Advertisement

SenseTime postpones US$768 million IPO in Hong Kong after US blacklists AI firm on human rights grounds

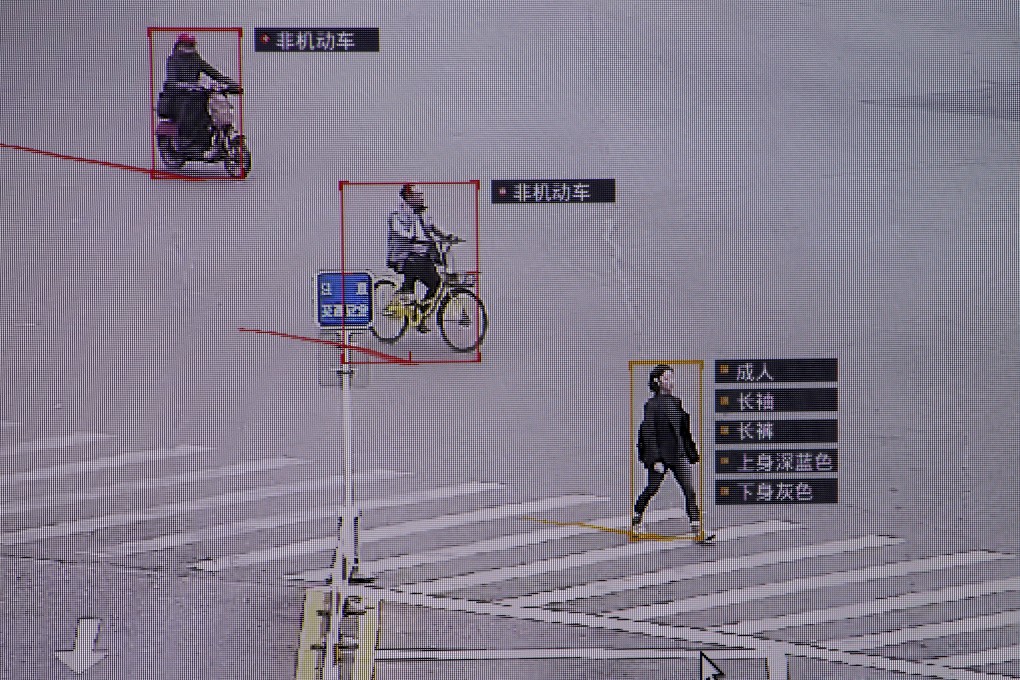

- China’s largest AI firm said it would postpone its Hong Kong IPO after the US barred American investors from owning shares in the firm

- Washington blacklisted SenseTime over alleged human rights abuses in Xinjiang, which the AI firm called ‘unfounded,’ based on a fundamental misperception of the company

Reading Time:3 minutes

Why you can trust SCMP

18

SenseTime Group halted its US$768 million initial public offering (IPO) in Hong Kong, pulling the plug for now on the city’s biggest stock sale since September, after the United States placed China’s largest artificial intelligence (AI) firm on an investment blacklist on human rights grounds.

The company will publish a supplemental prospectus with amendments and an updated schedule, and refund all the IPO applications made by investors without the associated interest, SenseTime said.

SenseTime “remains committed to completing the global offering and listing soon,” the company said, without elaborating. Spokespeople at SenseTime declined to comment. Joint sponsors of the deal including CICC, Haitong International and HSBC were not immediately available for comment.

Advertisement

The postponement made SenseTime, founded by a group of Chinese University of Hong Kong (CUHK) professors, the biggest corporate casualty yet of the Uyghur Forced Labor Prevention Act, which was passed last week in the US House of Representatives 428 votes to 1. The act contains a “rebuttable presumption” clause that assumes all goods coming from western China’s Xinjiang region are made with forced labour - and thus banned - unless the commissioner of US Customs and Border Protection gives an exception.

Two days after the law passed, the US Treasury Department put SenseTime on its sanctions list, which would bar American investors from holding stocks in the company.

Advertisement

Advertisement

Select Voice

Select Speed

1.00x