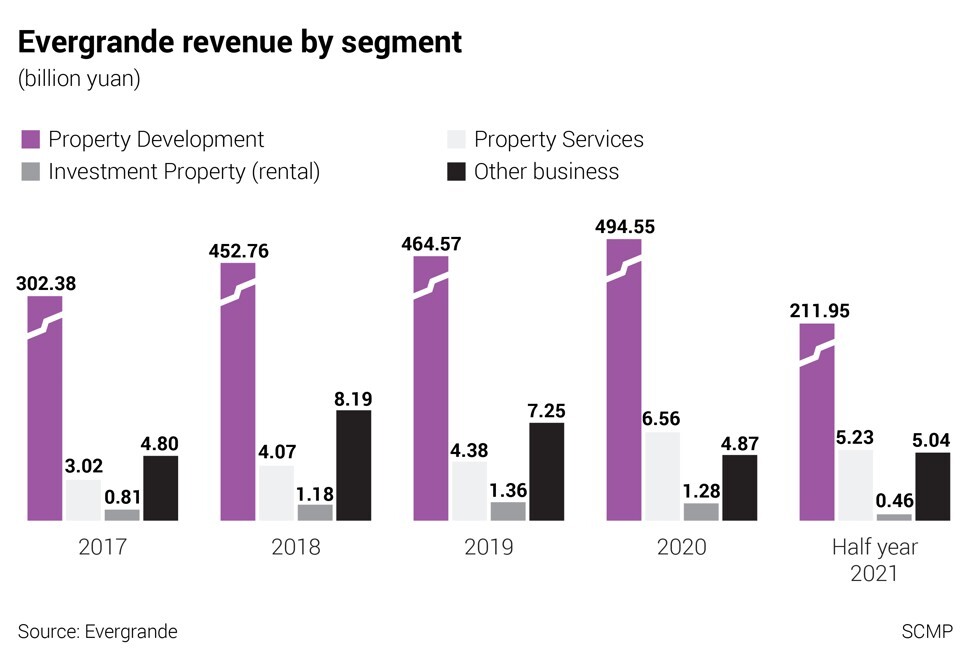

Evergrande has been trying to sell a variety of assets to help ease its cash crunch and repay suppliers, who are critical to the company’s survival. It has a backlog of 1.3 trillion yuan (US$203 million) of unfinished properties and has run into difficulty selling uncompleted flats and homes as questions have risen about its financial future.

Evergrande Property Services, spun off from the parent last December, rose 18 per cent over four consecutive days in late September to HK$5.12 (US$0.66) before trading was halted for the announcement of its controlling stake to Hopson. Evergrande itself has plunged to HK$2.95 per share from a January 19 high of HK$17.26, losing US$24.4 billion in market value.

Hopson’s shares rose 4.5 per cent over three days in a row to HK$25.18 before trading was suspended for its Evergrande deal.